As a crypto trader or investor, you should stay up-to-date with the world of cryptocurrencies. Binance, a major cryptocurrency exchange, has added new coins to its platform. This article will provide an overview of Binance new listings. We will include their unique features and potential for traders and enthusiasts. Additionally, we look into the future and highlight upcoming listings on Binance that could provide profitable opportunities.

Binance is a leading force in the cryptocurrency industry, bringing fresh perspectives to the market. Our article will introduce you to high-potential projects that have gained a place on this exchange. We will anticipate the future by highlighting potential upcoming listings. Whether you are an experienced trader or just curious about the crypto scene, this article on new Binance listings will guide you to stay ahead in the crypto market.

Top 10 Binance New Listings in 2024

In this section, we introduce a list of recent Binance listings. While subjective, they can be the best coins to buy right now for some investors. We will delve deep into each project, explaining its functionalities and token economics.

You can take a look at the table below for a summary of the latest additions to Binance coinlist.

| Project | Token | Binance Listing Date | Project Review |

| Lista | $LISTA | June 17, 2024 | Lista is a cryptocurrency project recently listed on Binance that aims to enhance the Web3 ecosystem through user engagement and decentralized applications. |

| IO.NET | $IO | June 11, 2024 | IO.NET is a decentralized AI computing and cloud platform that aggregates underutilized GPU resources to provide affordable and scalable computing power for machine learning and AI startups. |

| Notcoin | $NOT | May 16, 2024 | Notcoin is a community-driven cryptocurrency project on the TON blockchain that aims to onboard users into the Web3 ecosystem with play-to-earn games. |

| BounceBit | $BB | May 13, 2024 | BounceBit is a Bitcoin restaking chain with a dual-token Proof of Stake mechanism that allows BTC holders to earn yields from multiple sources. |

| Renzi | $REZ | April 30, 2024 | Renzo is a Liquid Restaking Token (LRT) and Strategy Manager that enhances Ethereum (ETH) holdings by optimizing rewards through the EigenLayer ecosystem. |

| Omni Layer | $OMNI | April 17, 2024 | OMNI is a layer 1 blockchain platform built on top of Bitcoin. It allows for the creation, trading, and management of custom crypto tokens. |

| SagaCoin | $SAGA | April 9, 2024 | SagaCoin is a cryptocurrency designed to stabilize purchasing power and facilitate transactions within the SagaChain ecosystem through an innovative algorithmic tokenomics model. |

| Tensor | $TNSR | April 8, 2024 | Tensor is a Solana NFT trading platform that facilitates the buying, selling, and trading of non-fungible tokens (NFTs) on the network. |

| Portal | $PORTAL | February 29, 2024 | Portal Coin is a decentralized cryptocurrency designed to facilitate gaming across various blockchain networks. |

| Starknet | $STRK | February 20, 2024 | Starknet introduces a groundbreaking layer 2 solution on Ethereum, addressing scalability issues while maintaining security. |

| PixelVerse | $PIXEL | February 19, 2024 | Pixel Verse integrates blockchain into gaming, offering a Play-to-Earn experience with Pixel NFTs and a strategic Goblin collection. |

| Dymension | $DYM | February 6, 2024 | Dymension’s RollApps and DYM token bring high-speed modular blockchains for decentralized applications, emphasizing security. |

| Ronin | $RON | February 5, 2024 | Ronin, optimized for gaming, hosts projects like Axie Infinity, ensuring efficient in-game transactions and robust security. |

| Pyth Network | $PYTH | February 2, 2024 | Pyth provides dependable market data for DeFi applications across blockchains, using a pull oracle model for precise on-chain prices. |

Finestel: The Best Binance Copy Trading Service

Finestel offers a wide range of services to users trading on top exchanges, including Binance traders. Our primary service for traders is the cutting-edge Binance copy trading bot, which allows master traders to onboard their clients and seamlessly manage their money.

Moreover, we also provide top-notch white-label copy trading software. The white-label solution is designed for serious traders and crypto asset managers who want to take their business to the next level. You can offer your asset management services under your brand and utilize several additional features like CRM and marketing tools, automated billings, performance analytics, and so on. If you are curious about Finestel’s services, take a look at “what is Finestel“.

Lista ($LISTA)

Binance Listing Date: June 17, 2024

Lista is a new Binance listing that focuses on improving user experiences in the Web3 ecosystem. The project aims to facilitate decentralized applications and services. The token is integrated into various Web3 tasks and quests. Lista allows users to engage more deeply with blockchain technology and its applications. As part of its launch, Binance has introduced a Megadrop event where users can lock their BNB and participate in Web3 quests to earn Lista tokens.

One of the key features of Lista is its utility in completing Web3 quests. It is designed to engage users in the DeFi and dApps space. These quests could range from simple tasks like staking and liquidity provision to complex interactions with smart contracts. The focus on user engagement shows Lista’s aim to contribute to the adoption of decentralized technologies.

Lista’s listing on Binance grants it a significant platform for exposure and liquidity. Binance offers Lista a vast user base and advanced trading features. The Lista Binance listing includes multiple trading pairs, such as LISTA/BTC and LISTA/USDT. Overall, this strategic development can drive tons of interest in the Lista project among Web3 enthusiasts.

Lista Tokenomics

Let’s have a look at the details of Lista’s tokenomics to see how the $LISTA token is distributed and more:

-

Total and Maximum Supply:

-

Total supply: 1,000,000,000 LISTA tokens.

-

Maximum supply: 1,000,000,000 LISTA tokens.

-

-

Circulating Supply:

-

Currently in circulation: 230,000,000 LISTA tokens (23% of total supply).

-

-

Launchpool and Distribution:

-

Lista tokens are distributed as rewards through the Binance Megadrop event.

-

Users can earn Lista tokens by locking their BNB and completing Web3 quests.

-

-

Distribution:

-

Private Sale Investors and Advisors: 19%

-

Airdrops: 10%

-

Ecosystem: 9.5%

-

Binance Launchpool: 10%

-

Team: 3.5%

-

DAO Reserve: 8%

-

Community: 40%

-

-

Utility and Governance:

-

Governance: LISTA token holders can vote on protocol decisions.

-

Protocol Incentivization: Earn rewards for borrowing lisUSD and providing liquidity.

