Welcome to Finestels’ exploration of “Trading Psychology Books,” where we delve into the literature that sheds light on the psychological aspects of trading. Although the financial markets are heavily influenced by numbers and charts, the human mind plays a vital role in successful trading. Understanding ourselves, our biases, our fears, and our aspirations is just as important as comprehending the markets, as these factors can greatly influence our trading decisions.

Traders rely on technical analysis, market research, and strategic planning to make informed decisions. However, trading psychology is an equally important but often neglected aspect of trading. It involves understanding the complex emotions, biases, and mental processes that impact our decision-making while navigating the markets. The key to success in trading lies not only in understanding the markets but also in understanding yourself.

Discover the captivating world of trading psychology books, where the human mind holds the key to trading success. Whether you’re a trader looking to improve your strategy or a curious investor eager to learn, this journey promises to be enlightening. By understanding your psychology, you can transform your approach to trading and life. Let’s explore these transformative books together and uncover the secrets to thriving in the dynamic trading world.

The Role of Emotions in Successful Trading

Developing mental clarity and emotional control is the key to becoming a successful trader. It’s essential to take the time to reframe your thoughts, analyze your trading strategies, and document your decisions. Thinking in writing and recording every step of the trading process will put you in a better position to identify negative patterns in your thinking and recognize emotional triggers.

Learning to recognize and manage emotions is crucial to developing the mental clarity and emotional control needed to make informed decisions in the market. One way to increase emotional state awareness and gain perspective is to step away from the market for a while.

Ignoring the “noise” of the market and taking a step back can help traders recalibrate their focus. Positive thinking is vital in trading. It assists traders in maintaining confidence and staying calm while making decisions by replacing negative thought patterns with productive ones.

