I’ve written this Altrady review from my own experience testing it out after spending time with many other trading automation platforms. As a part of the team at Finestel, I wanted to see if Altrady could really deliver on what it promises, which are easier trading, smart bots, and a dashboard for managing multiple exchanges.

After using it for a while, I’d say it’s a mixed bag. Some features are genuinely useful, especially if you like trading automation. But it also feels clunky at times, and not everything works as smoothly as it should. Well, in this Altrady review, I’ll go over the real strengths and weak points, and what I honestly think about Altrady in 2025.

What Is Altrady?

Altrady is basically a crypto trading platform that lets you connect multiple exchanges and trade from one place. You just plug in your API keys from Binance, KuCoin, OKX, or others. Then, you can manage all your trades, bots, and portfolios from one dashboard.

It’s not an exchange itself. I’d call it more like an automated trading hub. I mean, the idea is simple: you get one dashboard to automate trades, track your positions in real time, and analyze performance. For traders who like structure and data, it can look pretty appealing.

Yet, I think Altrady tries to do a lot at once. It offers smart trading tools, bots, scanners, a trade journal, and even portfolio analytics. On paper, it sounds great. But in practice, it feels like a mix of powerful tools that sometimes lack the polish or smooth workflow serious traders expect.

Altrady Features Overview

We’ll continue this Altrady review by discussing its features. Well, it packs a lot of features under one roof. Some tools are genuinely solid, but a few feel like they still need refining. Here’s what stood out to me while using it.

Multi-Exchange Trading Terminal

This is the core of Altrady. You can trade on Binance, KuCoin, Kraken, OKX, and others directly from one interface. The layout feels similar to most crypto exchanges, and the charts are powered by TradingView.

Real-time profit and loss tracking across all your trades is available, which is a must, but I did notice occasional syncing delays on some exchanges. It’s not a dealbreaker for most traders, but something to be aware of if you scalp or rely on fast execution.

Trading Bots

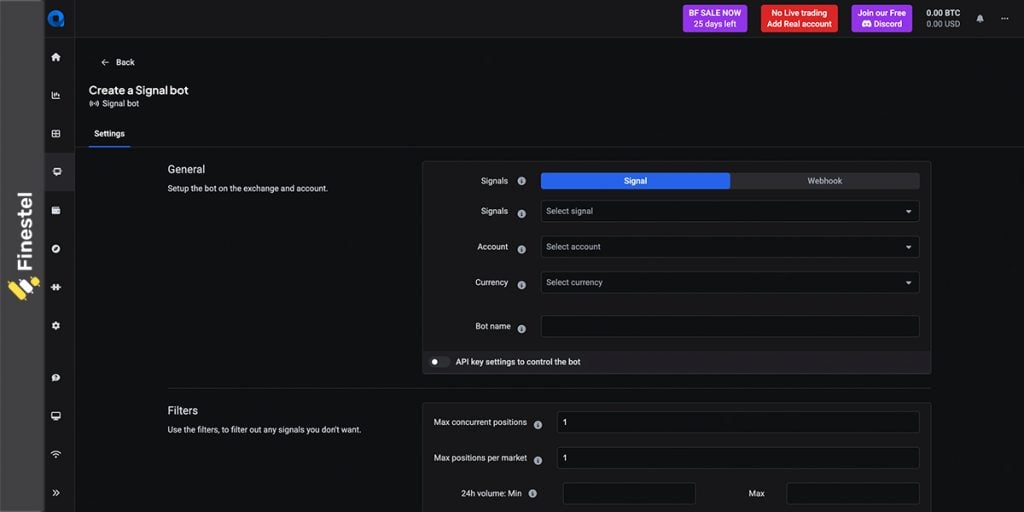

This part of Altrady is solid. You can set up grid bots and signal Bots that work with external webhooks or signals. The grid bot is nice for sideways markets, as it places layered buy and sell orders within a price range.

The Signal Bot feels more advanced. It can take signals from your own TradingView alerts or custom systems. It’s flexible, but setting it up obviously takes a bit of trial and error.

Community Bots Marketplace

One thing Altrady also added is the Community Bots Marketplace. It’s a section where traders can share or copy the bots made by other users. You’ll find all the public bots connected to different exchanges, and each shows their real-time PnL, runtime, and performance history.

It’s a good idea in theory. You can see how other traders’ bots have performed and copy the ones you like with a single click. But there’s a catch. Performance varies a lot, and many public bots show negative returns over time.

Market Scanners and Alerts

The Crypto Base Scanner is one of Altrady’s signature features. It’s based on the QuickFingersLuc (QFL) strategy and looks for base levels where the price might bounce from. For many short-term traders like myself, this can save hours of chart scanning.