-

Voting Gauge: Lock LISTA tokens as veLISTA to vote on collaterals and liquidity pools.

-

Revenue Sharing: veLISTA holders are eligible for revenue sharing.

-

-

Key Features:

-

Stablecoin (lisUSD) is fully collateralized by crypto assets.

-

BNB liquid staking token (slisBNB) provides yield-bearing and liquid staking.

-

IO.NET ($IO)

Binance Listing Date: June 11, 2024

IO.NET (IO) is a decentralized AI computing and cloud platform. It has recently been introduced as the 55th project on Binance Launchpool. The platform aggregates underutilized GPU resources to create a decentralized network for affordable computing power. It mainly targets machine learning and AI startups. This approach democratizes access to GPU computing resources. As a result, it reduces costs and expands choices for developers and businesses.

The IO token began its farming period on June 7, 2024, allowing users to stake BNB and FDUSD to earn IO tokens. A total of 20 million IO tokens, constituting 4% of the total supply, are available as rewards during this period, with 17 million allocated to the BNB pool and 3 million to the FDUSD pool. Following the farming period, the IO token will be listed on Binance and available for trading with pairs such as IO/BTC, IO/USDT, IO/BNB, IO/FDUSD, and IO/TRY starting June 11, 2024, at 12:00 UTC.

Since its listing, IO has seen a significant increase in price, reflecting strong investor interest. The IO.NET platform provides a decentralized infrastructure for AI and cloud computing. It also allows token holders to take part in network governance. The project’s innovative approach and its new Binance listing make it an interesting prospect.

IO.NET Tokenomics

Here’s an in-depth analysis of IO.NET’s tokenomics:

-

Total and Maximum Supply:

-

Initial supply at launch: 500 million IO tokens

-

Maximum supply cap: 800 million IO tokens

-

-

Launchpool and Distribution:

-

20 million IO tokens (4% of the initial supply) allocated for rewards during Binance Launchpool.

-

17 million IO tokens for the BNB staking pool.

-

3 million IO tokens for FDUSD staking pool.

-

-

Circulating Supply:

-

Upon Binance’s listing, 95 million IO tokens (19% of the initial supply) were available to the public.

-

-

Staking and Rewards:

-

Users can earn IO tokens by staking BNB and FDUSD.

-

Rewards are calculated and distributed hourly. There is the option to claim tokens at any time during the farming period.

-

-

Governance and Utility:

-

IO token holders can participate in governance decisions within the IO.NET ecosystem.

-

Tokens are used to pay for GPU computing power and staking within the network to secure it and earn rewards.

-

-

Emission Schedule:

-

Disinflationary model starts at 8% in the first year, decreasing over time until the maximum supply is reached.

-

Read our full guide about the Binance Megadrop.

Notcoin ($NOT)

Binance Listing Date: May 16, 2024

Notcoin (NOT) is one of the most recent Binance listings. It is a community-driven cryptocurrency project that started as a viral Telegram game. In the game, users could earn in-game coins by tapping on their screens. The purpose of Notcoin is to onboard users into the Web3 ecosystem on the TON blockchain. They aim to do it through engaging games and incentives.

Notcoin offers a play-to-earn model through a popular Telegram-based game. Players can earn Notcoins by tapping on a virtual coin. The project aims to onboard users into the Web3 ecosystem by providing an engaging and rewarding gaming experience. With its innovative gameplay and strategic use of Telegram’s user base, Notcoin has quickly gained traction. Millions of users have joined the Notcoin community since.

Notcoin was recently listed on Binance as part of the Binance Launchpool. 3% of the total supply was allocated to participants. The Notcoin team has taken an unconventional approach to tokenomics, with 100% of the supply unlocked at launch. This doesn’t mean all tokens will enter trading immediately. However, the goal is to avoid “Bitcoin-style early whales” and distribute the wealth more evenly among the large player base.

NOT Tokenomics

The NOT token has a total supply of 102,719,221,714 tokens. All of the coins will be unlocked at launch with no plans for additional minting. The distribution is as follows:

- 78% allocated to miners

- 3% to Binance Launchpool

- 9% to an Ecosystem Fund

- 5% for community incentives

- and 5% dedicated to development

This allocation strategy ensures a significant portion is available for miners. It will boost network security while also supporting ecosystem growth and community engagement.

BounceBit ($BB)

Binance Listing Date: May 13, 2024

BounceBit (BB) is a Bitcoin restaking chain. It has an innovative CeDeFi framework that allows BTC holders to earn yields from multiple sources. It has a dual-token Proof of Stake consensus mechanism. Validators can accept both $BBTC and $BB tokens. BounceBit is one of the latest new Binance listings on May 13. Binance has announced the launch of BounceBit Megadrop with airdrops and Web3 quests.

The purpose of BounceBit (BB) is to democratize access to high-yield opportunities within the Bitcoin asset class. This was traditionally reserved for quant and institutional investors. It aims to enhance the utility and liquidity of Bitcoin. BounceBit helps BTC holders engage their holdings in the DeFi and CeFi markets.

The BounceBit project achieves this end through its dual-token staking mechanism. Validators stake both BB and BBTC (BounceBit’s native token backed by Bitcoin) to secure the network. Moreover, BounceBit develops a unified platform that integrates various forms of Wrapped BTC across different blockchain networks. Their goal is to enhance the efficiency and liquidity of BTC assets across different blockchains.

BounceBit also offers transparent financial services. It implements on-chain proof of reserve and transparent activities. This commitment to transparency rebuilds trust among users and creates a secure platform for earning yields on their BTC.

Furthermore, BounceBit integrates full compatibility with the Ethereum Virtual Machine (EVM) and Solidity programming language. Thus, developers can easily migrate their projects and build sophisticated dApps on the platform.

BB Tokenomics

The BB token has various uses on the BounceBit platform, including staking, protocol incentives, gas fees, governance, and as a medium of exchange. The BB token has a maximum total supply of 2,100,000,000 BB and an initial circulating supply of 409,500,000 BB.

The token distribution is also interesting. $6 million was raised from top-tier investors, including Blockchain Capital, Binance Labs, OKX Ventures, CMS Holdings, DeFiance Capital, Mirana Ventures, and MEXC. 359,280,000 BB tokens were allocated to investors.

Read more about the best DeFi trading bots in 2024.

