Managing a cryptocurrency portfolio can be a daunting task, especially considering the volatile nature of the market and the ever-increasing number of digital assets available. Fortunately, there are advanced platforms that provide users with an array of tools and features that simplify the management process. The Binance Top 5 portfolio trackers comparison is crucial for effectively managing your cryptocurrency investments. As the cryptocurrency market continues to expand, Binance has emerged as one of the leading exchanges, attracting a significant number of traders and investors

In this article by Finestel, we will present a Binance Top 5 portfolio trackers comparison, including Delta, Coinigy, Finestel, Koinly, and CoinTracking. We will conduct an in-depth analysis and comparison of these platforms, evaluating their features, functionalities, user experience, etc. Throughout the article, we will emphasize the importance of crypto portfolio trackers in simplifying Binance portfolio management and maximizing investment strategies.

What Is a Binance Portfolio Tracker, and How Does It Work?

A Binance portfolio tracker is a powerful tool designed to simplify the management of cryptocurrency portfolios, specifically on the Binance exchange. It enables users to efficiently track and analyze their holdings, orders, and positions, and monitor market trends on all of their accounts and subaccounts all in one place, then make data-driven investment decisions. By utilizing a Binance portfolio tracker, investors can optimize their portfolio performance and stay ahead in the dynamic world of cryptocurrencies.

![]()

These portfolio trackers leverage the Binance API (Application Programming Interface) to seamlessly integrate with the exchange’s platform, allowing users to access real-time data on their holdings, transaction history, and market prices. Firstly, the main function of a Binance portfolio tracker is to track and monitor the performance of individual assets within the portfolio. Users can view detailed information about each asset, including its current price, historical price movements, and percentage change over different periods.

Furthermore, Binance portfolio trackers often offer advanced features such as profit/loss calculations, tax reporting, and performance analytics. These features help users accurately measure their returns, track their trading history, and simplify the tax reporting process.

Read our comprehensive guide on crypto tax free countries in 2024.

What Are the Benefits of Using a Binance Portfolio Tracker for Cryptocurrency Portfolio Management?

Using a Binance portfolio tracker for cryptocurrency portfolio management offers numerous benefits that can greatly enhance your investment experience. Let’s explore the key advantages of utilizing a Binance portfolio tracker, incorporating all the main factors:

- A Binance portfolio tracker offers real-time information on asset prices, market trends, and portfolio performance.

- Supports different market types of a Binance account like spot, USD-M futures, etc.

- It consolidates all holdings from multiple exchange accounts and sub-accounts into one platform.

- Comprehensive portfolio analysis tools allow for assessing performance, and history, optimizing asset allocation, and identifying overexposure.

- Real-time profit/loss calculation saves time and provides accurate insights into investment returns.

- Customizable alerts and notifications keep users informed about market movements and portfolio changes.

- Generates transaction histories and tax reports for tax reporting and compliance.

- Enhances decision-making capabilities by leveraging analytical tools and real-time data.

- Provides efficient portfolio tracking, multi-exchange, and wallet support, and improved decision-making capabilities.

Overall, a Binance portfolio tracker simplifies cryptocurrency portfolio management and helps users navigate the dynamic cryptocurrency market and their performance with confidence.

How to Use a Binance Portfolio Tracker for Efficient Portfolio Management and Analysis?

Setting up different crypto portfolio trackers is somewhat similar, and those for Binance are not an exception either. However, there are some minor and major differences between some of them, as they might deliver different extra services. For example, some options of the 4th and 6th are not necessarily available on all of the portfolio tracker apps.

![]()

- Connect your Binance account to the portfolio tracker via the Binance API keys (read-only access) to receive real-time data on your holdings, transaction history, and market prices.

- The portfolio tracker will consolidate all your assets into a single dashboard, providing a comprehensive overview of your portfolio’s performance, asset allocation, and historical data.

- Utilize the portfolio analysis tools to assess your portfolio’s allocation across different categories and sectors, and adjust your portfolio allocation based on your investment strategy and risk tolerance.

- Set customizable alerts based on specific price thresholds or market conditions to stay informed about significant changes in your portfolio or the overall market, allowing you to make timely investment decisions.

- Leverage the profit/loss calculations and performance analytics provided by the portfolio tracker to measure your investment returns, track your trading history, and evaluate the overall performance of your portfolio over time.

- Explore any additional features offered by the portfolio tracker, such as tax reporting, transaction history, or integration with other platforms, to streamline your portfolio management process and provide valuable insights for tax purposes or tracking external investments.

Find out the Binance word of the day game daily updated answers.

