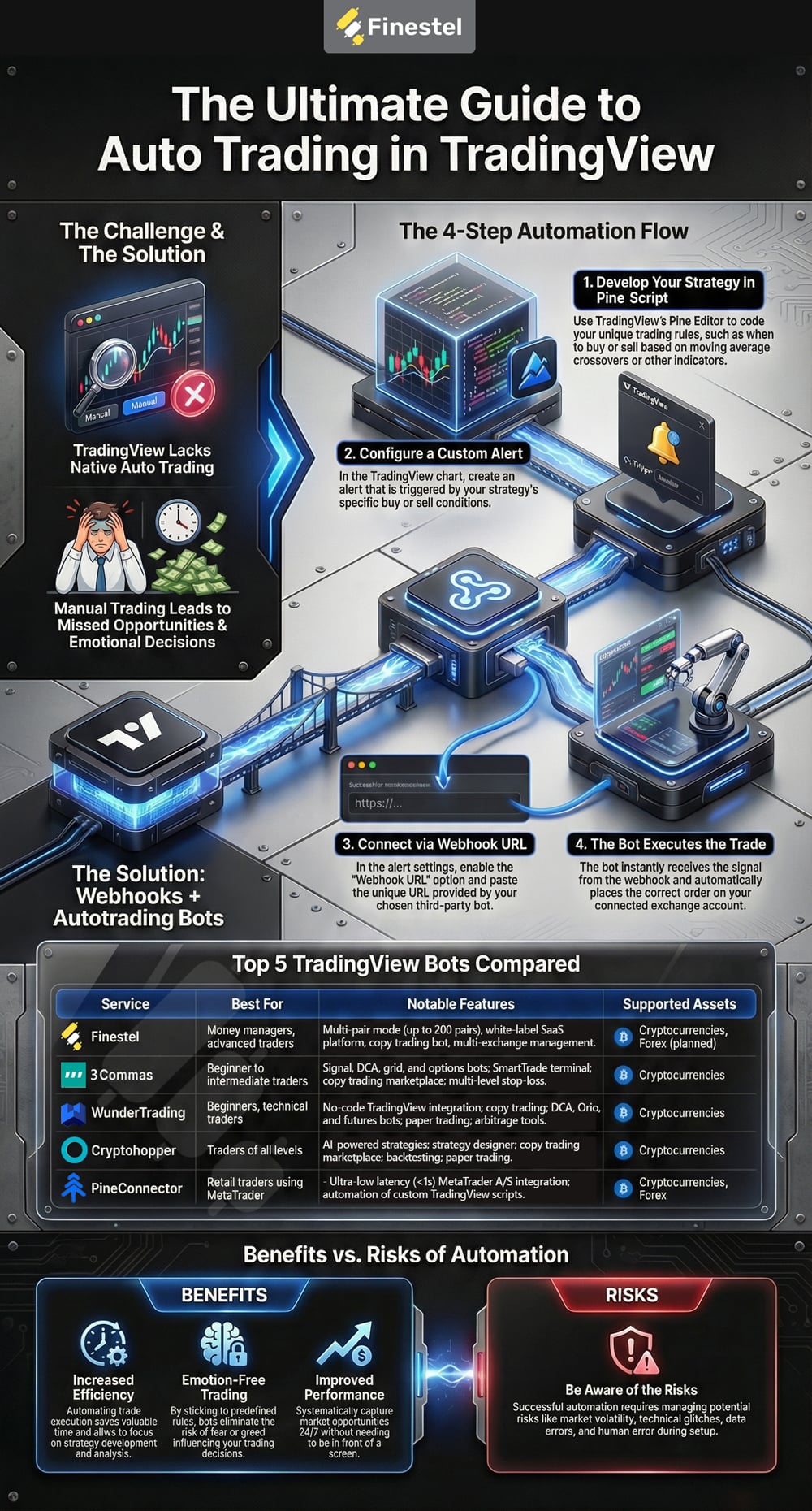

Auto trading in TradingView, or algorithmic or systematic trading, harnesses a technology-driven system where trading orders are executed automatically according to predefined rules or algorithms. Auto trading in TradingView facilitates the swift capture of real-time market opportunities, extending from simple, single-asset setups to sophisticated, AI-powered multi-asset platforms.