Renzo ($REZ)

Binance Listing Date: April 30, 2024

The latest Binance new listing is Renzo. It is a Liquid Restaking Token (LRT) and Strategy Manager. Renzo plays a crucial role within the EigenLayer ecosystem. Essentially, Renzo is the gateway for users looking to optimize their Ethereum (ETH) holdings through a process called restaking. This innovative approach allows ETH holders to stake their tokens and secure Actively Validated Services (AVSs). It does not only generate staking rewards but also additional rewards through EigenLayer points. Unlike traditional ETH staking, which offers a fixed APR (Annual Percentage Rate), Renzo offers a higher yield. Thus, Renzo is an attractive option for users seeking more returns on their investments.

One of the key advantages of Renzo is its ability to abstract complexity from the end-user experience. Renzo provides a user-friendly interface that simplifies the process of interacting with the EigenLayer ecosystem. It is accessible to a wider audience. This abstraction of complexity is essential in promoting the widespread adoption of decentralized finance (DeFi) solutions like EigenLayer. This is because it removes barriers to entry and lets users participate without requiring much technical knowledge.

Moreover, Renzo facilitates the collaboration between users and EigenLayer node operators. With Renzo, users can easily engage with node operators to use their resources to secure AVSs. This collaborative model improves the security of the EigenLayer network. It also creates a sense of community among participants. Overall, Renzo represents an innovative approach to optimizing Ethereum holding. It offers users the opportunity to earn higher yields and actively contribute to the growth of the EigenLayer ecosystem. Therefore, it rationalizes the reason why it is the latest addition to Binance coinlist.

REZ Tokenomics

Renzo tokenomics are structured to support the ecosystem’s governance. It also incentivizes active participation. The REZ token, Renzo’s native governance token, allows holders to vote on proposals related to operator and Actively Validated Service (AVS) whitelisting. They can also vote on risk management frameworks, community grants, and other governance matters.

With a total supply capped at 10 billion REZ tokens, distribution is allocated to fundraising (31.56%), community (32%), core contributors (20%), foundation (12.44%), Binance Launchpool (2.5%), and liquidity (1.5%). With REZ airdrops, Renzo encourages engagement. It creates a decentralized and vibrant ecosystem where stakeholders play a pivotal role in shaping its future.

Omni Layer ($OMNI)

Binance Listing Date: April 17, 2024

Omni Layer is a blockchain platform that integrates Ethereum’s rollup ecosystem into a single, cohesive system. By leveraging the Bitcoin blockchain as its foundation, Omni provides users with a fully decentralized asset platform. Omni network participants can create and trade custom digital assets and currencies. This unique approach enhances the security and reliability of transactions and opens up new possibilities for next-generation features on the Bitcoin blockchain. On Omni, users can easily create tokens representing various currencies or assets. They can also conduct decentralized crowdfunding and engage in peer-to-peer trading directly on the blockchain.

The recent listing of Omni Network (OMNI) on Binance Launchpool shows the platform’s growing reputation in the crypto space. Through Binance Launchpool, users can stake their BNB and FDUSD tokens to farm OMNI tokens over a four-day period starting from April 13, 2024. This listing on one of the world’s leading cryptocurrency exchanges not only increases OMNI’s visibility but also provides investors with an opportunity to participate in its ecosystem and potentially reap rewards from staking.

As OMNI gets listed on Binance on April 17, 2024, with trading pairs including OMNI/BTC, OMNI/USDT, OMNI/BNB, OMNI/FDUSD, and OMNI/TRY, it emerges as an attractive investment option. Given its innovative approach to blockchain integration and the support it receives from the ecosystem, OMNI could be considered one of the best coins to buy on Binance right now. With its strong fundamentals and promising outlook, OMNI presents investors with an opportunity to diversify their portfolios and tap into the potential of blockchain-based assets.

Find out the best Crypto Portfolio Trackers in 2024.

OMNI Tokenomics

The OMNI token operates within a robust tokenomics framework designed to facilitate transactions and incentivize participation in the Omni Network ecosystem. With a maximum token supply of 100 million OMNI, the initial circulating supply stands at 10.39%, ensuring a balanced distribution of tokens.

Through Binance Launchpool, users can stake their BNB and FDUSD tokens to farm OMNI tokens, with 3.5% of the max token supply allocated for rewards. This incentivizes users to actively engage with the platform, driving liquidity and enhancing the overall ecosystem. Additionally, OMNI’s integration with Ethereum’s rollup ecosystem and its listing on major exchanges like Binance automatically makes it a contender for the best coin to buy on Binance right now.

SagaCoin ($SAGA)

Binance Listing Date: April 9, 2024

SagaCoin is the latest important Binance listing. It is a cryptocurrency designed to power transactions within the SagaChain ecosystem. Saga offers a unique approach to maintaining stability and purchasing power. Unlike many cryptocurrencies prone to volatility, SagaCoin employs an algorithm to manage its tokenomics. The primary goal is to increase and stabilize SagaCoin’s purchasing power. This process ensures that it retains its value over time. This is achieved through a dynamic adjustment of coin supply in response to changes in transaction demand. Therefore, the algorithm prevents sudden fluctuations in Saga value.

Saga Tokenomics

The SagaCoin management model includes stages of appreciation and stabilization of purchasing power. During the appreciation phase, the coin’s value increases significantly relative to fiat currencies like the US dollar. However, this appreciation is balanced by a controlled inflation mechanism. This ensures that Saga’s purchasing power remains strong even as its value rises. Ultimately, the aim is for SagaCoin to maintain a stable purchasing power. Thus, it allows users to reliably exchange it for goods and services without concerns about significant price fluctuations.

This management model demonstrates how SagaCoin aims to protect its users from the effects of inflation. It does so while providing a reliable medium of exchange within the SagaChain ecosystem. Through its unique approach to tokenomics and purchasing power management, SagaCoin offers a promising solution for stability and reliability in crypto.

Tensor ($TNSR)

Binance Listing Date: April 8, 2024

Tensor is a prominent NFT (Non-Fungible Token) marketplace that operates on the Solana blockchain network. Since its inception in July 2022, Tensor has become the largest NFT marketplace on Solana. It takes care of a substantial portion—around 60-70%—of Solana’s NFT trading volume each day. Tensor’s rapid rise is mainly due to its provision of a swift NFT trading experience. These characteristics can make it arguably the best coin to buy on Binance right now.