Top 5 Binance Portfolio Trackers Comparison: Features, Fees, and Performance

Through our Binance Top 5 portfolio trackers comparison, you will gain the knowledge needed to make informed decisions and choose the most suitable portfolio tracker that aligns with your requirements and investment goals. So, let’s explore these platforms and discover which Binance portfolio tracker offers the ideal combination of features, competitive fees, and exceptional performance.

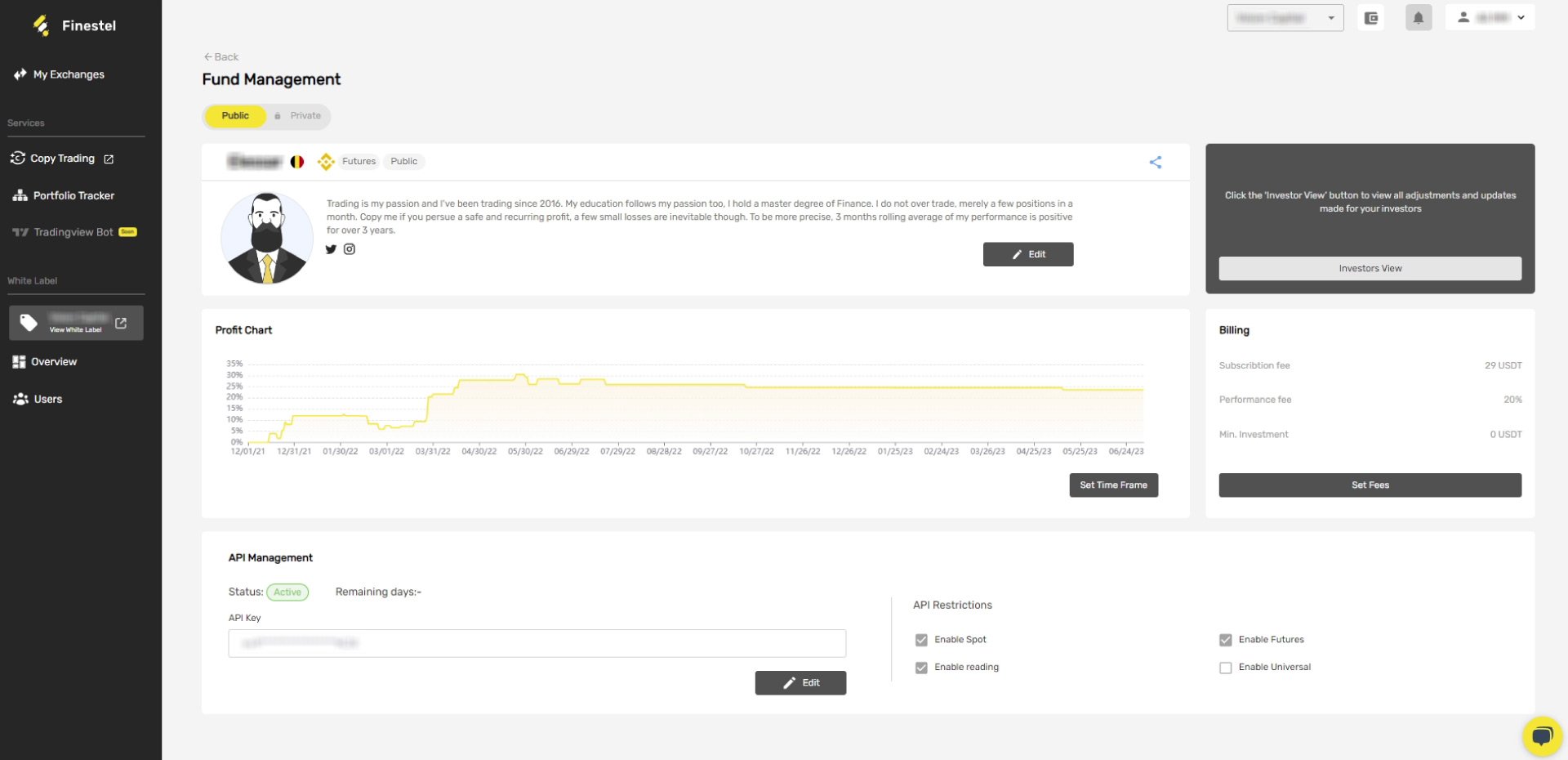

Finestel: The Best Free Binance Portfolio Tracker

Finestel offers a cutting-edge portfolio tracking application designed for cryptocurrency pro traders, money managers, their clients, and investors. Finestel delivers this service, amongst a lot of robust tools and bots, under a white label solution designed for pro traders and asset managers. One of the most important services Finestel delivers within its white label dashboard is branded copy trading software. The combination of its sophisticated portfolio tracker and other services and tools, it arms the users with comprehensive portfolio management services and tools to stay ahead of the game.