The primary strength of auto trading in TradingView lies in its capacity to function with minimal human intervention post-setup, albeit under watchful supervision. In recent times, traders have found ingenious ways to overcome TradingView’s direct limitations by leveraging webhooks, advanced PineScript techniques, and third-party TradingView bots to automate their trading strategies effectively.

In this article by Finestel, you will get familiar with the benefits of auto trading in TradingView, the possibility of it, and the nature of TradingView bots and alerts. Finally, we will look at widespread trading automation with key features suitable for traders and asset managers.

Does TradingView Support Automated Trading?

The Short Answer: Not directly.

While TradingView is a formidable platform for chart viewing and market condition analysis, it needs to improve by directly facilitating auto trading. Despite an announced plan to integrate such a service, this limitation still needs a specified timeline for its implementation. The absence of auto trading is especially felt by traders seeking to reduce the impact of emotional decisions on their trading actions, given the market’s high stakes and fast-paced nature.

However, there are alternative solutions within TradingView. One such option is the manual trading route, which calls for creating a bot and setting an alert. The final step involves utilizing the ‘Webhook URL’ option to link the bot’s web address. This workaround enables some automation, even if it doesn’t provide full-fledged auto trading.

Furthermore, for those open to exploring beyond TradingView, third-party order automation services exist as viable options. These services, which we will delve deeper into later in the article, offer additional flexibility and control, potentially enriching your experience and strategy for auto trading in TradingView.

Trading Automation in TradingView

Automating trading with TradingView requires bridging its powerful charting and strategy development tools with external platforms capable of executing trades. Since TradingView does not natively support automated trade execution, two key components enable this process: webhooks and autotrading bots.

Leveraging Webhooks for Real-Time Trade Execution

What Are Tradingview Webhooks? A webhook is a mechanism that enables one application to send real-time data to another when a specific event occurs. In TradingView, webhooks allow users to transmit trading signals, such as buy or sell instructions, generated by a PineScript strategy or indicator to an external platform, such as a trading bot or broker, for automated execution.

Steps to Set Up Webhooks in TradingView

To use webhooks for automation, follow these steps:

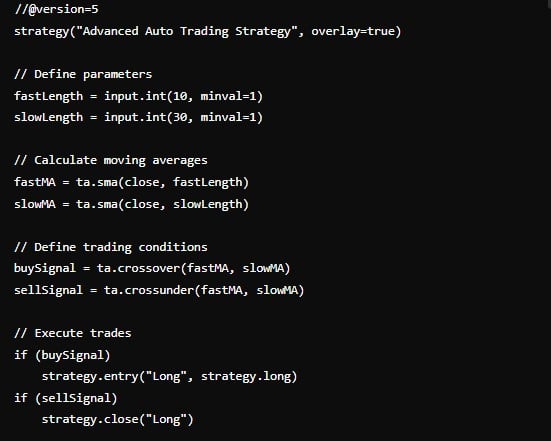

- Develop a PineScript Strategy: Use TradingView’s Pine Editor to create a strategy defining your trading rules. For example, a simple strategy might trigger a buy signal when a 10-period simple moving average (SMA) crosses above a 20-period SMA.

Pinescript Code for AutoTrading in Tradingview:

Advanced Features to Explore:

- Strategy Backtesting:

- Test your strategies against historical data to evaluate performance.

- Use the

strategy()to define properties such as entry/exit rules and backtesting criteria. For advanced use, consider integrating external data sources via webhooks for real-time strategy adjustments.

- Custom Indicators:

- Develop unique indicators that align with your trading methodology.

- Combine multiple indicators to create complex conditions.

- Optimization:

- Adjust parameters to optimize for profitability, risk management, or other criteria.

