Wundertrading is one of the most popular cryptocurrency platforms worldwide. It was launched in 2019 and has been serving both beginner and advanced crypto traders since. Wundertrading offers an automated system for trade execution. Traders can use Wundertrading via the web and also its Android mobile app. Therefore, it is easily accessible for almost any trader using any device.

In Wundertrading review by Finestel, we review this platform and the services it provides for traders. Then, we take a deeper dive into the platform and evaluate its features, strengths, and weaknesses. We also analyze what traders and investors think about Wundertrading and how they rate it. The main goal of this article is to provide insight for the readers on whether Wundertrading is a platform they can benefit from.

What Is Wundertrading?

Wundertrading is a trading bot platform. You can engage in automated trading or trade manually with their advanced terminal. Creating a fully automated trading strategy using TradingView is also one of the useful services Wundertrading provides. Traders can connect different exchanges to the platform and use its features.

A wide range of users can benefit from Wundertrading’s services. Beginner traders can use the copy trading service to grow their knowledge and gain experience, while professional traders are able to raise capital and grow their assets under management.

They also provide an arbitrage bot to exploit price differeneces across exchanges.

Discover the potential profitability of social trading now! Is social trading really profitable?

Wundertrading’s Key Features Review

Wundertrading offers a variety of useful tools and features to crypto traders and investors. Here are some of the most prominent ones:

- Trading Terminal: The trading terminal Wundertrading provides is one of the best around. Whether you are into strategy automation, copy trading, or even trading manually by yourself, the Smart Terminal is there for you.

- Crypto Trading Bot: Wundertrading’s cloud-based platform allows traders to automate their strategies. Utilizing TradingView’s scripts, users can create an unlimited number of crypto trading bots to execute orders or backtest strategies automatically.

- Wundertrading Marketplace Review: Investors can select the best traders or strategies listed on Wundertrading’s marketplace and seamlessly replicate the results of successful traders.

- DCA Bot: Dollar-cost averaging (DCA) is a simple yet effective method of investing. Wundertrading’s DCA bot automatically purchases a certain portion of the specified crypto asset as determined price fluctuations occur.

- Spread Trading: Wundertrading platform allows you to create a spread between different assets on the same exchange. Traders can choose an asset to create a spread, and the smart trade terminal will simultaneously buy one of the selected assets and sell the other.

- Crypto Portfolio Tracker: Users can easily track their portfolio’s performance and monitor asset allocation in real time using Wundertrading’s portfolio tracker.

Pros and Cons

While Wundertrading offers significant value to crypto traders, there are also some key areas the platform can aim to improve on. Here are the main pros and cons of Wundertrading:

Pros

- Competitive trading fees

- Crypto trading bots integration

- Seamless crypto copy trading

- Sophisticated trading terminal

- Multiple account management

- User-friendly interface

Cons

- Limited customization options

- No IOS mobile app

- Relatively young company with a limited track record

- Traders’ strategies might get leaked on social media

Wundertrading Reviews on Trustpilot: What Do Traders Think?

Trustpilot is one of the best online sources for analyzing businesses and what customers have to say about them. Wundertrading has more than 100 reviews on Trustpilot. The overall score is around 4 out of 5, suggesting that users are reasonably satisfied. However, delving deeper into the review, there are some weaknesses stated as well as the platform’s strengths.

While many users have mentioned that the platform provides a satisfactory user experience and has a clean interface, there are some issues in the background. One of the main technical problems is related to API connections and execution latency. Yet, the reviews that stated these bugs are from 2022, and these issues are likely fixed by now.

When it comes to customer support, users have mixed feelings. Some claim that customer support is relatively weak with one customer saying that it sometimes takes up to 48 hours for paid users to get a response from online support. Yet, others are more than happy with the support, calling it quick and effective.