Surprisingly, despite the tracker being free of charge, it offers a reliable API connection and an easy setup. Finestel’s white label portfolio tracker includes a multi-channel notification bot, offering notifications via email, Telegram, and in-app alerts to empower the pro traders and asset managers with a system to keep their users informed about critical updates and even market movements.

Furthermore, The platform also incorporates a fully automated client management dashboard (CRM), streamlining processes such as billing, payment systems, and profit calculations. Additionally, Finestel has a solid support team that is more than willing to help users in case of an issue.

Pros

- Customizable white-label platform

- Autonomous bots

- Advanced analytics tool

- Live and historical track record reporting

- Multi-channel notification system

- Free to use

- Excellent customer support

- Seamless setup process

Cons

- Limited supported exchanges

Delta

Delta, a premier portfolio tracker for Binance, offers users an array of vital features to streamline their portfolio management. As a versatile mobile financial tracking app, Delta monitors balances, fluctuations, and transactions across various investments, including cryptocurrencies, stocks, bonds, futures, and currencies. In 2019, eToro acquired Delta in a deal valued at $5 million.

In addition, with its user-friendly interface, Delta offers comprehensive insights into portfolio performance, including profit/loss calculations, asset allocation breakdowns, and detailed historical price charts.

Furthermore, the platform also boasts advanced features such as price alerts, news integration, and multi-portfolio management. Regardless, both seasoned traders and beginner investors can utilize Delta as a valuable tool to monitor and optimize your Binance portfolio effectively.

![]()

Pros

- User-Friendly Interface

- Advanced Analysis Tools

- Price Alerts and Notifications

Cons

- Limited exchanges support

- High cost

- The long learning curve for new users

- Weak customer support

Coinigy

Coinigy, a leading portfolio tracking platform, empowers cryptocurrency traders by delivering vital information for informed decision-making. Businesses of all sizes benefit from its comprehensive access to global financial markets. With real-time data and advanced charting tools, Coinigy facilitates efficient trading strategies. Its intuitive interface and robust features enable seamless navigation across multiple exchanges. By aggregating market data and providing valuable insights, Coinigy enhances traders’ competitive edge. Stay informed and make informed choices in the dynamic cryptocurrency market with Coinigy’s reliable platform.

The cryptocurrency trading platform’s trading terminal supports stop-loss and limit order types, while Coinigy facilitates synthetic stop-limit orders on multiple exchanges. With a focus on active trading, Coinigy offers a range of tools and functionalities to enhance trading strategies and maximize profit potential.

Pros

- 30-day Free trial accounts offer excellent features, charts, price alerts, and more.

- 45+ supported exchanges

- Beginner-friendly user interface.

Cons

- Expensive subscription

- Limited updates

- Relatively high cost

Koinly

Koinly is a popular portfolio-tracking solution for Binance users. It offers a range of features designed to simplify cryptocurrency portfolio management. Finally, with its user-friendly interface and comprehensive tools, Koinly aims to streamline the tracking, analysis, and tax reporting processes.

![]()

Pros

- Advanced tax reporting

- User-friendly interface

Cons

- Complexity for novice users

- Limited customization options

- Reports of potential data inaccuracies

- Weak customer support

- High cost

CoinTracking

CoinTracking is a popular Binance portfolio tracker that offers a range of features and tools to help cryptocurrency investors effectively manage their portfolios.

![]()

Pros

- Extensive exchange compatibility

- Advanced reporting and analytics

- Tax reporting and compliance

Cons

- Steep learning curve

- The complexity of tax reporting

- Limited customer support

- Manual data entry for certain transactions

- Subscription pricing model

How to Manage Risk and Diversify Your Cryptocurrency Portfolio Using Binance Portfolio Trackers

In order to effectively manage risk and diversify your portfolio, it is crucial to take steps beyond simply tracking your portfolio. Some portfolio tracking software offers additional portfolio management tools, which may require granting trade access in addition to read-only access from the exchange. It is important to note that even in this case, the platform will not have the ability to withdraw, and you will maintain full control over your assets.

Here are some tips and tricks for managing risk in your Binance portfolio using a portfolio tracker:

-

Diversify your investments: Spread your investments across various cryptocurrencies, sectors, and market caps to reduce the impact of market volatility on your portfolio. Avoid concentrating your investments in a single asset or sector.

-

Set allocation limits: Establish a maximum percentage allocation for each cryptocurrency in your portfolio. This helps maintain a balanced investment strategy and prevents overexposure to a single asset.

-

Regularly rebalance your portfolio: Periodically review your portfolio and adjust your holdings to maintain your desired asset allocation. Rebalancing helps ensure your portfolio remains diversified and aligned with your risk tolerance. Read more about the Binance rebalancing bot.