- Utilize input variables to easily tweak your strategy settings.

Read our Full guide on how to backtest on Tradingview.

2. Configure an Alert:

-

- On the TradingView chart, access the “Alerts” tab or click the alert icon.

- Select your strategy and specify the condition (e.g., “Buy” or “Sell” signal).

- Enable the “Webhook URL” option in the alert settings.

3. Provide the Webhook URL:

-

-

- Obtain the webhook URL from your chosen third-party platform (e.g., Finestel).

- Enter this URL in the alert’s webhook field.

- Customize the alert message to include relevant data, such as:

-

{

“action”: “{{strategy.order.action}}”,

“symbol”: “{{ticker}}”,

“price”: “{{close}}”,

“quantity”: 1

}

4. Test the Setup: Use TradingView’s Paper Trading feature or a demo account on the external platform to verify that the webhook sends signals correctly and triggers trades as intended.

Read our 2025 guide on how to trade on Tradingview.

What Are TradingView Autotrading Bots?

A TradingView autotrading bot is a software tool or service that receives signals from TradingView alerts (typically via webhooks) and automatically executes trades on a connected broker or exchange. These bots act as intermediaries, translating TradingView’s signals into actionable trades, enabling automation for strategies developed in PineScript.

Want to explore the best crypto trading bots? Start by checking out our guide and testing a bot on a free trial to see how it fits your strategy.

Best TradingView Bots in 2025

These platforms offer a range of innovative features designed to streamline and optimize your trading activities, especially for auto trading in TradingView. Let’s explore the key highlights of each Automator:

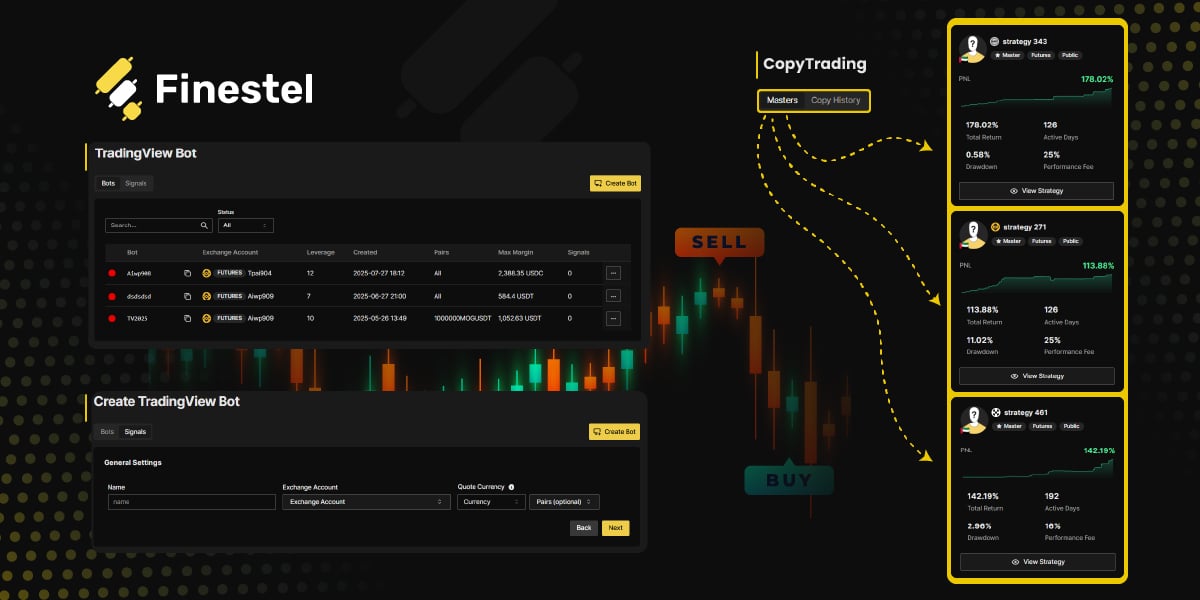

1. Finestel

The Finestel TradingView Bot is a cryptocurrency trading automation tool designed to execute trades automatically based on alerts generated by TradingView strategies or indicators. By integrating TradingView’s alert system with Finestel’s platform via webhooks, the bot enables traders to automate their strategies on major cryptocurrency exchanges such as Binance, Bybit, KuCoin, OKX, and Gate.io, with plans to support Coinbase in the future.