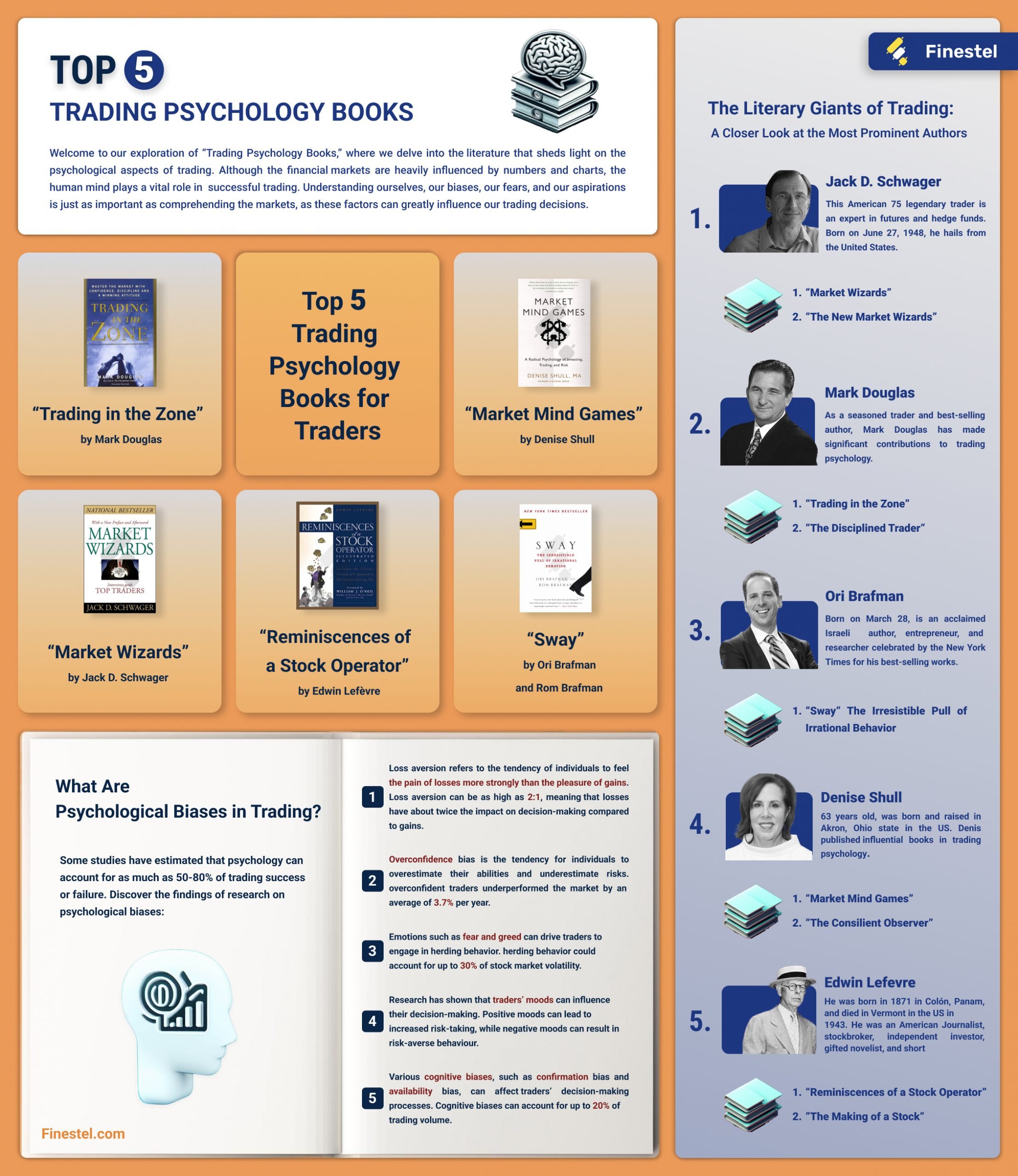

The Numbers Don’t Lie: Statistical Evidence of Psychological Biases in Trading

Some studies have estimated that psychology can account for as much as 50-80% of trading success or failure.

Discover the findings of research on psychological biases:

-

Loss aversion refers to the tendency of individuals to feel the pain of losses more strongly than the pleasure of gains. Research suggests that loss aversion can lead traders to exit positions prematurely or avoid potentially profitable opportunities. One study found that loss aversion can be as high as 2:1, meaning that losses have about twice the impact on decision-making compared to gains.

-

Overconfidence bias is the tendency for individuals to overestimate their abilities and underestimate risks. Research indicates that overconfident traders tend to trade more frequently, resulting in lower returns. One study found that overconfident traders underperformed the market by an average of 3.7% per year.

-

Emotions such as fear and greed can drive traders to engage in herding behavior, where they follow the actions of others rather than making independent decisions. This behavior can lead to market bubbles and subsequent crashes. One study estimated that herding behavior could account for up to 30% of stock market volatility.

-

Research has shown that traders’ moods can influence their decision-making. Positive moods can lead to increased risk-taking, while negative moods can result in risk-averse behaviour. One study on crypto trading psychology found that traders in a positive mood were more likely to take on riskier positions, leading to higher returns but also higher volatility.

-

Various cognitive biases, such as confirmation bias and availability bias, can affect traders’ decision-making processes. These biases can lead to distorted perceptions of market information and influence trading outcomes. One study estimated that cognitive biases can account for up to 20% of trading volume.

-

Studies on gender differences in trading and decision-making have produced mixed results. Some research suggests that men may exhibit higher levels of overconfidence and risk-taking behavior, which can potentially lead to less self-control in trading. On the other hand, other studies have found that women may be more risk-averse and exhibit greater caution in their trading decisions.

Can Trading Psychology be Learned and Developed, or Is it Innate?

Trading psychology is both learnable and inherent, depending on your preferences, experience level, and personality type. One’s psychology is the most important factor to understand in developing a successful trading psychology. Everyone is different in terms of their individual preferences, risk tolerance, and emotional triggers. Some traders prefer a more cautious approach, and others are more adventurous and aggressive.

Another factor that affects a trader’s psychology is experience. The more experience you have, the better you will become at trading. Over time, you will understand the markets and develop psychological skills such as discipline, patience, and risk management. Also, it is important to understand the psychology of other traders. Knowing how the market works, what other traders think, and their strategies can help you develop better trading strategies. It is important to create the right psychological attitude and skills to be successful in trading.

The Literary Giants of Trading: A Closer Look at the Most Prominent Authors

Trading psychology is one of the most important aspects of a successful trade because it significantly impacts a trader’s performance. Here, we are investigating some of the most influential figures in this area.

Jack D. Schwager: This American 75 legendary trader is an expert in futures and hedge funds. Born on June 27, 1948, he hails from the United States. Another reason that we know Jack D. Schwager is for his influential financial books. In “Market Wizards” and “The New Market Wizards,” one of the Trading Psychology books in which, he features interviews with top traders who unveil their strategies, experiences, and trading psychology. Jack D. Schwager’s writings have not only inspired aspiring traders but also established him as a key authority in the field of finance.

Mark Douglas: Mark Douglas was born and raised in Montana, The US. He is a trader Psychologist and has made significant contributions to trading psychology. He is a pro trader with the title of one of the best-selling authors in his records. He has several books, including “Trading in the Zone” and “The Disciplined Trader,” which offer practical guidance on mastering the mental aspects of trading. These books empower readers to overcome emotional obstacles and consistently enhance their trading performance.

Ori Brafman: Ori Brafman, born on March 28, is an acclaimed Israeli author, entrepreneur, and researcher celebrated by the New York Times for his best-selling works. His expertise in studying human behavior within financial markets allows him to integrate psychological insights and real-world scenarios seamlessly.