-

Use stop-loss orders: Set stop-loss orders on your exchange or within your portfolio tracker (if supported) to automatically sell a cryptocurrency if its price falls below a predetermined level. This can help limit potential losses during market downturns.

-

Monitor market trends and news: Stay informed about market trends, news, and developments in the cryptocurrency space. This can help you make informed decisions about adjusting your portfolio based on changing market conditions.

-

Set price alerts and notifications: Use the price alerts and notifications feature of your portfolio tracker to stay updated on significant price movements in your holdings. This can help you make timely decisions to protect your investments or capitalize on new opportunities.

-

Assess your risk tolerance: Understand your risk tolerance and adjust your investment strategy accordingly. If you’re more risk-averse, consider allocating a larger portion of your portfolio to stablecoins or less volatile cryptocurrencies.

-

Keep track of your tax liabilities: Use the tax reporting features of your portfolio tracker to monitor your tax liabilities and ensure compliance with tax regulations. Proper tax management can help you avoid potential penalties and optimize your investment returns.

-

Stay disciplined and stick to your strategy: Develop a clear investment strategy and stick to it, even during periods of market volatility. Emotional decision-making can lead to poor investment choices and increased risk.

Binance Top 5 Portfolio Trackers Comparison, 2024 Summary

| Portfolio Tracker | Price | Pros | Cons |

| Delta | Free with limited features, Pro version for $7.99/month or $59.99/year | User-Friendly Interface, Advanced market analysis Tools, Price alerts and notifications, Support for spot and futures portfolios | Limited exchange support, High cost, Learning curve for new Users, Weak customer support |

| Finestel | Free | Customizable white-label platform, Autonomous bots, Advanced performance analysis tool, Live and historical track record reporting, Multi-channel notification system, Free to use, Excellent customer support, Seamless setup process, Support for spot and futures portfolios | Limited exchange support, Does not connect to personal wallets |

| Coinigy | 7-day free trial then $18.99 or $99.99/month | Advanced tax reporting, User-friendly interface, Can sync with more than 500 exchanges and wallets, Support for spot and futures portfolios | Weak customer support, Only available on mobile devices, Offers similar features and rarely updates the functionality. |

| Cointracking | Free with limited features, Pro version for $179.99/year | Extensive exchange compatibility, Advanced performance reporting and analytics, Tax reporting and compliance, Extended exchange and wallet support, Support for spot and futures portfolios | A steep learning curve, The complexity of tax reporting, Limited customer support, Manual data entry for certain transactions, Subscription pricing model, Reported issues with analytics and tax reporting tool |

| Koinly | Free with limited features, Premium version from $49 to $179/per year | Tax Reporting, Transaction History, NFT support, Extended exchange support, Localized tax reports, Support for spot and futures portfolios | No support for crypto as a payment method, High cost |

Conclusion

Choosing the ideal Binance portfolio tracker is paramount in effectively tracking your holdings, whether in spot or futures markets. Additionally, for those seeking a free crypto portfolio tracker, there are options available to suit your needs including Finestel. These platforms are equipped with Binance API integration and a range of tracking and analysis tools. This will allow you to keep track of your investments, monitor portfolio performance, and make informed decisions.

Now that you have gained valuable insights into the world of Binance portfolio trackers through our Binance Top 5 portfolio trackers comparison, it’s time to take action. Choose the crypto portfolio tracker that best suits your requirements, sign up, and embark on a journey toward efficient portfolio management and tracking.

FAQ

How do I ensure the security of my cryptocurrency holdings when using a Binance portfolio tracker?

Binance portfolio trackers prioritize security by utilizing encrypted connections and read-only API keys, ensuring that your funds remain safe and secure. Additionally, it’s essential to choose reputable and trusted portfolio tracker platforms to further enhance the security of your cryptocurrency holdings.

Can I use a Binance portfolio tracker to manage portfolios on other exchanges besides Binance?

Yes, many Binance portfolio trackers offer multi-exchange support. This allows you to manage portfolios across various exchanges, including popular platforms like KuCoin and Bybit. This enables you to consolidate and track all your crypto assets in one centralized location.

Can I use a Binance portfolio tracker to manage my Binance futures portfolio?

For the most part, yes. Many Binance portfolio trackers cater to both spot and futures markets. However, some only support one. They provide comprehensive tracking and analysis tools specifically designed for managing Binance futures portfolios. These trackers enable you to monitor your futures positions, track performance, and make data-driven decisions to optimize your trading strategies. Finestel’s portfolio tracker fully supports both spot and futures portfolios.

Do Binance portfolio trackers charge a service fee?

No, Binance portfolio trackers provided by Finestel do not charge a service fee. Traders can enjoy a $0 service fee.

Leave a Reply