The rise of cryptocurrencies has introduced new opportunities and challenges for organizations seeking to optimize their financial strategies. At the heart of this paradigm shift is crypto treasury management. It is a strategic approach to overseeing and leveraging digital assets. Enterprises, DAOs, investment funds, and other institutions can benefit from these treasury management solutions. In this article, we focus on crypto treasury management.

Crypto treasury management encompasses a spectrum of activities, from acquiring and storing digital assets to mitigating risks and maximizing returns on investments. It requires a fine understanding of blockchain technology, regulatory landscapes, and market dynamics. Robust tools and solutions tailored to the unique needs of the crypto space are also essential. This article delves into the fundamentals of blockchain treasury management, exploring its significance, use cases, and top solutions reshaping the way crypto assets are stored and managed.

What Is Crypto Treasury Management?

Crypto treasury management can be easily interpreted by its name. It is the process of managing cryptocurrencies by an organization or individual entity. The primary aim of crypto treasury management is to optimize the allocation and storage of crypto to ensure security and risk management.

The operations that comprise crypto treasury management are acquisition, storage, and allocations of crypto assets. Thus, a good management requires both correct decision making and reliable means. This way, you will be able to protect your capital from security threats and market volatility.

Crypto treasury managers of decentralized autonomous organizations use various decentralized governance structures. So, the decisions on how to store and allocate funds are made through voting mechanisms and smart contracts on the blockchain. On the other hand, traditional institutions will likely design robust treasury management procedures when entering the blockchain space. So, while depending on the type of entity and its goals, the primary aim of managing crypto treasuries is the same.

Crypto Treasury Management Types and Use Cases

The methods of treasury management crypto entities use can be categorized into several types. These categories depend on the nature of the organization and its objectives. The most prominent blockchain treasury management types are explained below:

Decentralized Autonomous Organizations (DAOs)

DAOs rely on decentralized governance structures and smart contracts to manage their treasuries. Treasury management DAOs and organizations include decisions on investments, spending, and governance. The community often decides on these matters through voting. By utilizing this method, the DAOs ensure both transparency and decentralization.

Enterprises and Businesses

Traditional companies in the crypto space also need robust treasury management strategies. Crypto treasury management for businesses allow for regulatory compliance. It also helps them optimize their financial positions. All these factors are reliant on crypto treasury management for enterprises. Some examples for these procedures are implementing security measures, diversifying holdings, and managing liquidity.

Crypto Funds and Investment Vehicles

Crypto funds, such as hedge funds, venture capital firms, and asset management companies, manage crypto treasuries on behalf of investors. They focus on maximizing returns on investment. Meanwhile, they also aim to minimize risks associated with investing in crypto. So, they also need unique blockchain treasury management structures in place.

Non-Profit Organizations and Foundations

Non-profit organizations are entities that operate for social welfare purposes. They do not have the intention of making a profit for shareholders or owners. Those who have a treasury in crypto use specific management methods to fund their projects. Treasury management in this context is allocating funds for research, community grants, and ecosystem development.

Individual Traders and Investors

Individual traders and investors seek to capitalize on market opportunities. They might do so by day trading or long-term investing. The process of portfolio management and how they store funds is also an example of crypto treasury management. In fact, it is a crucial factor for investors with high amounts of capital.

Top 5 Crypto Treasury Management Solutions

Now that we have explained what blockchain treasury management is and what types it includes, it is time to review the best crypto treasury management for businesses and individuals.

Request Finance

The first entry to our list is Request Finance. The company develops tools for both businesses and individuals in the crypto market. To streamline financial operations, users turn to Request Finance and use their crypto treasury management services. Some examples are invoicing, expenses, and payments. Request Finance manages all of them through one single platform.

The Request blockchain treasury management software is very user-friendly. It is also designed to be easy for accounting. Users can denominate their crypto transactions in fiat currencies of their liking. The platform can also integrate with accounting software like QuickBooks and Xero.

One of the key features of Request crypto treasury management is support for over 150 cryptocurrencies. Its invoicing capabilities for paying and getting paid in crypto are also exceptional. There is also a payroll functionality for paying salaries and bonuses in crypto.

The platform’s real-time dashboard makes the organization’s financial position clear. Clients can easily track and organize their payments and asset allocation. The Request crypto treasury management also provides a paper trail for every transaction. As a result, there is maximum transparency in operations.

Overall, Request crypto treasury management is a comprehensive solution for businesses and enterprises. Moreover, individuals who seek to manage their crypto treasuries can also use the platform.

Fipto Crypto Treasury Management Review

Fipto is another solution for managing any treasury in crypto. Its features help businesses effectively manage their digital assets. With Fipto, businesses can streamline their treasury management processes. Sending and converting fiat and digital currencies is as easy as can be with Fipto. You can also secure transactions with multi-role access management and 2FA. The audit-ready valuation is also a huge plus for Fipto.

One key benefit of Fipto is its compliance with tax and accounting frameworks. Fipto is registered with the French Financial Markets Authority (AMF). So businesses can trust the platform and follow regulations carefully.

Additionally, Fipto offers practical tips for managing crypto-related risks. Some of the tips are as simple as using stablecoins for transactions or utilizing top corporate wallets for security. Selecting a compliant solution like Fipto can ensure maximum security.

Overall, Fipto crypto treasury management is a simple and efficient solution for enterprises. It enables them to navigate the complexities of blockchain treasury management easily. Fipto’s innovative solutions are here to help businesses thrive in the blockchain era.