Readers gain a profound understanding of decision-making processes by reading his books. Ori has eight other influential books, including the notable “Sway,” co-authored with his brother Rom Brafman. Ori’s impact on behavioral economics and psychology is commendable among the top rank of Trading Psychology books. Below books are the books he has written so far:

- “The Chaos Imperative”

- “Click: The Forces Behind How We Fully Engage with People, Work, and Everything We Do”

- “Radical Inclusion: What the Post-9/11 World Should Have Taught Us About Leadership”

- “The Starfish and the Spider: The Unstoppable Power of Leaderless Organizations”

- “The Spider and the Starfish Workbook”

- “The Power of Unreasonable People: How Social Entrepreneurs Create Markets That Change the World.”

Rom Brafman: Rom Brafman was born May 26, 1968, and is a preeminent psychologist recognized for advocating positive human growth and personal development. Rom Brafman, with his precious research and writings, unveiled the intricate complexities of human behavior and decision-making processes. He presents invaluable insights for traders aspiring to understand their psychology better. As an author, Rom Brafman has penned three books until now, all contributing to understanding human behavior and personal growth. These books include:

- “Sway” – Co-written in collaboration with his brother Ori Brafman, “Sway” explores the hidden forces that shape our decisions and actions.

- “Succeeding When You’re Supposed to Fail” – This book offers empowering strategies to overcome challenges and succeed even in adversity.

- “The Magic of Instant Connections” – Rom reveals the secrets behind creating meaningful and authentic connections with others in personal and professional settings.

Denise Shull: Denise Shull, 63, was born and raised in Akron, Ohio state in the US. Denis published influential books in trading psychology. “Market Mind Games” and “The Consilient Observer” are books that improve traders’ vision at a higher level. In Market Mind Games, traders learn how to control their emotions on trading to choose proper strategies. The book is among the best Trading Psychology books that train traders to develop their winning mindset. Her unique approach in this book is a passage that extends the winning attitude in traders.

Edwin Lefevre: Edwin Lefevre was born in 1871 in Colón, Panam, and died in Vermont in the US in 1943. He was an American Journalist, stockbroker, independent investor, gifted novelist, and short story writer. His most praised work, “Reminiscences of a Stock Operator,” offers a fictionalized account inspired by the legendary trader Jesse Livermore. He provides timeless insights into the mindset and strategies of successful traders in his book. Edwin Lefevre authored another notable book in psychology and trading called “The Making of a Stock Trader.”

Top 5 Trading Psychology Books for Traders

Trading successfully in the financial markets is difficult, but some of the greatest traders have achieved it. Aspiring traders may be wondering what it takes to become one of these masters of the market, and the answer is simple – learning the psychology of trading. Understanding the psychological processes involved in trading is the key to becoming a master trader.

The top 5 trading psychology books delve into the depths of the human psyche, offering unique insights and strategies to enhance traders’ mental understanding and decision-making. This detailed analysis will explore each book’s key themes, concepts, strategy, and the author’s approach and writing style.

“Market Wizards” by Jack D. Schwager

“Market Wizards” is an indispensable book for traders and investors seeking wisdom from some of the greatest traders of our time. Wizards” is a timeless classic that features interviews with some of the most successful traders of our time. Schwager’s engaging writing style enhances the transformative experience, making it an invaluable aid for traders and investors.

“Market Wizards” by Jack D. Schwager (1989)

Jack D. Schwager, in this book, interviews various market participants involved in stocks, commodities, futures, and foreign exchange. He studies different trading strategies utilized by the interviewees. Through these engaging discussions, Schwager explores various trading strategies, allowing readers to delve into the philosophical and psychological aspects of trading. In this book, we learn from successful traders how to deal with fear, greed, and other emotions that can impact decision-making.

“Trading in the Zone” by Mark Douglas

We highly recommend Mark Douglas’s Trading in the Zone if you are a professional trader. The book delves into the psychological aspects of trading and emphasizes the importance of developing a winning mindset. Douglas advocates for a shift in perspective from external factors to internal processes and self-awareness, highlighting how fear of loss and the need to be right can lead to destructive behaviours.

“Trading in the Zone” by Mark Douglas (2000)

The book introduces practical concepts like “mental rehearsal” to visualize successful trades and reinforces positive mental patterns. It emphasizes the significance of maintaining a positive mindset and cultivating self-belief through affirmations and positive self-talk. “Trading in the Zone” provides valuable insights into the mental state. It is necessary for traders to perform at their best and overcome obstacles to successful trading.