This tool is particularly suited for cryptocurrency traders seeking efficiency, consistency, and the ability to manage multiple exchange accounts, as well as asset managers looking to scale their operations through white-label solutions.

Finestel distinguishes itself with features like multi-exchange account execution, multi-pair trading, robust risk management, and white-label capabilities tailored for professional traders and businesses.

For more information, contact us and start enhancing your trading performance with Finestel. Sign up on Finestel today.

How the Finestel TradingView Bot Works

The bot operates through a streamlined process that integrates TradingView’s alert system with Finestel’s platform and connected exchanges. The webpage outlines three key steps, with an additional step for asset managers:

- Connect TradingView Alerts:

- Traders link their TradingView account to Finestel by setting up alerts that trigger based on specific conditions, such as a technical indicator signal (e.g., a moving average crossover) or a custom PineScript strategy.

- A webhook URL, provided by Finestel, is added to the TradingView alert settings to send signals to the bot.

- Finestel Processes the Signal:

- When an alert is triggered, Finestel’s platform receives the webhook signal and processes it in real-time, interpreting details like the trade action (buy/sell), asset, and quantity.

- Execute Trades on the Exchange:

- The bot places the trade on the connected exchange (e.g., Binance, KuCoin) according to the alert’s instructions, ensuring fast and accurate execution.

- Copy Trading for Asset Managers (Optional):

- Asset managers can use Finestel’s copy trading feature to replicate trades across multiple client exchange accounts instantly, enhancing scalability for professional trading operations.

2. 3Commas

At its core, 3Commas provides an API-to-Webhook listener. It assigns a unique URL and JSON schema to a bot, which then waits for an external POST request from TradingView’s alert server to execute orders on a linked exchange.

2.1. The Signal Bot Protocol

The Signal Bot is the primary tool for executing Pine Script strategies. Unlike standard bots, it follows the “State” of the TradingView chart.

- State Management: It uses specific JSON commands (

enter_long,exit_long,enter_short,exit_short) to sync the exchange position with the chart strategy. - Position Flipping: It allows for immediate reversal of market direction in a single execution block, minimizing the time the account is out of the market.

- Hedge Compatibility: It supports “Hedge Mode” for futures trading, enabling concurrent long and short positions on the same ticker managed by a single bot ID.

2.2. The DCA Bot Integration

This is a Trigger-Action setup. TradingView acts only as the “Start Condition.”

- Logic Hand-off: Once the alert hits 3Commas, the bot takes over. The exit logic (Take Profit/Stop Loss) and safety orders are handled by the 3Commas engine, not the TradingView script.

- Use Case: Best for simple indicator alerts (e.g., “Start Long when RSI < 30”).

3. WunderTrading

WunderTrading has a specific Signal Bot, which is built specifically for TradingView integration. It works like other typical signal bots we have talked about. WunderTrading, like Finestel, is also functioning as a Multi-Account Layer. It isn’t just about moving a trade from A to B; it’s about broadcasting a single Pine Script signal across an entire infrastructure.

The bot broadcasts that trade across every linked account, making it a native tool for managing multiple sub-accounts or acting as a “copy-trading” provider.

4. Cryptohopper

This is Cryptohopper’s most unique feature. Most platforms execute a TradingView signal as a binary command (If Signal -> Trade). You can feed TradingView alerts into Cryptohopper’s AI Engine as a “Source.”

