Ten years ago, digital assets were a niche experiment. Today, they represent one of the fastest-growing corners of global finance. Bitcoin and Ethereum have become household names, and institutions are now seriously allocating to digital assets.

For asset managers, the conversation has shifted. Clients are no longer asking if they should invest in crypto, but how. High-net-worth individuals, family offices, and even small institutions want exposure, but they want it managed with the same professionalism, security, and transparency they expect in Traditional Finance (TradFi).

This is where Separately Managed Accounts (SMAs) come in. Long used in equity and fixed-income markets, SMAs are now emerging as one of the most cost-efficient and tax-efficient ways to deliver tailored crypto exposure while preserving direct ownership, compliance, and customization.

What Is a Separately Managed Account (SMA)?

When people first hear the term SMA, they often wonder about its exact role in finance. Put simply, an SMA account (Separately Managed Account) is an individual managed account where a professional asset manager runs a portfolio on behalf of a single client. Unlike pooled products such as mutual funds, each investor in an SMA directly owns the underlying assets in their account.

This is the core of SMA finance meaning: instead of buying shares in a fund, the investor has direct ownership of the securities (or in the case of crypto SMAs, the tokens). That ownership unlocks important benefits: control, transparency, and flexibility.

From an SMA investment meaning perspective, SMAs are not just another financial product. They are a structure for investing that lets managers customize portfolios around each client’s needs. For example, an investor can instruct their manager to avoid certain sectors, include specific assets, or align the portfolio with tax strategies.

Advantages of Separately Managed Accounts

The advantages of separately managed accounts over pooled vehicles are well-documented:

- Direct ownership: Clients hold the assets in their name, not just a share of a fund.

- Customization: Portfolios can be aligned with personal goals, exclusions, or risk profiles.

- Tax efficiency: Lot-level tax-loss harvesting and reporting flexibility can improve after-tax returns.

- Transparency: Investors can see exactly what they own at any given moment.

These features explain why SMAs are popular in Traditional Finance (TradFi) for equities, bonds, and even alternatives like private equity.

SMA vs Mutual Fund: Key Differences

|

Feature |

Separately Managed Account (SMA) |

Mutual Fund |

|

Ownership |

Client directly owns the securities or crypto assets in their account. |

Investor owns shares of a pooled vehicle, not the underlying assets. |

|

Customization |

High; investors can exclude or include assets based on preferences, goals, or restrictions. |

None; all investors follow the same fixed strategy. |

|

Tax Management |

Allows tax-loss harvesting and individual lot selection for personalized tax efficiency. |

Gains/losses are distributed across all shareholders proportionally. |

|

Transparency |

Investors can see their holdings in real time. |

Limited visibility, typically through periodic fund reports. |

|

Flexibility |

Tailored to each client’s mandate and investment style. |

One-size-fits-all approach. |

This comparison highlights why many high-net-worth clients and institutions consider SMAs the best separately managed accounts structure, especially when entering new asset classes like crypto.

Find the best crypto asset management tools in 2025.

Segregated vs. Separately Managed Accounts in Crypto

It’s worth clarifying terms:

- Separately Managed Account (SMA): An account tailored for a single client, run by an asset manager.

- Segregated Managed Account: Focuses on custody. Assets are held in dedicated, segregated wallets, not commingled with others.

In crypto, segregation is vital. We’ve all seen headlines of exchanges collapsing, leaving customers in limbo. A properly structured segregated managed account ensures that assets remain legally owned by the client, even if the custodian or platform experiences issues.

This legal clarity builds confidence, something both high-net-worth clients and institutional investors demand.

Do asset managers need a license? find out here.

Why Crypto SMAs Are Rising in Popularity

So, why are crypto SMAs becoming the preferred model for digital asset exposure? Let’s break it down.

1. Direct Ownership Builds Trust

Unlike ETFs or trusts, where investors hold a financial product, crypto SMAs give clients ownership of the actual coins or tokens. This matters when investors want transparency, portability, or the option to move assets.

2. Tailored Portfolios

Crypto SMAs aren’t one-size-fits-all. A client can choose:

- A large-cap index strategy (e.g., BTC, ETH, SOL).

- A thematic strategy (DeFi, Web3, Layer-2 tokens).

- A conservative allocation (stablecoins + BTC/ETH mix).

- Exclusions (e.g., avoiding meme tokens or specific sectors).

This customization is one of the biggest selling points for both independent asset managers (EAMs) and large RIAs.