Sway: The Irresistible Pull of Irrational Behavior” by Ori Brafman and Rom Brafman

Sway, written and published by the Brafman brothers, with 12 chapters that explore the concept of “Sway. This book provides a thought-provoking and insightful exploration of the forces that shape our behaviour, and it offers practical strategies for avoiding the pull of irrational behaviour and making better decisions. Whether you’re a seasoned stock market enthusiast or a budding real estate investor, the book caters to diverse investment interests.

Sway: The Irresistible Pull of Irrational Behavior” by Ori Brafman and Rom Brafman (2009)

The author investigates irrational behaviour in fields diverse as medicine, archaeology, and the legal system. The book surveys our decisions and behaviour under the effect of irrational forces, such as emotions, biases, and social pressure, rather than logic and reason. We can study Sway from many aspects of our lives, such as decision-making, marketing, and negotiation. It can greatly impact our behaviour and outcomes. This book helps us reduce Sway’s influence by being aware of our biases, avoiding groupthink, and seeking diverse perspectives and information.

“Market Mind Games” by Denise Shull

Denise Shull, the CEO of The ReThink Group, created the Shull Method of performance training. Her popular book Market Mind Games, is perfect for professional traders to leverage their convictions and intuitions. Every pro trader knows they must get the risk management edge by understanding themselves based on their knowledge about their emotions.

Market Mind Games” by Denise Shull (2011)

Denise Shull has written this book for beginners. Like other trading psychological books, she discusses the trading mindset in Market Mind Games. The book offers audiences to create physical energy. She recommends they refrain from trading when tired, hungry, or physically unwell. She believes that having knowledge about other people and Thinking about the emotional state of the market to see if it Is greedy or fearful would be helpful.

“Reminiscences of a Stock Operator” by Edwin Lefèvre

“Reminiscences of a Stock Operator” is a valuable classic book by Edwin Lefèvre, first published in 1923. The book offers valuable insights into a stock market speculator’s mindset, strategies, and experiences. We see the market in this book from the window of the eyes of Jesse Livermore. He was an investor in the early 1900s, and the story begins when he finds himself interested in the stock market.

“Reminiscences of a Stock Operator” by Edwin Lefèvre (1923)

“The most entertaining book written on investing is Reminiscences of a Stock Operator, by Edwin Lefèvre, first published in 1923.”

“The Seattle Times”

Throughout Livermore’s journey, the book highlights the importance of market psychology and how it influences stock prices. The book stresses the need to protect capital and cut losses quickly when a trade goes against him. Readers gain valuable insights into the trading world, including the significance of market psychology, risk management, and the emotional challenges traders face. All investors need to read this book if they are interested in the stock market and the art of speculation.

Psychological Techniques for Improving Trading Performance

Knowing how to control your emotions while navigating the ever-changing markets is integral to making sound decisions and earning profits. Here are our top tips on how to master trading psychology and create sustainable income trading. Foremost, creating and sticking to a proper trading plan is important. Developing and having a plan will help alleviate some of the stress and anxiety of trading. It’s essential to ignore emotions during trades and instead base decisions on the calculated trading strategy you have created.

To improve your insight into the markets and make the best trades, gaining experience is important. Experiences in trading will act as the catalyst for understanding market data and formulating the best strategies for entering and exiting positions. Try to look at losses as a part of the journey to success. It’s important not to lose hope and accept losses as part of learning.

Taking breaks during trading sessions can benefit the mind as it helps ease mental fatigue. It’s important not to dedicate all your time to monitoring market changes on your screens, as this can lead to burnout. Attempt to incorporate trading into your daily life and view it as a way to supplement your income.

Reviewing how a trading strategy has worked in the past and determining its efficacy for future trading success is the soul of trade backtesting.

Top 5 Trading Psychology Books in a Nutshell

Conclusion

Understanding the human mind becomes the key to successful trading in the intricate world of financial markets. Often overlooked yet crucial, trading psychology shapes our decision-making and influences market outcomes. As we’ve explored the captivating realm of “Trading Psychology Books,” we’ve discovered the profound impact of emotions, biases, and mental processes on our trading journey.

While technical analysis and market research are essential, trading psychology is a pillar of success.

Market Wizards by Jack D. Schwager provides invaluable insights from successful traders. In “Trading in the Zone,” Mark Douglas emphasizes emotional control’s importance. “Sway” by the Brafman brothers reveals the forces that shape our behavior, urging us to make better decisions. Denise Shull’s “Market Mind Games” empowers traders to navigate the mental aspects of trading.

In the pursuit of trading excellence, we find wisdom in “Reminiscences of a Stock Operator” by Edwin Lefèvre. This book is about the life of a stock market speculator and teaches the significance of market psychology and risk management. As we step into the captivating trading psychology, we realize that mastering the human mind is the key to trading success. We become resilient and confident traders by reframing our thoughts, managing emotions, and developing sound trading plans.

Leave a Reply