I did this Mizar review after seeing more and more traders talk about the platform and its bots. Since I use trading tools every day, I wanted to check if Mizar actually works in real market conditions. At first, I suspected it was just another hyped product. Yet, that wasn’t quite the case.

I tested the Mizar trading bots, DCA system, copy trading, wallet tracker, and even checked out the Discord group to see if they have an actually active community or not. So, in this Mizar review, I share what I liked, what I didn’t, and who Mizar is really for. Keep in mind that this is all based on my real use and experience, and not theory.

What Is Mizar?

Let’s start this Mizar review by explaining what it actually is. Well, Mizar is a crypto trading platform that gives you bots, DCA tools, copy trading, and wallet tracking. It has two main sides: C-Mizar for centralized exchanges and D-Mizar for on-chain tools like sniper bots.

The first thing that catches the eye is that you don’t need a subscription to use it. You only pay small fees based on your trading volume. Mizar fees can go even lower if you stake the Mizar token (MZR).

The Mizar crypto trading platform is for everyday traders who want easy automation. That is, those who don’t know how to code a bot, but want to use one. It’s a good choice, as Mizar trading bots and copy trading work quite well. It also connects to several major exchanges and chains.

From my time testing it, Mizar feels simple to use and fast to set up. But this also means that it’s more retail-focused than the professional dashboards I’ve used for multi-account or fund-level work. Nevertheless, it’s perfectly fine for retail traders who want to automate their trading.

Mizar Trading Bots

On C-Mizar (the centralized exchange side), the bots are made for simple and steady automation. So, expect the usual trading bots you find on other platforms. You can set up classic buy/sell bots and Mizar DCA bots in a few minutes. The steps are quite clear: choose your exchange, pick a pair, set your rules, and let it run. The layout is simple enough that even new traders can follow it without confusion.

On D-Mizar, however, the bots are more aggressive. These include tools like sniper-style Mizar tracing bots that work directly on chains like Ethereum or Solana. These bots aim for fast entries on new tokens or early moves. Needless to say, the D-Mizar trading bots are riskier by nature. Their performance depends heavily on chain conditions.

In my tests, both sides worked well for their purpose. C-Mizar bots were stable and predictable. They placed orders on time and followed the rules I set. D-Mizar bots also reacted fast but felt more volatile, which is normal for on-chain trading. The main limit is the depth of the strategy settings. You don’t get advanced logic or heavy customization.

Now, when I compare Mizar’s bots to the systems I use on Finestel, the difference is clear. Mizar focuses on quick setup and ease of use, while Finestel’s automation leans more toward structured signal routing, account grouping, and strategy-level control. Finestel trading view bots and signal bots also give me more flexibility with TradingView alerts and custom signals, which helps a lot when running more serious strategies.

So, Mizar trading bots are better suited for retail traders who want simple bots they can launch fast. Meanwhile, Finestel’s trading bots are for more advanced traders and asset managers who need more control and cleaner execution across several accounts.

Mizar DCA Bots

Moving on to Mizar DCA bots, I’ve found them as one of the easiest parts of the platform to use. You choose your exchange, pick your pair, and set how often you want the bot to buy. You can also define your safety orders and take profits. It’s all very clear, and you won’t need much trading background to set one up.

These DCA bots worked well during the normal market conditions I tested them on. They placed orders on time and handled dips smoothly. They’re quite decent for steady accumulation, but not fast trading. So, I’d prefer to use them in slow or choppy markets where timing entries is hard. Of course, like any DCA setup, they can struggle in strong downtrends if the market keeps falling. You’ll need enough capital and patience for them to work properly.