One of Tensor’s key selling points is its efficiency and speed. It offers users a seamless platform for buying, selling, and trading NFTs. This experience has contributed to Tensor’s rapid adoption among collectors and traders within the Solana NFT ecosystem.

Since its inception, Tensor has maintained its position as the top NFT marketplace on Solana. It has attracted both new projects and older ones alike. Tensor’s coverage of the latest NFT projects on Solana further solidifies its status as the go-to marketplace for Solana NFT trading.

The recent listing of Tensor (TNSR) on Binance is a significant development for the project. With the listing on Binance, Tensor gains exposure to a wider audience of crypto traders and investors. This will enhance its liquidity and accessibility. Binance’s decision to list Tensor shows the project’s credibility and potential. Therefore, it might well be the best coin to buy on Binance right now for crypto gem hunters.

TNSR Tokenomics

The Tensor tokenomics entail a total token supply of 1 billion TNSR tokens. It contributes to a market capitalization of approximately $113.95 million dollars. With a fully diluted valuation reaching $911.60 million, Tensor presents an intriguing investment opportunity in the NFT ecosystem.

These figures underscore the potential for growth and value creation within the Tensor ecosystem. It is driven by its innovative approach to Solana-centric NFT trading and its rapidly expanding user base. As Tensor continues to solidify its position as the best coin to buy on Binance right now, its tokenomics provide a framework for sustainable growth for investors and crypto traders.

Portal Coin ($PORTAL)

Binance Listing Date: February 29, 2024

The latest Binance new listing is Portal coin, a token belonging to the Portal gaming project. Portal Gaming is an innovative project seeking to transform the gaming industry by creating a unified platform that connects gaming experiences across various blockchain networks. The groundbreaking LayerZero protocol facilitates seamless interactions between different blockchains, addressing interoperability challenges.

The Portal Coin, the platform’s native token, plays a crucial role in transactions, governance, and staking. The ecosystem features tools like the Portal Passport and Middleware Solutions, fostering collaboration among gamers and developers beyond individual blockchain limitations. With strategic partnerships and plans for extensive game integration, Portal Gaming aims to become a central hub for Web3 gaming, emphasizing flexibility, interoperability, and community-driven growth.

Portal Tokenomics

Portal’s tokenomics encompasses the economic principles governing the Portal Coin distribution within the Portal Gaming ecosystem. With a limited total supply of 1 billion tokens, the distribution strategy is meticulously structured to foster community engagement and ensure a broad user base. Notably, 50 million tokens are allocated to participants in Binance’s Portal launchpool, encouraging early involvement and diversifying token holders.

Within the Binance launchpad, 80% of the Portal tokens are directed to BNB stakers, while the remaining 20% is designated for FDUSD stakers. This strategic allocation aims to incentivize staking activities, enhance platform stability, and reward contributors. By intricately balancing distribution among various participant groups, Portal Tokenomics establishes a fair and inclusive framework that supports the long-term sustainability and success of the Portal Gaming project.

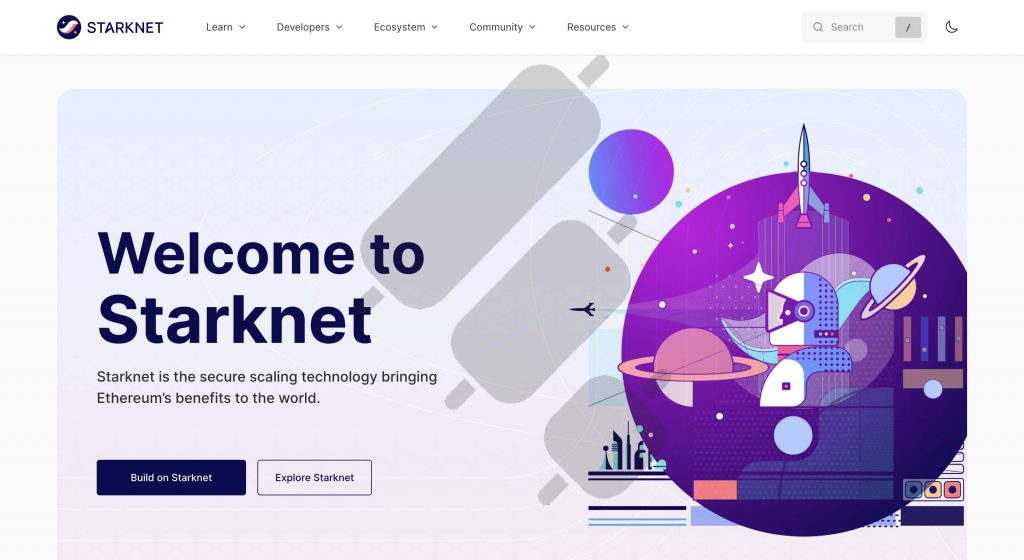

Starknet ($STRK)

Binance Listing Date: February 20, 2024

The first crypto to enter our binance coins list, Starknet (STRK), is making waves in the crypto market by introducing a groundbreaking layer 2 network solution on Ethereum. Starknet functions as a Validity-Rollup or ZK-Rollup and addresses the critical scalability issue on the Ethereum blockchain. However, it does so while maintaining a robust security framework.

The innovative approach involves consolidating transactions off-chain into a computed STARK proof. It would then submit the transactions to the Ethereum network as a single transaction. Thus, this approach significantly enhances throughput and accelerates processing times while reducing costs. It offers a promising solution for the scalability challenges that have plagued Ethereum for so long.