4.1. The Technical Edge

The AI doesn’t just blindly follow the alert. It collects signals from multiple sources (TradingView, its own Strategy Designer, and Marketplace signalers) and “scores” them. If your TradingView signal has a high win rate historically, the AI gives it more weight. This allows for a consensus-based execution rather than relying on a single Pine Script indicator.

4.2. Config Pools for Webhook Overrides

Cryptohopper uses a “Baseconfig” for general settings, but its Config Pools allow for hyper-specific webhook behavior. You can set up a Config Pool specifically for trades triggered by TradingView.

You can tell the bot: “If a trade comes from my RSI-TradingView alert, use a 2% Stop Loss. If it comes from my MACD-TradingView alert, use a 5% Stop Loss.”

This allows you to manage different risk profiles for different indicators within the same bot, a level of granularity that usually requires multiple bots on other platforms.

5. PineConnector

While the previous platforms focus on Crypto exchanges, PineConnector is a specialized bridge built specifically for Forex and CFD traders who use MetaTrader 4 (MT4) or MetaTrader 5 (MT5).

Unlike the others, PineConnector is not a cloud-bot with its own dashboard; it is a MetaTrader Expert Advisor (EA)that converts TradingView alerts into local brokerage orders.

It allows you to trade Prop Firm accounts (like FTMO, MyForexFunds, etc.) using TradingView. Since most prop firms require MetaTrader, PineConnector is the industry standard for “bridging” high-quality Pine Script charts to restricted prop firm environments.

Explore more about TradingView’s free indicators.

Top 5 TradingView Bots Compared

There are several services available to automate strategies in TradingView. Here is a list of some popular ones:

|

Service |

Description |

Best For |

Notable Features |

Supported Assets |

|

Finestel |

Automates TradingView alerts with multi-pair support and white-label capabilities, ideal for traders and asset managers. |

Asset managers, wealth managers, Money managers, advanced traders |

Multi-Pair Mode (200 pairs), white-label SaaS, copy trading bot, multi exchange account management, risk allocation cap, custom signal bot, TradingView integration, 4.7/5 Trustpilot |

Cryptocurrencies, Forex (planned) |

|

WunderTrading |

A platform for automating TradingView scripts, designed for ease and flexibility. |

Beginners, technical traders |

No-code TradingView integration, copy trading, DCA/Grid/Futures bots, paper trading, arbitrage tools |

Cryptocurrencies |

|

3Commas |

Provides strategy automation, copy trading, and risk management tools like stop-loss and take-profit orders. |

Beginner to intermediate traders |

Signal/DCA/Grid/Options bots, SmartTrade terminal, copy trading marketplace, multi-level stop-loss |

Cryptocurrencies |

|

Cryptohopper |

Versatile bot platform offering real-time trading, backtesting, and a strategy marketplace for automated trading. |

Traders of all levels |

AI-driven strategies, strategy designer, copy trading marketplace, backtesting, paper trading |

Cryptocurrencies |

|

PineConnector |

Low-code tool for automating TradingView strategies on MetaTrader with ultra-low latency execution. |

Retail traders using MetaTrader |

MetaTrader 4/5 integration, TradingView script automation |

Cryptocurrencies, Forex |

Tips for Choosing an Automation Platform

Consider factors such as asset compatibility, features like backtesting and customization, pricing, and your own technical expertise. Tools like 3Commas and Cryptohopper provide beginner-friendly options, while Finestel and Quadency are better for advanced portfolio management and trading. Read more in 3commas Review and 3commas copy trading articles.

These third-party solutions can significantly enhance your TradingView experience, especially when used with TradingView’s premium account for features like additional alerts, advanced charting tools, and real-time data.

Discover details about TradingView’s premium account: Find out about the features and benefits of TradingView’s premium account, including advanced charting tools, real-time data, and additional customization options for serious traders and investors.

What are TradingView Alerts?

TradingView alerts are a vital tool for traders, delivering important notifications when specific conditions are met on a chart. These conditions can include price changes, technical indicators, or other market events. Instant alerts are sent immediately once the conditions are met, while scheduled alerts are dispatched at predetermined times.