3. Tax Optimization

Tax-loss harvesting in crypto is a powerful tool. Volatility creates frequent opportunities to capture losses and offset gains. In the U.S., platforms like Eaglebrook have shown millions in harvested losses for clients.

Unlike ETFs, SMAs allow for lot-level trading, giving managers flexibility in reporting and optimization.

4. Security Through Segregation

Segregated custody means a client’s digital assets aren’t mixed with others. In the event of custodian trouble, their holdings remain safe and identifiable. This is far safer than omnibus accounts, where assets are pooled.

5. Advisor Integration

Crypto SMA platforms integrate into reporting and billing systems already used by RIAs and institutions. This makes digital assets manageable as part of a holistic wealth strategy, rather than as an isolated experiment.

Top 6 Crypto SMA Providers

When evaluating the market for Crypto SMA providers, dozens of names come up, from custodians and infrastructure firms to DeFi protocols and wealth-tech platforms. But not all of them truly operate as Separately Managed Account (SMA) platforms.

For this list, we focused on five providers that most clearly deliver real SMA functionality:

- They allow client-specific accounts (not pooled funds).

- They support professional asset management workflows (strategy delivery, reporting, billing, tax integration).

- They ensure custody clarity, either non-custodial (Finestel) or custodial with segregated ownership (Eaglebrook, Bitwise via Eaglebrook, Anchorage, Onramp).

1) Finestel; Non-custodial, White-label SMA Infrastructure

Finestel positions itself as a non-custodial autotrading, client management, reporting, and portfolio management software built specifically for professional crypto asset managers and businesses. Unlike custodial SMA platforms, Finestel never touches client funds assets remain in the client’s own exchange or custodian account, with managers connecting via secure APIs.

Why it matters:

- Non-custodial by design: Unlike most SMA providers in the market, Finestel does not offer the custody SMA solution; however, keeping the edge by offering its masterpiece non-custodial SMA solution that carries no more risk for HNWI or their manager regarding the counterparty risk of asset custody by the SMA service provider.

- White-label ready: Asset managers can brand the entire platform, client dashboards, reporting, and billing, under their own name. This makes Finestel especially appealing for independent/external asset managers (EAMs) and boutique firms.

- Trading tools:

You can offer your strategies and portfolios to your clients by using various types of Finestel features offering. Finestel offers TradingView bot, and signal bot and copy trading (trade copier) support, allowing managers to scale strategies across many accounts simultaneously. It also provides a trading terminal for bulk actions and bulk trade execution.

- Major exchange integrations: Finestel supports Binance, Binance.US, Bybit, KuCoin, OKX, Bitget, MEXC, Gate, and more.