Taking everything into account, keep in mind that reading reviews on Trustpilot can be tricky. Remember to analyze several reviews instead of focusing on only a handful of them. Moreover, be wary of fake, positive reviews. These are mostly promotional and are not made by real customers. Try to remain objective and take note of issues mentioned in multiple comments.

Discover more trading platform reviews such as Zignaly review, 3commas review, and Pocket Option review.

Wundertrading Pricing Plans Review

Wundertrading offers its services under 5 distinct pricing plans. Each plan has different features and characteristics. Here is a general view:

- Free Plan: As the name gives it away, Wundertrading’s basic plan is completely free. It offers you the opportunity to explore crypto trading automation. The Free plan includes:

-

-

- 5 open positions

- 1 API per exchange

- Trading terminal

- Copy trading

- Portfolio tracker

-

- Starter Plan: The starter plan is suitable for traders new to automated trading and willing to automate their investments and earn passive income. It includes everything in the Free plan plus:

-

-

- 10 open positions

- 1 API per exchange

- 1 active bot

- Fixed amount

- Futures spread and arbitrage

-

- Basic Plan: The basic plan is the more sophisticated version of the Starter plan. It is suitable for users who want access to all the basic features of Wundertrading. It offers everything from the Starter plan plus:

-

-

- 15 active positions

- 5 active bots

- 2 API per exchange

- Trailing stops

- Multiple take profits

- Dollar-cost averaging trading terminal

- Multi-pair bots

-

- Pro Plan: As the name suggests once again, the Pro plan is for professional full-time traders. If you are looking to combine manual, automated, and copy trading, the Pro plan is for you. It includes everything from the basic plan plus:

-

-

- 100 open positions

- 15 active bots

- 5 API per exchange

- Swing trade

-

- Premium Plan: If you want to use Wundertrading at its full potential, you should opt for the Premium plan. It offers unlimited features to traders and their followers. The Premium plan consists of everything from the Pro plan plus:

-

- 1000 open positions

- Unlimited active bots

- Unlimited API per exchange

The table below presents the costs of each plan mentioned above on both a monthly and annual basis:

| Period | Free | Starter | Basic | Pro | Premium |

| Monthly | $0.00 / month | $4.95 / month | $19.95 / month | $39.95 / month | $89.95 / month |

| Annual | $0.00 / month | $3.47 / month | $13.97 / month | $27.97 / month | $62.97 / month |

The Best Alternative for Wundertrading

Let’s get this out of the way: choosing between Finestel and WunderTrading isn’t about which one’s “better”; it’s about which one fits what you’re actually trying to do. Both platforms connect to the big exchanges through API and let you run bots without manually clicking through trades like it’s 2015. The real difference? WunderTrading’s built for retail traders who want simplicity, while Finestel’s aimed at people running actual trading operations or managing client’s money.