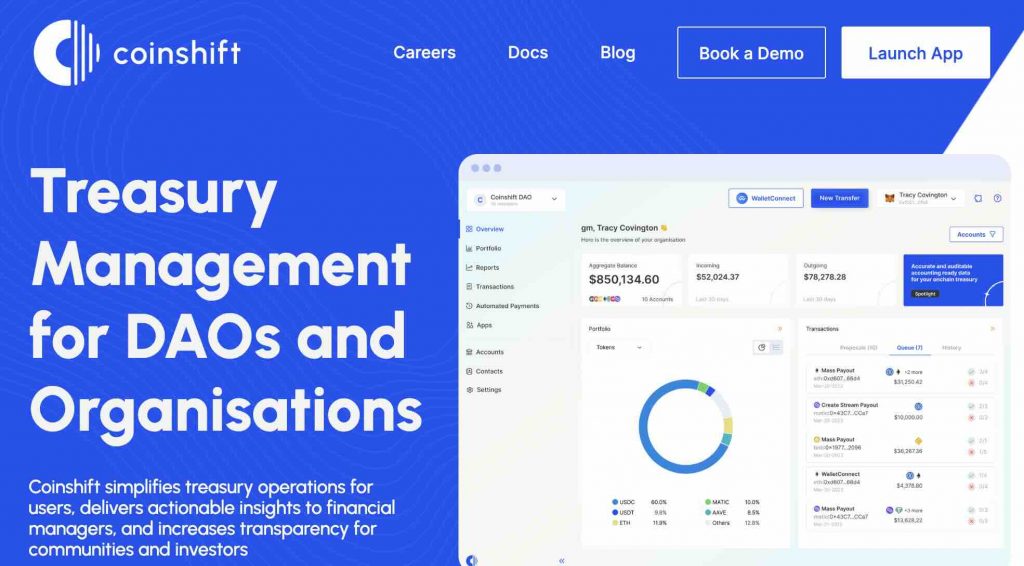

Coinshift

Coinshift is a platform that simplifies crypto treasury management for DAOs and organizations. It boasts a range of features to streamline financial management and increase transparency. Coinshift provides users with a unified dashboard. They can make payments and generate financial reports easily. Tracking assets across multiple accounts and blockchains is also possible with Coinshift.

One of Coinshift’s key features is Safe Integration. It allows users to self-custody their assets using a secure and trusted multisig solution. Moreover, Coinshift offers features for wallet tracking and smart contract tracking. These options let users gain insights into their transaction history.

The platform also simplifies crypto payments, especially mass payouts. Stream payouts and recurring payments are also covered by Coinshift solutions. Users can process payroll, grants, and expenses with confidence and ease. The Coinshift crypto treasury management system can easily automate these payments and, therefore, reduce administrative time.

Moreover, like other entries to our list, Coinshift provides accurate and auditable reporting. Users can gain real-time insights into the health of their treasury. This increases transparency for their community and investors. Some useful features include portfolio tracking, cash flow analysis, and accounting integration.

Coinshift aims to transform how organizations manage their crypto treasury operations. With its user-friendly interface and innovative features, it is safe to say that they have done so.

Zerocap Treasury Management Review

Zerocap is a leading provider of digital asset liquidity and custodial services. It is suitable for forward-thinking investors and institutions worldwide. With the increasing adoption of cryptocurrencies, Zerocap is crucial in assisting businesses with effective crypto treasury management.

Zerocap’s tailored solutions are designed to address the main challenges in crypto treasury management. These include liquidity management and risk mitigation. At Zerocap, businesses can benefit from a range of services that help them in managing their crypto treasuries.

One of their key tools is a treasury portal with advanced reporting features. They also provide access to on/off-ramp with fast settlement. Balance sheet management services help businesses optimize their financial positions and mitigate risks. With Zerocap, institutions can rest assured that their crypto assets are handled safely.

In essence, Zerocap is a trusted partner when ot comes to crypto treasury management. It provides easy access to digital assets and security solutions for its clients. Therefore, businesses that seek to thrive in the new blockchain era can rely on Zerocap.

Krayon

Krayon crypto treasury management solutions are trusted by companies and DAOs around the world. Their crypto treasury operations include a complete set of features. Clients can easily manage their digital assets with Krayon.

One of Krayon’s key features is its MPC Custody solution. It offers institutional-grade security for treasury assets using Multi-Party Computation (MPC) technology. This allows users to create multiple wallets and manage their crypto assets securely. Additionally, with Krayon’s Wallet Management feature, organizations can keep track of all their wallets in one place. They can also manage user roles and permissions, as well as control access to individual wallets.

With Krayon, users can also issue mass payments and store wallet addresses for contacts. Creating payment groups for regular transactions is also possible for making mass transactions. Therefore, clients can manage their company’s digital assets efficiently. Whether you’re a startup or a scale-up, Krayon provides the tools and support you need to optimize your crypto treasury operations.

Conclusion

In this article, we introduced the concept of crypto treasury management. We have discussed what the term really means and described some of the common types and use cases of blockchain treasury management procedures. Finally, we introduced the top 5 crypto treasury management solutions worldwide. The entries to this list are some of the most trusted names in the crypto industry.

As the crypto market continues to mature, effective crypto treasury management is a must for businesses. Centralized crypto institutions and DAOs can both implement crypto treasury management for enterprises to secure their holdings. Meanwhile, individual investors can also utilize these solutions. Practically, any entity with a considerable amount of capital in crypto should opt for top blockchain treasury management services.

Leave a Reply