Mizar Copy Trading

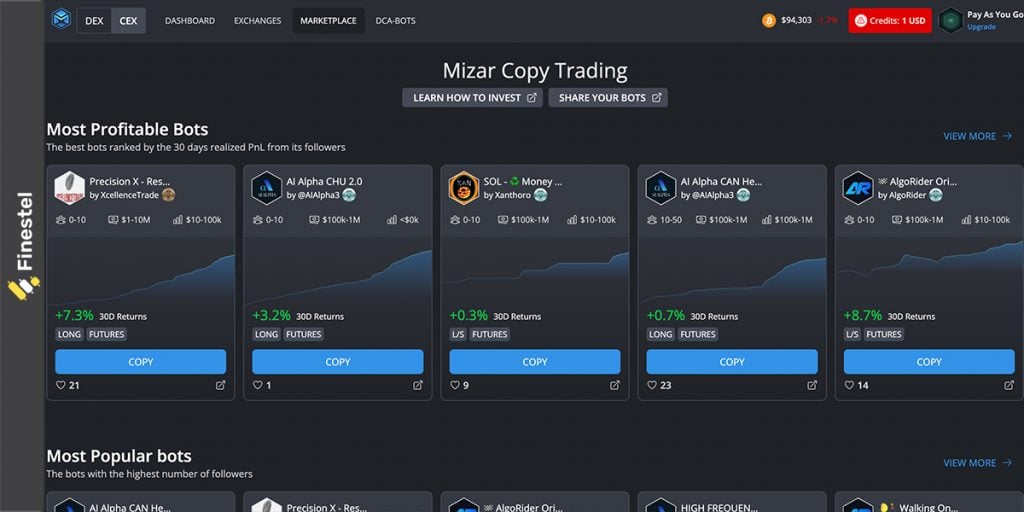

Now, this was the most interesting part of my Mizar review. The Mizar copy trading system is one of its main features. You can browse a list of traders and check their past performance on the Mizar marketplace. Whichever strategy you like most, you can copy it with a few clicks. You should also pick your allocation, set your limits, and you’re done.

In my opinion, the Mizar copy trading system felt smooth. Trades were copied quite fast, and the platform handled entries and exits without issues. The performance pages show basic stats like ROI, drawdown, and trading history. It’s enough to understand how a trader performs, but not that deep. I mean, if you want more advanced data or risk metrics, you’ll feel the limits pretty fast.

Mizar Copy Trading vs Finestel

Now, compared to the Finestel copy trading software, Mizar’s copy trading is much more “marketplace-style.” I’d classify it as social trading. You follow listed traders, and the platform executes their moves for you.

|

Feature |

Finestel Copy Trading |

Mizar Copy Trading |

|---|---|---|

|

Type of System |

Professional copy-trading infrastructure for multi-account execution |

Marketplace-style social copy trading |

|

Target Users |

Asset managers, pro traders, trading teams |

Retail traders and casual followers |

|

How It Works |

One trader trades → copied instantly across all linked accounts |

You choose a trader from the marketplace and copy their strategy |

|

Execution Speed |

Faster execution with bulk routing across several accounts |

Good execution for single accounts, but limited to your own exchange link |

|

Supported Exchanges |

Binance, Bybit, OKX, KuCoin, Bitget, MEXC, Gate, Coinbase, and more |

Mainly Binance, Bybit, KuCoin, OKX (varies by C-Mizar) |

|

Control & Customization |

Deep control: leverage, margin mode, hedge mode, position sizing, and per-account rules |

Simple settings: allocation, stop copy, basic risk controls |

|

Performance Reporting |

Advanced portfolio analytics, PnL breakdowns, and account-level insights |

Basic stats like ROI, drawdown, and trade history |

|

Scaling |

Built for managing dozens or hundreds of accounts at once |

Built for single-account retail use |

|

Best For |

Professional traders, money managers, and people with multiple accounts |

New or intermediate traders who want to follow strategies easily |

Finestel takes a completely different approach. It’s built more for professional traders and asset managers who want to run strategies across many accounts of their own or their investors. Executions are faster, and there’s simply more control. You can also personalize and customize your front-office dashboard for your clients using our white-label feature.

Moreover, Finestel’s portfolio tracker and analytics also provide better reporting. So, Finestel provides a much better experience for those who want to manage serious capital. But if you’re just a retail trader who wants to list your strategy on a public marketplace and earn performance fees, or you want to follow others’ strategies, Mizar is the way to go.