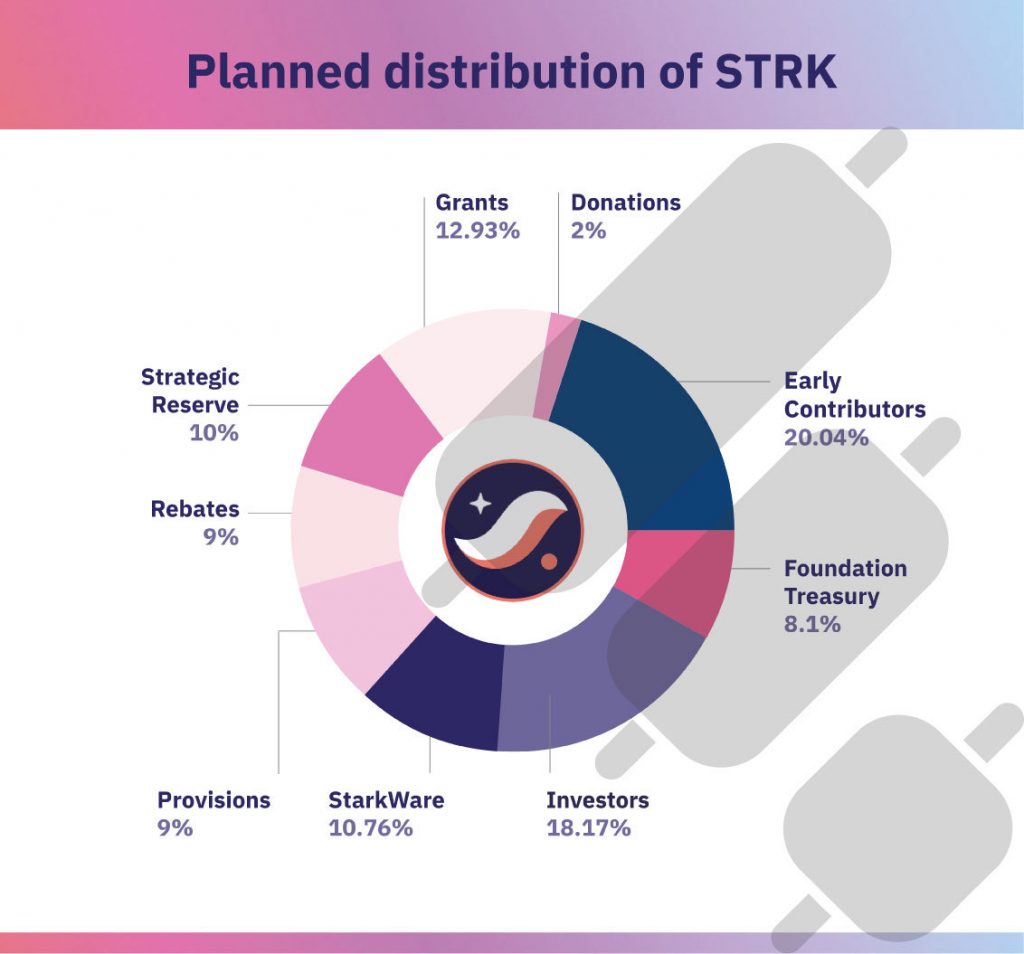

STRK Tokenomics

At the heart of Starknet‘s transformative ecosystem lies its native token, STRK. Beyond serving as a means for users to pay network fees alongside ETH, STRK plays a pivotal role in governance participation. It allows users to shape the future trajectory of Starknet. As the network evolves, STRK is poised to take on additional significance by becoming a key player in a proof-of-stake model.

Initially created in May 2022 and minted on-chain in November 2022, the ten billion STRK tokens follow a strategic distribution plan:

- Early Contributors: 20.04% (subject to lockup schedule)

- Investors: 18.17% (subject to lockup conditions)

- StarkWare: 10.76% (for operational services)

- Grants: 12.93% (including Development Partners)

- Community Provisions: 9.00%

- Community Rebates: 9.00%

- Foundation Strategic Reserves: 10.00%

- Foundation Treasury: 8.10%

- Donations: 2.00%

PixelVerse ($PIXEL)

Binance Listing Date: February 19, 2024

Pixel Verse, an immersive blockchain-powered gaming realm, has recently joined the Binance list of coins. It redefines the gaming experience by seamlessly integrating blockchain technology into the Play-to-Earn (P2E) landscape. This dynamic game goes beyond traditional boundaries, inviting players to connect, compete, and monetize their skills.

![]()

At its core, Pixel Verse utilizes Pixel NFTs, representing formidable creatures, to engage in battles, build within the gaming universe, and embark on treasure hunts, all backed by the secure and transparent blockchain. This synergy transforms Pixel Verse into a collaborative journey that rewards active player participation and skillful gameplay.

PIXEL Tokenomics

The heart of Pixel Verse’s economy lies in the Pixel token. Operating on the Ethereum platform, this token holds immense potential, with a total supply of 1,000,000,000. In the Pixel ecosystem, the token is not just a currency but also a key that unlocks a realm of possibilities, transforming your gaming experience into a rewarding adventure.

![]()

Dymension ($DYM)

Binance Listing Date: February 6, 2024

Dymension, the hub for RollApps, introduces a groundbreaking concept with its easily deployable and high-speed modular blockchains called RollApps. These consensus-free structures aim to boost token value while ensuring heightened security. Dymension’s dedicated modular blockchain, the Dymension Hub, is crafted to empower and serve RollApps, offering users the flexibility to deploy their own blockchains with minimal complexity.

As a decentralized Delegated Proof-of-Stake L1 blockchain, Dymension relies on the DYM token for security. It is meticulously designed to provide security, interoperability, and liquidity to RollApps, acting as a decentralized router connecting them to the broader crypto economy.

Dymension’s streamlined architecture allows for the swift deployment of blockchains in just a few minutes, transforming the landscape of decentralized applications. Dymension stands out by securing funds, enabling bridging, and including an Automated Market Maker (AMM). It plays a crucial role in making modular blockchains integrate seamlessly and operate efficiently.