There’s also the Quick Scan, which hunts for fast market movements across exchanges, plus customizable alerts for price changes or volume spikes. These tools are helpful, but they depend heavily on how you use them. Clearly, they won’t hand you profitable setups automatically.

Portfolio Management and Analytics

This is where Altrady becomes more than just a trading terminal. You can see your whole portfolio across all exchanges in real time using their crypto portfolio tracker, and check how each coin or sub-portfolio is performing.

Paper Trading

Finally, there’s Altrady’s paper trading mode. As the name suggests, it lets you test setups without risking real funds. It’s simple but also practical, especially for new users or anyone experimenting with bots or new strategies before going live.

Altrady Pricing

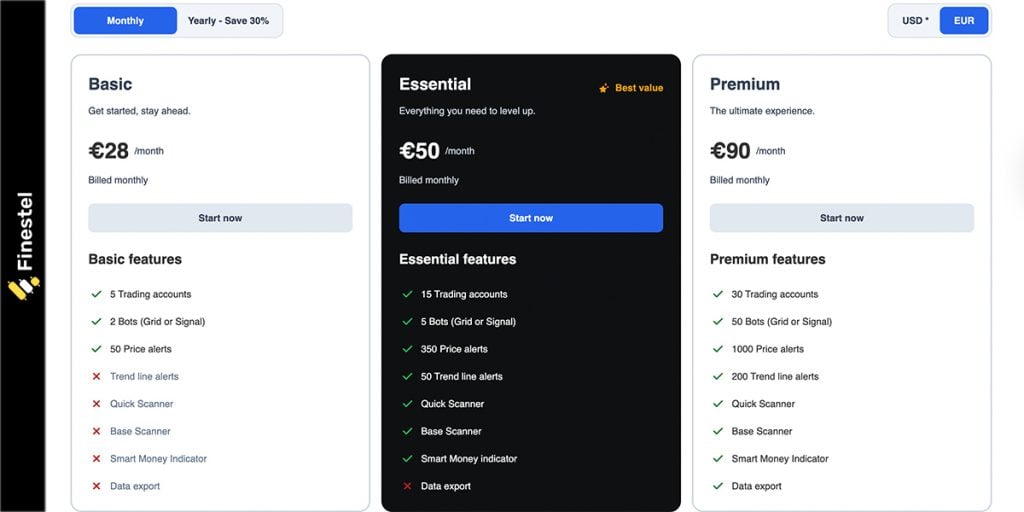

Altrady has three main plans, which are Basic, Essential, and Premium. At the time of writing, the monthly plans start at €28, while the top-tier plan costs €90 per month.

You can also pay yearly and get around 30% off, and even use the Altrady Black Friday offers. Still, with these discounts, it’s still not a cheap tool compared to other retail trading platforms.

Here’s what each plan gives you:

|

Plan |

Monthly Price |

Trading Accounts |

Bots |

Alerts |

Key Features |

|

Basic |

€28/month |

5 |

2 (Grid or Signal) |

50 price alerts |

Good for simple trading setups |

|

Essential |

€50/month |

15 |

5 (Grid or Signal) |

350 price + 50 trend line alerts |

Unlocks Base & Quick Scanner |

|

Premium |

€90/month |

30 |

50 (Grid or Signal) |

1000 price + 200 trend line alerts |

All features unlocked: Smart Money Indicator, data export, scanners |

In my opinion, Altrady’s pricing is on the high side. You’re paying for convenience and a feature-packed setup, not necessarily for performance.

If you’re an active trader who uses automation and wants everything in one app, it can be worth it. But for casual users or the very advanced ones who manage client funds through a system like Finestel, the cost might not really justify itself.

User Experience and Interface

Altrady’s interface is clean and organized, but it can feel a bit crowded when you first log in. There’s a lot going on, and it can take time to figure out what’s what. Once you get used to the layout, it starts to make sense, but the learning curve is definitely there.

The trading terminal feels solid. You can place orders quickly, view charts, and manage positions without switching screens. It’s well-integrated with TradingView, which makes analysis smooth. But some panels load slower than expected when syncing data across multiple exchanges. I mean, it’s not broken, just not instant.

On mobile, Altrady works fine for tracking and checking alerts. Yet, I don’t consider it ideal for executing trades. The desktop version is clearly where the real control is.

Altrady Pros and Cons

As I’ve mentioned in this Altrady review, and like many other platforms, Altrady has some strong points and some things that just don’t hit the mark.

Here are the pros that stood out to me after spending real time using it:

- The smart trading terminal is solid, and you can manage multiple exchanges and orders in one place.

- Smart orders with multiple take-profits and trailing stops make trade management easier.

- Built-in Grid and Signal Bots let you automate without coding.

- The Crypto Base Scanner and Quick Scanner are actually useful once you understand how to use them.

- The portfolio tracker gives a clear, real-time view of your assets across exchanges.