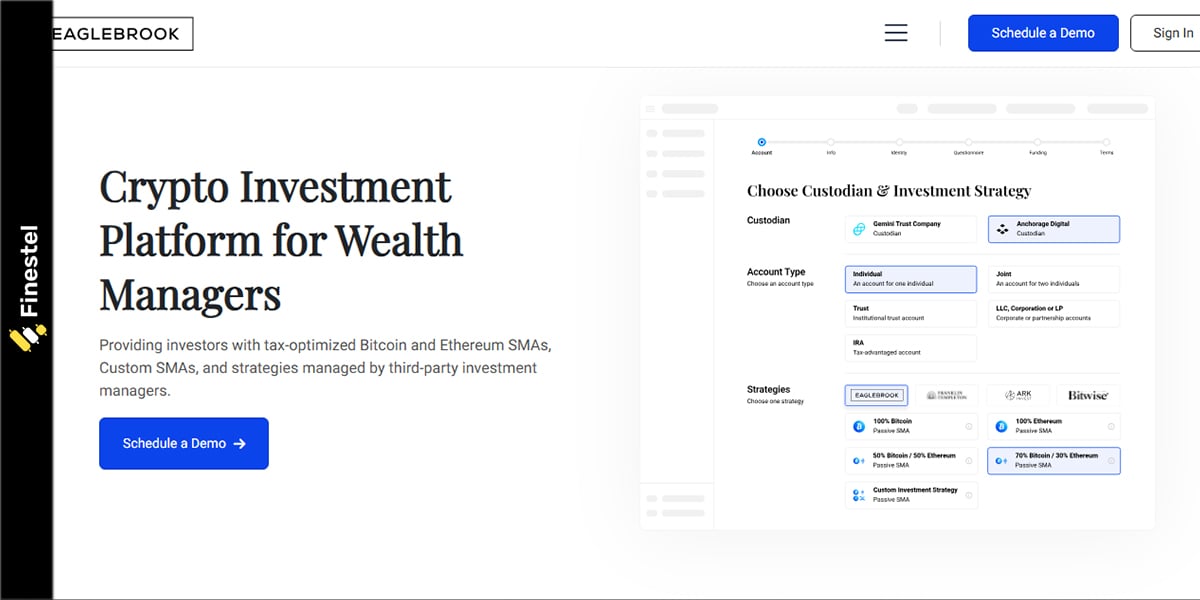

2) Eaglebrook Advisors; SMA Rails for RIAs

Eaglebrook has positioned itself as the go-to custodial SMA platform for Registered Investment Advisors (RIAs). It offers a streamlined, plug-and-play way for advisors to introduce digital assets to their clients without needing to build new systems from scratch. What sets Eaglebrook apart is its ability to integrate with existing billing, reporting, and compliance software, ensuring crypto exposure can sit neatly alongside traditional portfolios.

Eaglebrook also works with high-profile asset managers like ARK Invest, Franklin Templeton, and Bitwise, delivering their model portfolios directly through its SMA platform. For RIAs, this means they can give clients exposure to curated strategies from trusted names while still maintaining direct asset ownership at a qualified custodian.

Best for: RIAs who want to meet client demand for crypto quickly and professionally, while leveraging strategies from brand-name managers.

3) Bitwise (via Eaglebrook); Strategy Provider

Bitwise Asset Management is well known for its crypto index funds and ETFs, but it also delivers its expertise through SMA structures. By leveraging Eaglebrook’s custodial rails, Bitwise provides large-cap, sector-based, and thematic crypto portfolios in a separately managed account format.

The advantage for advisors is that they can offer clients Bitwise’s research-driven strategies while preserving the ownership and tax benefits of an SMA. Portfolios can be customized at the client level, and advisors can use features like lot-level trading for tax optimization, something not available in pooled products.

Best for: Advisors who want to deliver Bitwise’s model design and market expertise in an SMA wrapper that combines direct ownership with efficient tax management.

4) Anchorage Digital; Bank-Level Custody

Anchorage Digital is unique in the crypto SMA ecosystem because it operates as the first and only OCC-chartered digital asset bank in the U.S. This status gives it credibility and compliance advantages that few others can match. As a qualified custodian, Anchorage provides the segregated accounts and bank-grade security that RIAs and institutions require to manage digital assets responsibly.

Anchorage also partners with SMA platforms like Eaglebrook and Onramp to provide the custody backbone for their managed solutions. This makes Anchorage less of a direct SMA provider and more of the infrastructure layer that ensures assets are held safely and in line with regulatory expectations.

Best for: Institutions and RIAs that value regulatory clarity, security, and segregation of assets, and want a custodian that already meets U.S. compliance standards.

5) Onramp Invest (Securitize); Advisors + Tokenization

Now part of Securitize, Onramp brings an innovative angle by combining crypto SMAs with tokenized private investments. Its platform connects advisors to both digital assets and tokenized securities, such as real estate, private equity, and credit, creating a broader menu of opportunities for clients who want exposure beyond traditional crypto assets.

Onramp uses a multi-institution custody (MIC) model, which distributes custody across several independent entities, reducing single-point-of-failure risks. In addition, it provides advisor-focused tooling for education, compliance, and reporting, making it easier for RIAs to integrate digital assets into their existing practice.

Best for: Advisors who want to offer clients both crypto and tokenized alternatives inside a single, SMA-like workflow that is forward-looking and aligned with the future of wealth management.

6. Tilvest

Tilvest is the leading crypto-asset management platform specifically designed for French and European Wealth Management Advisors (CGPs) and Family Offices. It operates as a fully regulated bridge (PSAN registered with the AMF), allowing advisors to offer digital asset management mandates (mandats de gestion) to their clients without handling private keys or execution themselves.

Tilvest’s biggest competitive advantage is its integration with O2S (Harvest) and Wealthcome. These are the dominant aggregator tools used by French wealth managers, meaning crypto assets on Tilvest appear automatically on a client’s net worth statement alongside their life insurance and real estate.

-

Best for: European CGPs, CIFs, and Private Bankers who need a turnkey, compliant way to add crypto mandates to their clients’ portfolios while keeping the data visible in their existing wealth management software.