Mizar Wallet Tracker

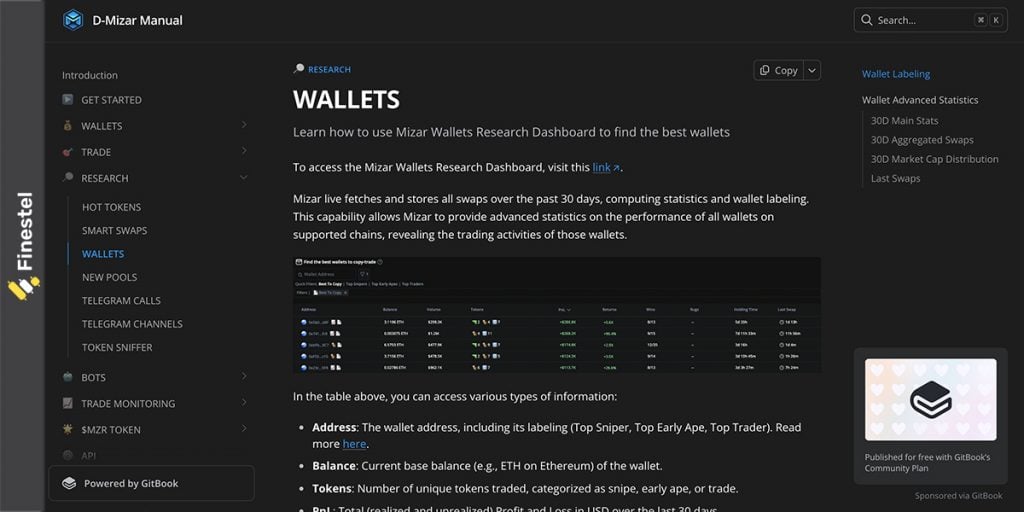

Another interesting feature I’ve tested to write this Mizar review is its wallet tracker. It is on the D-Mizar side and gives you an intuitive way to check how wallets perform on supported chains. You can check out their recent swaps and profit and loss. Even their win rates and holding times are visible.

I’ve also tried labeling, which allows you to classify and label wallets based on their behaviour. Using these labels, you can quickly see if a wallet is a decent trader who knows what they’re doing, or a risky one, or one that doesn’t perform well. And also, the platform shows you which wallets focus on small-cap crypto trading, and which ones just stick to bigger coins like BTC and ETH.

Mizar Trading Terminal

The last part of the platform I want to write about in this Mizar review is their trading terminal. Just like the other parts, I think the terminal is simple for traders with experience. But the main difference between Mizar’s terminals and other platforms is that it’s built primarily for on-chain trading.

The chart is TradingView-powered, like most terminals these days, and you can see your trade history and all the other usual stuff you expect to see on a trading platform. Yet, the trading actually works differently in the background, as you trade tokens directly on chains like Ethereum or Base. Safety tools like gas limits, slippage control, and auto-retry are also available. So, I think it’s actually a pretty solid and unique terminal for trading directly on-chain.

Now, I want to make a comparison with Finestel again. In fact, I’d say that Finestel’s trading terminal is built for a completely different style of trading. Asset managers and master traders use it for multi-exchange and multi-account execution, not on-chain tokens. You can trade across Binance, Bybit, OKX, KuCoin, Bitget, MEXC, and more from one screen, and send the same trade to dozens of accounts at once. You can change leverage, margin type, hedge mode, and run bulk actions across all connected portfolios. So, again, if you manage accounts and portfolios, Finestel is definitely the platform for you.

Mizar Pricing

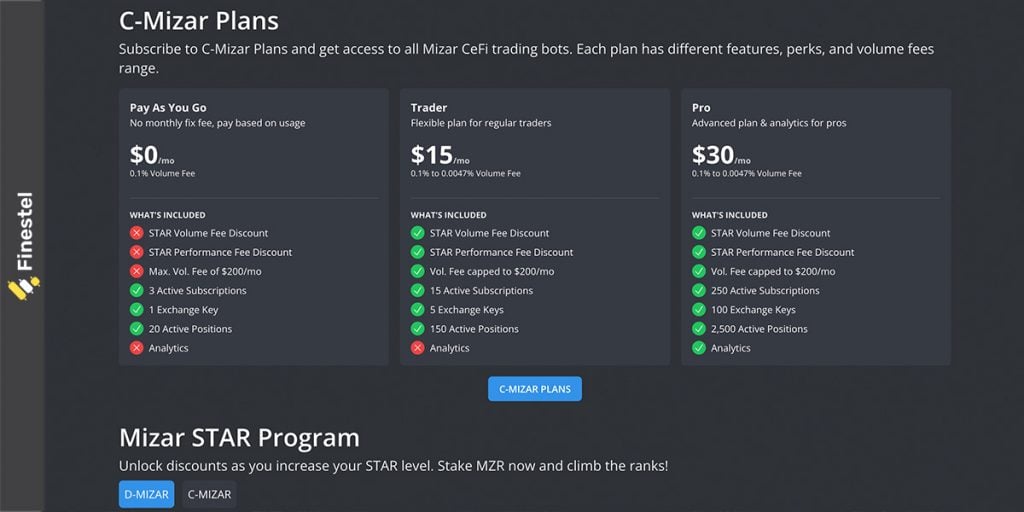

Another key section of this Mizar review is, of course, about pricing. Well, Mizar’s pricing on the C-Mizar side comes in three simple plans:

- Pay As You Go (Free): This plan has no monthly fee and charges a flat 0.1% volume fee on trades.