- Having a paper trading mode helps you test setups safely before going live.

- The Community Bots Marketplace is interesting for learning and experimenting with other users’ setups.

And here are some limitations I’ve noticed:

- It’s expensive, especially if you need scanners or multiple bots. Most key features are locked behind higher plans.

- The learning curve is steep at the start, and it’s not beginner-friendly.

- Performance can lag a bit when syncing across several exchanges.

- The mobile app feels limited compared to the desktop version.

Is Altrady Legit?

Yes, Altrady is legit. But it’s not perfect by any measure. Most Altrady reviews on Trustpilot give it high marks, with a 4.8/5 rating. Many say the platform feels reliable and professional once you get used to it. On the flip side, a few users mention that it takes time to learn and that the pricing feels steep for smaller traders.

Altrady reviews on Reddit, however, are more mixed. Some traders like how Altrady centralizes multiple exchanges and offers smart order control. Meanwhile, others feel it’s overcomplicated or too pricey for what it offers. Frankly, nobody’s calling it a scam.

In terms of security, Altrady connects through API keys. It means your funds stay on your exchange, not in the app. It also supports 2FA and encryption, which adds a solid layer of safety. So yes, I’d definitely say it’s a legitimate and secure platform.

Altrady Alternatives

Altrady is built for traders who want one dashboard to manage multiple exchanges, automate trades, and track portfolios. It does that fairly well. But as you’ve probably noticed throughout this Altrady review, it’s not always the best fit depending on how you trade or what stage you’re at.

Some traders want lighter tools with lower costs, others want copy trading, and some are already running serious trading businesses where Altrady quickly feels limited. Because of that, it makes sense to look at a few solid Altrady alternatives and see how they compare.

| Platform | Best For | Core Focus | Key Strengths |

| Altrady | Solo traders | Multi-exchange trading & bots | Smart orders, grid & signal bots, scanners, portfolio tracking |

| Finestel | Pro traders & asset managers | Automation & copy trading | Multi-account execution, TradingView bots, analytics, white-label dashboards |

| Bitsgap | Retail traders | Bots & trading terminal | Grid bots, arbitrage tools, clean UI |

| 3Commas | Retail & semi-pro traders | Bot automation | DCA & grid bots, TradingView alerts, wide exchange support |

| Cornix | Signal followers & providers | Signal-based automation | Telegram signal execution, fast setup |

Finestel: Altrady Alternative for Pros

Now, as someone who has used both platforms, I’d say they’re built for completely different types of traders. Altrady tries to simplify trading for individuals who want automation and portfolio tracking in one dashboard. Finestel, on the other hand, is built for professionals managing investors, signals, or full-scale trading businesses.

Here’s how they really compare:

|

Feature |

Altrady |

Finestel |

|

Main Focus |

Retail trading, automation, and portfolio tracking |

Professional fund, copy trading, and signal automation management |

|

Best For |

Individual traders running their own bots |

Master traders, fund managers, and trading businesses |

|

Automation Tools |

Grid Bots and Signal Bots |

Signal Bots, TradingView Bots, and Copy Trading with full investor syncing |

|

Trading Terminal |

Smart terminal for manual and automated trading |

Web-based trading terminal with performance analytics |

|

Analytics |

Portfolio overview and scanners |

Account analytics, investor dashboards, and AUM tracking |

|

White-Label Option |

Not available |

Yes, branded client portals and dashboards are available. |

|

Extra Features |

Market scanners, bots marketplace |

MLM software, signal integrations, and client management tools |

|

Trading Scope |

Retail trading automation and chart tools |

Institutional trading infrastructure for scaling businesses |

As already mentioned in this Altrady review, it’s great if you trade alone and want everything in one place. But it stops there. Once you start handling investor accounts, offering signals, or scaling your brand, it quickly feels limited.

That’s where Finestel offers the edge. I mean, it’s not built for casual traders. Finestel is built for teams, master traders, and trading businesses that need professional infrastructure. Features like trading terminal, signal bots, TradingView bots, white-label copy trading, and MLM software make Finestel great for scaling operations, not just executing trades.

If you’re trading solo, Altrady makes sense. But if you’re serious about growth, managing investors, or building a trading brand, Finestel is clearly the next level up.

Conclusion

To wrap up this Altrady review, I’d say the platform has a lot of potential but isn’t for everyone. The interface and tools feel professional. It’s clear the team behind it understands trading. But at the same time, the pricing is steep, and the overall workflow can feel heavy for those who just want a quick and smooth setup.

Altrady can be a good option for a solo trader who enjoys automation and wants to manage everything in one place. But if your trading goes beyond personal use, like managing client funds or sharing signals, Finestel simply makes more sense. In the end, Altrady is good at what it does, but it’s not the all-in-one solution some claim it to be.

Leave a Reply