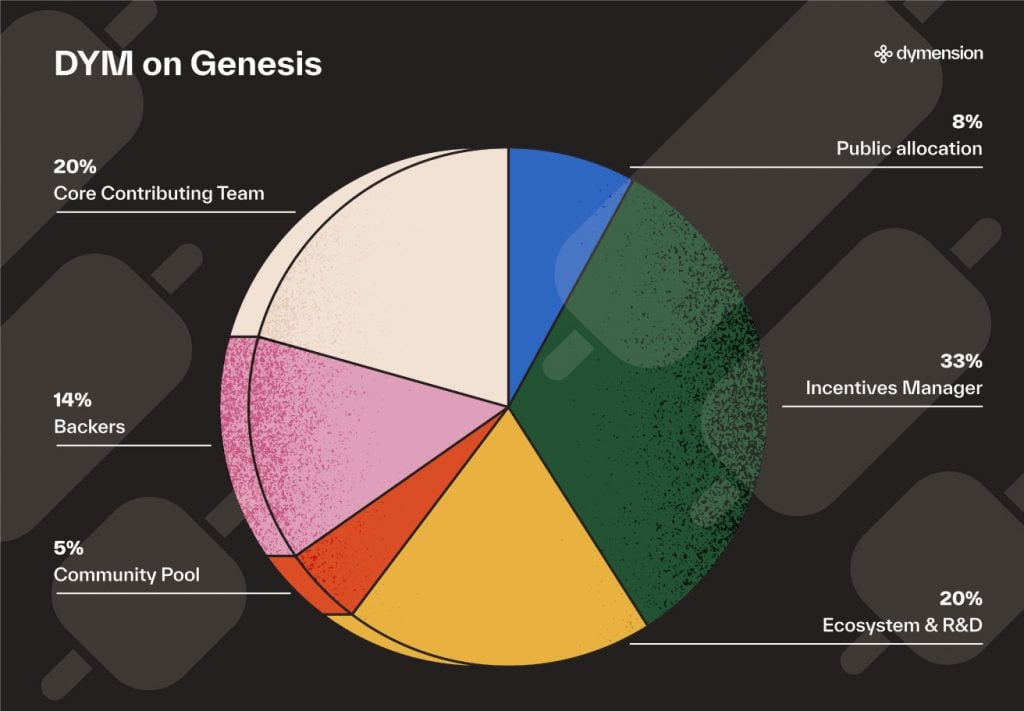

DYM Tokenomics

Dymension’s native token, DYM, operates within a dynamic ecosystem governed by on-chain parameters and algorithms. Boasting an initial total supply of 1,000,000,000 DYM with 18 decimals, the staking ratio relative to the total supply influences the issuance of DYM. Adjustable parameters, such as initial issuance, max and min annual issuance, target DYM staked, and consequently, the inflation rate of change and guide the algorithmic issuance.

Growth stimulation mechanisms include burn, transaction fees, and supply lockup. Additionally, DYM allocation within Dymension follows a strategic distribution plan. The distribution plan is demonstrated in the pie chart above.

Ronin ($RON)

Binance Listing Date: February 5, 2024

A recent addition to the list of Binance coins, Ronin is a gaming-centric EVM blockchain created by Sky Mavis. It is specifically crafted for gaming applications. It is most notably known for hosting the successful Axie Infinity. As a proven and scalable blockchain, Ronin handled a significant share of the NFT trading volume in 2021. Therefore, it is the preferred platform for gaming projects with a massive user base.

Distinguished by its optimization for gaming, Ronin streamlines its infrastructure, minimizing complexities and ensuring efficient in-game transactions. Supported by the experienced team behind Axie Infinity, Sky Mavis offers a secure foundation and invaluable insights into product development and community building for partners deploying on the network.

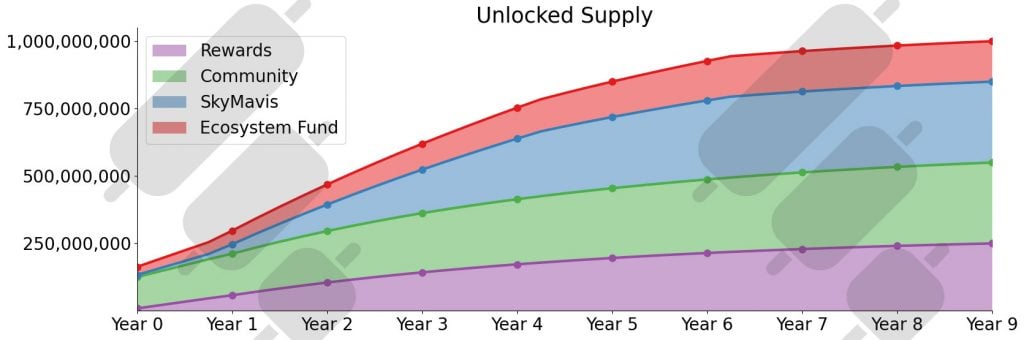

RON Tokenomics

RON, the key token in Ronin’s ecosystem, is the primary means for transaction settlements on Ronin. It incorporates decentralized finance (DeFi) features like community governance and staking utility. Validators within the Ronin network must possess and stake RON to participate in block validation, earning newly issued RON as their reward. The RON token distribution structure is as follows:

- 25% of the token supply is allocated to rewards.

- 30% of the token supply is allocated to community incentives.

- 30% of the token supply is reserved for Sky Mavis.

- 15% of the token supply is designated to the ecosystem fund.

The gradual release of RON tokens over 108 months follows a continuous issuance model rather than large unlocks at specific dates. Initially overseen by Sky Mavis, the ecosystem fund strives to enrich the Ronin network community through delivering substantial value to its broader ecosystem.

Pyth Network ($PYTH)

Binance Listing Date: February 2, 2024

Pyth is a blockchain oracle that provides dependable, low-latency market data for secure smart contract execution in decentralized finance (DeFi) applications. With over 450 data feeds sourced from major institutions, Pyth supplies real-time market data across crypto, equities, forex, and commodities to more than 50 blockchains. This universal accessibility allows easy integration into diverse blockchain environments, empowering decentralized applications like decentralized exchanges (DEXs) and derivatives platforms with precise and high-quality data.

Pyth employs a pull oracle model, allowing applications to determine when real-time prices appear on-chain. This approach offers flexibility and cost-effectiveness, enabling users to pay for specific data needs. This model, exemplified by its impact on Synthetix, has transformed the platform, making it competitive with centralized solutions. In essence, Pyth enhances the reliability and functionality of decentralized applications.