- Trader ($15/mo): Under this plan, Mizar charges A small monthly fee that gives you higher limits for open positions and exchange keys, while still starting at a 0.1% volume fee.

-

Pro ($30/mo): This is the highest monthly plan with even more limits and flexibility. Again, it starts at 0.1% but can drop lower if you stake MZR (the Mizar utility token).

On D-Mizar, however, you don’t pay a monthly fee at all. Instead, each on-chain buy or sell has a small cost, up to 1% depending on the network. Mizar claims to have flexible pricing, and all I can say is that they’re definitely spot on about this.

The Mizar Coin

Zooming out a bit, it’s time to have an overview of the whole ecosystem and its native token. Yes, Mizar uses its own token, MZR. This Mizar utility token is used to reduce trading fees and unlock better tiers inside the platform. So, if you stake MZR, your fees drop, and some features become cheaper to use.

If you know your way around crypto, you’ll recognize this as a quite common system. Lots of crypto platforms have their own utility token, and the Mizar crypto token is one of those. Yet, D-mizar is where the token is especially valuable, because fast on-chain trades will benefit a lot from lower costs.

Mizar Reviews and Community

I’ve also done some research on Mizar reviews and feedback from traders online. The platform gets mostly positive feedback, especially due to the no-subscription model on D-Mizar. Some Mizar Trustpilot and Reddit reviews also show strong results with copy trading. Still, some others warn that the big returns are rare and depend on the trader you follow.

The Mizar Discord community is also quite active. People share their setups and recent trades, and sometimes quick tips to use the platform or just to trade better. It’s also easy to get help there, and most questions get answered fast. It really gave me a strong sense of community, which is very important in my opinion.

Mizar Alternatives

Mizar is a strong option for retail traders who want fast automation, copy trading, and on-chain tools without complexity. But as you’ve probably realized while reading this Mizar review, it’s not built for everyone.

Some traders want more advanced automation, others want multi-account execution, and some are simply looking for a different style of copy trading or bot control. Depending on your experience level and trading goals, there are several platforms that overlap with Mizar in different ways.

Below, I’ve listed five relevant Mizar alternatives, including Mizar itself for context, so you can clearly see where each platform fits.

|

Platform |

Best For |

Core Focus |

Key Strengths |

How It Compares to Mizar |

|

Mizar |

Retail traders |

Bots, DCA, copy trading, on-chain tools |

Easy setup, no-code bots, DEX sniper tools, pay-as-you-go pricing |

Simple and fast, but limited strategy depth |

|

Finestel |

Asset managers, pro traders |

Automation & multi-account execution |

Advanced copy trading, TradingView bots, portfolio analytics, and billing |

Much deeper and more professional, but less beginner-friendly |

|

Retail & semi-pro traders |

Bot automation |

Grid & DCA bots, TradingView alerts, large user base |

Similar retail focus, but weaker on on-chain tools |

|

|

Manual + bot traders |

Trading terminal & bots |

Clean UI, grid bots, arbitrage tools |

Better terminal, less social, and on-chain focus |

|

|

Signal followers & providers |

Signal-based automation |

Telegram signal automation, fast execution |

Strong for signals, weak for full bot strategies |

Conclusion

After testing everything for this Mizar review, I can say that it is quite a solid choice for retail traders who want simple automation, copy trading, and on-chain tools. And the best thing is that it’s not even complicated. The pay-as-you-go pricing also makes it accessible for everyone. The bots, DCA system, and wallet tracker all work well for everyday trading, and the active Mizar Discord community is a nice bonus.

That said, Mizar is still a retail-focused platform. If you need deeper control, multi-account execution, or a system built for managing several portfolios at once, platforms like Finestel offer a far more advanced environment. Then again, not everyone is a pro trader and in need of advanced tools. So, unique retail crypto trading platforms like Mizar are attractive for many, and I can now understand why.

Leave a Reply