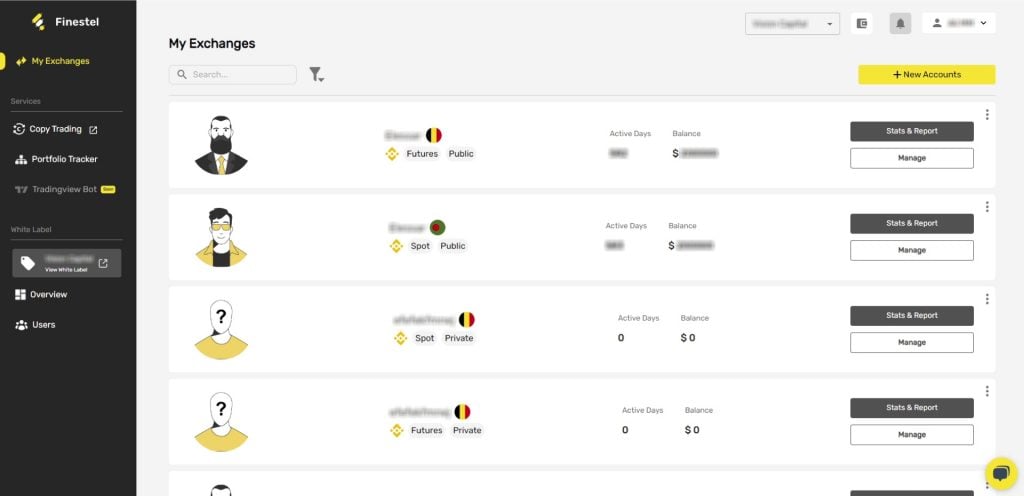

Where Finestel comes in differently

Finestel’s not trying to compete with WunderTrading for the beginner market. They’re playing a different game entirely. If you’re managing client funds, building a trading business, or need features that go beyond personal trading, this is where things get interesting.

Copy trading here is designed for fund managers. You can replicate trades across multiple client accounts with proportional sizing, risk controls, and complete privacy. Your strategies don’t end up in some public marketplace where anyone can see your edge. For anyone managing institutional capital or running a prop desk, this matters a lot.

The white-label option is the real differentiator. You can basically create your own branded automated trading platform, custom dashboards, mobile apps, client portals, automated billing. If you’ve ever wanted to run your own crypto hedge fund or signal service without building everything from scratch, this is how you do it. WunderTrading doesn’t even attempt this.

The automation’s more flexible. You’ve got TradingView bot that executes Pine Script alerts instantly. Custom signal bots that pull from Telegram, webhooks, or on-chain data. The architecture supports complex strategies like statistical arbitrage and high-frequency approaches that would choke simpler platforms. It’s built for people who know exactly what they want to do and need the tools to do it.

The numbers back up the reliability. Over $50 billion in trading volume processed, more than 100 million orders executed, and a 4.7/5 Trustpilot rating. They support all the major exchanges and they’re adding MT4/MT5 connectivity for forex traders. The platform’s proven it can handle serious scale.

Wundertrading vs. Finestel

|

Feature |

WunderTrading |

Finestel |

|

Best for |

Retail traders, beginners, personal accounts |

Asset managers, prop traders, trading businesses |

|

Starting price |

Free (limited), $4.95/month paid plans |

7-days free trial, starting from $59.3/month |

|

Bot types |

DCA, Grid, Arbitrage, Smart Trade |

TradingView, Custom Signal, Copy Trading, High-frequency capable |

|

Copy trading |

Public marketplace |

Private replication across client accounts, proportional sizing |

|

White-label platform |

Not available |

Fully available, custom branding, apps, client portals |

|

Mobile app |

Yes, native mobile access |

Yes, including native and white-label mobile options |

|

Trading terminal |

Basic interface, relies on exchange UI for advanced charts |

Advanced terminal with multi-exchange view, unified order management |

|

Volume handled |

Optimized for retail volumes |

Proven at $50B+ institutional scale |

|

Trustpilot rating |

3.8/5, good for ease of use |

4.7/5, praised for reliability |

|

Best use case |

Running personal bots, learning automation |

Scaling trading operations, building trading business |

Conclusion

To conclude the Wundertrading review, Wundertrading is one of the leading crypto trading automation companies. With its user-friendly interface and wide range of features, it can meet the requirements of most traders in the crypto space. Wundertrading is a competitive social trading platform in today’s market, but it is mostly useful for casual crypto traders. Yet, keep in mind to thoroughly assess the platform’s features, pricing plans, and security measures yourself.

Meanwhile, the crypto market involves considerable risk factors that might be somehow non-existent in the more traditional asset classes. These risks are a direct result of market volatility and lack of robust regulation. Therefore, you would be better off diversifying the trading platforms you use. In this case, Finestel can be an excellent option, being an up-and-coming platform with rapid innovation. Finestel focuses on serving the most serious asset managers in the crypto market. So, if you are a professional trader or if you are willing to level up your asset management business, Finestel is the optimal choice.

Leave a Reply