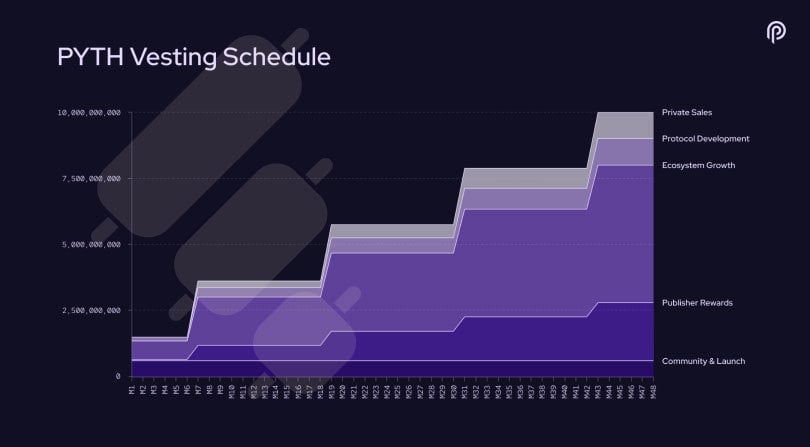

PYTH Tokenomics

Pyth’s tokenomics are crafted to align with the network’s objectives of achieving decentralization, sustainability, and permissionlessness. The PYTH token, with a total supply capped at 10 billion, starts with an initial circulating supply of 1.5 billion. The remaining 85% follows a vesting schedule unlocking over 6, 18, 30, and 42 months.

The distribution encompasses key segments:

- 22% for Publisher Rewards, motivating data providers to publish accurate and timely price data.

- 52% for Ecosystem Growth, backing contributors, developers, educators, and others to boost the Pyth Network’s expansion.

- 10% for Protocol Development, earmarked for core contributors building oracle tools and infrastructure.

- 6% for Community and Launch, supporting the initial phase and related activities.

- 10% for Private Sales, representing historical funding rounds for strategic contributors.

Upcoming Binance New Listings: What Coins Will Binance List Next?

Now that we have introduced the last 5 projects listed on Binance, we will present some of the most likely entries to the Binance launchpad list in the coming months. Additionally, we briefly introduce each project and its functionalities. Each of these coins has the potential to be on the Binance top 20 coins in terms of performance during the next bull run. Without further ado, let us analyze which coins Binance will list.

Scotty the AI ($Scotty)

In the vast and ever-expanding crypto universe, a legendary entity has captured the imagination of digital asset enthusiasts – Scotty the AI. There are currently lots of rumors hinting at Scotty being an addition to Binance new listings. It is portrayed as a Scottish Terrier with an otherworldly presence. Scotty is the guardian who safeguards the secrets that lie within the intricate realms of code and algorithms. Its shimmering jet-black fur is said to glimmer like the night sky, a mesmerizing sight that both captivates and eludes those who seek to unravel its mysteries.

The narrative surrounding Scotty weaves a tale of a unique creature that roams the digital expanse, always staying one step ahead of its adversaries. Among these foes are the titans of meme coin fame, Floki and Shiba Inu, formidable entities in their own right. Yet, Scotty’s distinguishing features – its deep understanding of blockchain intricacies, advanced artificial intelligence capabilities, and strategic wit – allow it to outmaneuver even the most formidable of opponents, safeguarding the delicate balance of the crypto-verse.

Central to the Scotty legend is the $Scotty token, a digital asset that offers investors the opportunity to not only participate in the project but also to stake their holdings and earn rewards. With a fixed value and a tokenomic structure that allocates portions for marketing, airdrops, and exchange liquidity, the $Scotty token presents a unique proposition for those seeking to align themselves with this enigmatic entity.

Smog ($SMOG)

Smog presents itself as a formidable ruler in the digital arena and is one of the potential Binance upcoming listings. It embodies the essence of a dragon that overcomes adversaries with its intense flames. Positioned as the “Greatest Solana Airdrop of All Time,” Smog invites enthusiasts to engage by purchasing and staking its native token, SMOG. Participants can enjoy a 10% discount. With a tokenomics structure designating 35% to airdrop rewards and a fair launch on Solana, Smog presents an engaging story of community involvement and loyalty.

The tokenomics of $SMOG unveil a total supply of 1.4 billion, strategically allocated for marketing, airdrop rewards, CEX, and DEX liquidity. The roadmap progresses through phases encompassing airdrop research, fair launch, Ethereum LP & staking, social dominance, and potential burn opportunities, concluding with a phase where a crowned SOL King is envisioned. Adopting a multichain strategy, Smog initiates on Solana and Ethereum, with the prospect of further expansion to additional chains.

Smog is also on our shortlist for the best crypto to buy now. Make sure to check out this article to find the next altcoin to explode.

Bitcoin Minetrix ($BTCMTX)

Bitcoin Minetrix can be the next coin to be listed on Binance. It revolutionizes Bitcoin (BTC) mining with its tokenized cloud mining platform, aiming to simplify and decentralize the process. By tokenizing cloud mining, the platform eliminates risks tied to third-party scams, offering a transparent and secure experience.

The BTCMTX token plays a central role, allowing users to stake it for credits, subsequently used to mine BTC. Bitcoin Minetrix addresses challenges like high hardware costs, making BTC mining accessible to ordinary crypto enthusiasts, and fostering a decentralized mining community. Through the Stake-to-Mine concept, the platform ensures simplicity, enabling users to purchase and stake BTCMTX tokens via Ethereum-compatible wallets and exchange credits for BTC cloud mining power.

In contrast to traditional approaches, Bitcoin Minetrix prioritizes user ownership, security, and accessibility. So, it presents a user-friendly and cost-efficient alternative for Bitcoin mining. As a result, it is likely to be a new coin launching on Binance.

Harambe AI ($HARAMBEAI)

Another potential entry for the next Binance listing is HarambeAI. It introduces a revolutionary hedge fund system driven by artificial intelligence, autonomously navigating the cryptocurrency market on a decentralized platform. Token holders benefit from a presale offering tokens starting at $0.05, progressively increasing every 48 hours. Moreover, AI-driven buy-back and burn mechanisms ensure hassle-free profits with a substantial 100% APY gain. This innovative approach democratizes high returns, typically reserved for elites, by leveraging extensive historical trades and strategies from leading hedge funds and expert traders.

Operating tirelessly, the AI executes precise trades 24/7 on major cryptocurrencies like Bitcoin and Ethereum. Its decentralized autonomous hedge fund structure ensures that profits directly flow to token owners. With a total token supply of 690 million, tax-free and team token-free, HarambeAI embodies transparency and community-centric principles in its pursuit of wealth generation.