Top 6 Crypto SMA Providers Side-by-side Comparison

|

Dimension |

Finestel |

Eaglebrook Advisors |

Bitwise (via Eaglebrook) |

Anchorage Digital |

Onramp Invest (Securitize) |

Tilvest |

|

Primary role |

White-label SMA software & non-custodial infrastructure |

RIA-first crypto TAMP (Turnkey Asset Management Platform) |

Strategy Provider(Model Manager) |

Qualified Custodian with SMA support |

Advisor-Tech for crypto + tokenized alts |

EU Wealth-Tech (French “Eaglebrook”) |

|

Pricing Model |

SaaS Subscription (~$299/mo business fee + setup; tiered pricing |

AUM-Based Platform Fee (Platform bps + Manager bps) |

Strategy Expense Ratio (~1.0% – 1.5% AUM fee on top of platform fees) |

Custody Fee (Bps on assets/year + Transaction fees) |

SaaS License (~$5k/firm/year or per-seat fees) |

AUM + Performance (~1-2% Mgmt + Custody Fees + Performance Fee) |

|

Custody model |

Non-custodial (Assets stay in client’s own exchange/wallet; connected via API) |

Custodial (Assets at Gemini/Anchorage in client’s name) |

Custodial (Leverages Eaglebrook’s custody partners) |

Bank-Grade Custody (OCC-Chartered Trust) |

Multi-Custody (Connects to various custodians) |

Custodial (PSAN) (Segregated wallets via institutional partners) |

|

Strategy delivery |

Your models; copy trading; bots; white-label portal |

Curated lineups (Franklin, ARK, Bitwise) |

Bitwise IP (Indexes, DeFi, Thematic) |

N/A (Custody & Settlement focus) |

Indexes/models + tokenized private credit/RE |

Managed Mandates (Mandats de Gestion: Balanced, Yield, Dynamic) |

|

White-label |

Yes (Full) (Custom domain, logo, emails, client dashboard) |

No |

No |

No(Custody brand) |

Partial (Advisor branding on reports/portal) |

Partial (Co-branded client reporting) |

|

Automation |

High (TradingView webhooks, signal bots, bulk terminal, copy trading) |

Medium (Rebalancing & tax-loss harvesting workflows) |

Medium (Relies on Eaglebrook’s rebalancing) |

Low (Settlement & Execution focus) |

Medium (Advisor rebalancing tools) |

High (Internal) (Algorithmic rebalancing within mandates) |

|

Best for |

Asset managers, financial advisors, RIAs, Wealth managers, Family offices, asset management firms, who want a plug & play solution. |

US RIAs who want a “plug-and-play” crypto solution. |

Advisors specifically who need Bitwise’s brand/research in client portfolios. |

Institutions prioritizing regulatory safety & bank charter. |

Advisors wanting Crypto + Tokenized Real World Assets in one view. |

European CGPs/CIFs who need a regulated (PSAN) & integrated solution. |

Quick guidance on picking the “right” one

-

Choose Finestel if you want to launch or scale your own branded SMA-style service, keep assets non-custodially under client control, and lean on automation to run multi-account, multi-exchange operations.

-

Choose Eaglebrook if you’re an RIA who wants immediate access to recognized strategies (Franklin/ARK/Bitwise) and direct client ownership with established advisor integrations.

-

Choose Bitwise (via Eaglebrook) if the core need is Bitwise’s model design, delivered in SMA form for tax and ownership benefits.

-

Choose Anchorage Digital when qualified custody and a bank-level control environment are your first priority; assemble model delivery via partners.

-

Choose Onramp Invest (Securitize) if you want a route into crypto plus tokenized private investments inside an advisor-friendly workflow.

Conclusion

Separately Managed Accounts have earned their place in Traditional Finance by offering investors transparency, direct ownership, and flexible portfolio design. That same structure is now powering a new wave of digital asset management. By combining familiar wealth management principles with the unique needs of crypto, SMAs give clients the professionalism and trust they expect, while opening doors to tax efficiency, personalization, and diversified exposure beyond simple ETFs or pooled funds.

For wealth managers and independent professionals alike, crypto SMAs are more than a product, they’re an opportunity. Custodial platforms deliver seamless entry for RIAs, while non-custodial, white-label solutions empower boutique managers to compete at scale. As tokenization, DeFi integration, and automation continue to mature, SMAs are set to become the standard framework for digital asset wealth management, bridging the gap between established TradFi practices and the fast-moving world of crypto.

Leave a Reply