To create an alert, traders select a condition to monitor, which can contain a wide range of options such as price, volume, indicators, or news events. Traders can then set the parameters to determine how the alert will be delivered, whether through email, SMS, or push notifications.

The benefits of utilizing TradingView alerts are extensive and valuable for traders of all experience levels. They enable traders to stay informed about market developments, identify potential trading opportunities, and avoid potential losses. By providing timely notifications when specific conditions occur, alerts empower traders to take immediate action, leading to improved trading outcomes. As a result, the exploration and utilization of TradingView alerts are highly recommended for all traders seeking to enhance their trading strategies.

List of TradingView Alert Automators in 2025

Here is a list of third-party providers that automate the TradingView Alert feature for your trading operations:

- Finestel

- 3Commas

- Aleeert

- Alertatron

- Wundertrading

- AutoView

- Gunbot

- Tickerly

- TradersPost

- Traderelay

- Mudrex

- Cryptowatch

- APIBridge

- Auto4Mex

- SignalBot

- Cryptohopper

- NextLevelbot

- ProfitView

- Quadency

- TradingConnector

- Superorder

- TradingView.to

Note that this comprehensive list includes the providers you can discover after conducting extensive research.

Auto trading in TradingView Infographic (2026 Update)

Conclusion

In summary, auto trading in TradingView provides traders with increased efficiency, reduced risk, and improved performance. By utilizing software to execute trades automatically, traders can save time and focus on other tasks. However, risks such as market volatility, technical issues, data errors, and human error should be considered.

Automated trading services offer traders increased efficiency, reduced risk, and improved performance by automating trading processes and enabling rational decision-making. These services provide access to advanced algorithms and strategies, facilitating effective identification and capitalization of market opportunities. However, traders should be aware of potential risks, including market volatility, technical problems, data errors, and human error. By evaluating these risks and implementing appropriate risk management measures, traders can harness the benefits of auto trading in TradingView and optimize their trading outcomes.

FAQ

Can I automate trading with TradingView?

Sort of, but not directly. TradingView doesn’t execute trades automatically on brokers or exchanges, that’s not what it does natively. As of January 2026, it’s still primarily a charting and analysis platform, not an execution engine. What you can do is use Pine Script strategies to generate trading signals, set up alerts with webhooks, and then connect those to third-party automation tools.

Can you algo trade on TradingView?

Yes for development and testing. You can build algorithmic strategies with Pine Script, backtest them against historical data, optimize parameters, validate logic.

How should I automate TradingView alerts into trades?

By using a trading bot, a webhook, and even a custom script on TradingView.

Can I run trading bots on TradingView?

You can run trading bots on TradingView or use third-party trading bot platforms that integrate with TradingView.

Do professional traders use TradingView?

TradingView is a popular charting platform offering professional traders a wide range of features.

Does TradingView have simulated trading?

Yes, TradingView does offer simulated trading through its Paper Trading feature. This allows users to practice trading strategies without financial risk. Using Paper Trading, traders can simulate buying and selling assets in real time, analyze market movements, and test their trading strategies with virtual funds. This feature is invaluable for honing skills and experimenting with new strategies in a risk-free environment before committing real capital.

I am interested in trading stock and etf using the bot and to set it on auto. Is there a Broker that I could integrate the bot and is it necessary to use MT 4 or 5.

Can you recommend a demo video for viewing.

Thanks

Paul

automated trading tradingview binance isn’t working

Very informative post and easy to understand, thanks for sharing

Thanks for your comment

Great list! However, none of your “Top 5 Trading Automators of TradingView” support forex, futures or stock trading.

Something like Tickerly, from your list of third-party providers, also supports Oanda, Capital.com or Alpaca if you want to automate a TradingView strategy for something else than Crypto.

Hey Justin. Thanks for your comment! This list is a bit more about crypto since Finestel is serving mainly in the crypto market. However, some of them support futures in crypto.

We will most probably publish another one for such services you mentioned supporting forex and stocks.