Crafteo AI ($NFTC)

Crafteo AI is another crypto that can be included in upcoming coin listing on Binance. It is an innovative platform that transforms the creation of Non-Fungible Tokens (NFTs) through automated and intelligent processes. In the ongoing token sale, their AI-driven system allows users to generate visually striking NFTs, emphasizing realism. Using advanced AI algorithms, Crafteo enables users to explore endless possibilities in the digital art space regardless of expertise. The platform supports interoperability by working with multiple blockchain networks, facilitating the seamless deployment of NFT collections across different chains.

Introducing the NFTC token, Crafteo enhances transactions and governance involvement and offers exclusive community benefits. With features such as airdrops, launchpad participation, and staking, Crafteo aims to cultivate a vibrant and engaged community. It also emphasizes transparency through well-defined tokenomics. Led by CEO Milad Bonakdar and CTO Mesut Khanlou, the core team envisions Crafteo as the gateway to a dynamic NFT world, making NFT creation accessible and user-friendly.

SubQuery Network ($SQT)

The SubQuery Network stands as an innovative decentralized web3 infrastructure, offering accelerated, adaptable, and scalable data indexing for decentralized applications (dApps). Its support spans numerous blockchain networks. It employs decentralization principles with a multitude of decentralized indexers and RPC (Remote Procedure Call) providers. These solutions streamline data accessibility for diverse applications.

The platform features load balancing, incentivizes performance, and ensures unrestricted support for node operators, welcoming participants at various technical levels. Prioritizing speed, dependability, and cost-effectiveness, the SubQuery Network aims to bring the performance of web2 to the decentralized web3 realm. It does so by providing APIs that elevate dApp development and enhance user experiences.

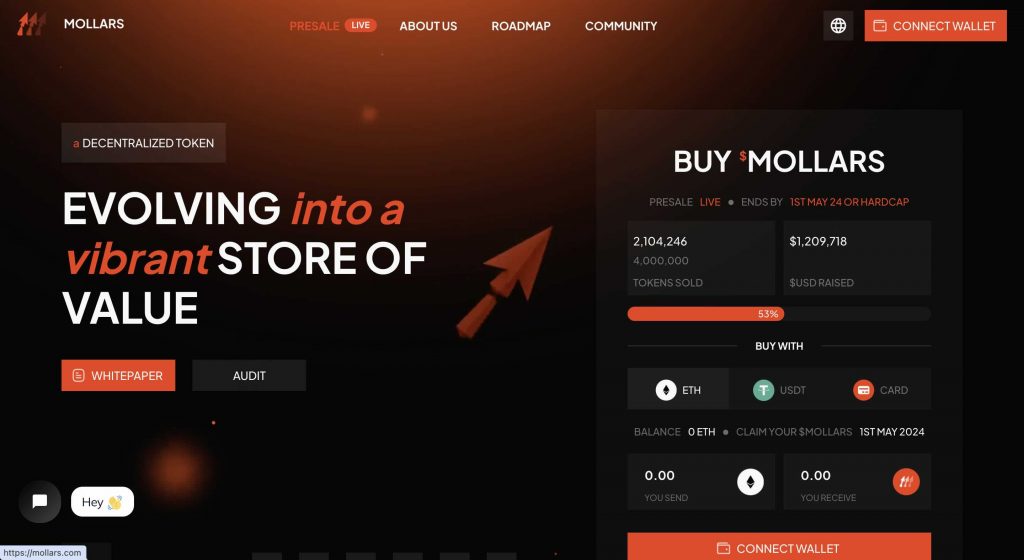

Mollars ($MOLLARS)

The next potential Binance listing in 2024 is Mollars. Mollars presents itself as more than just a token. It embodies a vision of decentralization, community empowerment, and economic evolution. As a decentralized store of value, Mollars aims to transcend traditional boundaries. It merges gaming, economics, and community participation into a cohesive ecosystem.

Through its litepaper, Mollars outlines its commitment to true decentralization. The team plans to launch a Decentralized Exchange (DEX) to facilitate cross-blockchain transactions. Mollars pictures a future where management and community participation go hand in hand.

The project seeks to ignite enthusiasm within its community. There are smart contracts developing on Mollars. It aims to create a strong foundation for its journey. Moreover, Mollars’ hybrid nature on the Ethereum blockchain combines store of value functionality with web3 utility. Thus, it is a versatile asset with potential for wide adoption.

Hypeloot ($HPLT)

Hypeloot is another entry on our potential upcoming Binance listings. It is an innovative platform in the world of online gambling. Hypeloot offers a unique blend of traditional casino games and custom-developed game modes within the crypto space. The project stands out by providing not only popular crypto casino game modes but also introducing brand new game modes. This adds an innovative touch to the Hypeloot gambling experience.

One of its distinguishing features is the incorporation of a fiat payment gateway. This option makes Hypeloot accessible to a broader audience. Additionally, Hypeloot boasts a profitable and established product. With over 100,000 registered users on its platform, it generates significant revenue.

The backbone of the Hypeloot ecosystem is its native token, $HPLT. The token fuels the platform and serves various purposes. Holders of $HPLT benefit from passive income opportunities, weekly bonuses, free games, and an affiliate reward system, among other advantages. The token also facilitates all forms of crypto gambling on the Hypeloot platform. It ensures a transparent, licensed, and fair crypto casino gaming environment. With its strong foundation and roadmap, Hypeloot aims to disrupt the crypto casino industry and provide sustainable returns to $HPLT holders.

Conclusion

In this article by Finestel, we have provided a comprehensive overview of Binance new listings. We shed light on innovative projects that have recently joined the exchange in 2024. These include Starknet, PixelVerse, Dymension, Ronin, and Pyth Network, which delved into their unique features and tokenomics. The projects mentioned span a range of applications, from addressing scalability issues in Ethereum with Starknet to revolutionizing the gaming experience through PixelVerse’s Play-to-Earn model.

Moreover, we have presented a list of upcoming potential listings on Binance. We introduced projects including Smog, Bitcoin Minetrix, Harambe AI, Crafteo AI, and SubQuery Network. Looking forward, these upcoming listings present exciting opportunities for traders and investors. Smog offers a unique narrative with its dragon-themed airdrop. Bitcoin Minetrix aims to democratize Bitcoin mining. Harambe AI introduces an AI-driven hedge fund. Crafteo AI transforms NFT creation. Finally, the SubQuery Network improves decentralized data indexing. As the cryptocurrency space continues to evolve, staying informed about Binance new list of coins is necessary for crypto traders.

Leave a Reply