There’s been quite a hype around automation and crypto trading bots in recent years. I’ve tested most of them over the years, including Bitsgap. So in this Bitsgap review, I’m sharing what actually happened when I checked out the platform and played around with a few different things.

For me, Bitsgap looks simple at first. But the more you use it, the more you see where it shines and where it doesn’t. In this post, I’ll break down my real experience, the features that matter, and whether it’s a platform even worth using or not. So, if you trade crypto actively or rely on automated systems and are curious about available solutions, you’ve come to the right place.

What Is Bitsgap?

Let’s begin our Bitsgap review by briefly introducing it. Well, as you might have guessed or even know already, Bitsgap is a crypto trading automation platform. It is built primarily for retail crypto traders who want to run bots and do so without coding a single line.

It connects to your exchange accounts through API keys. You can then launch grid trading bots, DCA bots, and even Bitsgap scalping bots in a few clicks. So, you simply set the rules on Bitsgap, and the bot handles the execution on your exchange account.

I’ve used Bitsgap on and off over the recent months. It has always positioned itself as an all-in-one automation suite. And they do quite well to back it up by offering bots, portfolio tracking, smart order tools, and more. It’s also compatible with a wide list of exchanges, including the big boys like Binance, Coinbase, KuCoin, Kraken, and others.

Bitsgap Features and Tools

As I’ve already mentioned in this Bitsgap review, the platform comes with a mix of automated bots. But it also offers an AI trading assistant, a manual trading terminal, and a full demo mode. Let’s have a brief overview of these products.

Trading Bots

Bitsgap trading bots are the core of the platform. You get both spot bots and futures bots. You should already know that each bot is built for a specific type of market movement. The setup is also quite simple, as you should pick a bot, choose your pair, adjust the settings, and launch.

You can run Bitsgap grid bots, DCA bots, BTD, and LOOP on spot. The Futures bots also include the Bitsgap DCA bot and the COMBO bot. All these bots run in the cloud, so they keep working even when you’re offline.

When I was testing these bots to write this Bitsgap review, the first thing I found out was how simple it is to use these bots. They also behaved quite consistently across my accounts on Binance and KuCoin.

You also get a backtesting feature and some ready-made strategies. As for risk management settings, you can use stop-losses, take-profits, trailing stops, and pump protection. So, Bitsgap crypto bots are quite equipped. Yet, I failed to find a Bitsgap arbitrage bot anywhere. But no need to worry, as I’ve already reviewed the best crypto arbitrage bots you can use.

AI Assistant

The Bitsgap AI Assistant is a new feature, and is for those of you who don’t want to set up individual bots or fine-tune parameters by yourself. I mean, you just choose your exchange and the amount you want to invest, and the AI creates a full portfolio of bots for you. That’s quite smart if you ask me.

While I didn’t test the Bitsgap AI Assistant long enough to say how it performs, it truly behaved like a diversified bot manager. It also adjusts them based on market conditions, and lets you stop everything once you hit your profit target. Bitsgap claims the system comes from seven years of research, and from what I’ve seen, they’re not wrong about that.

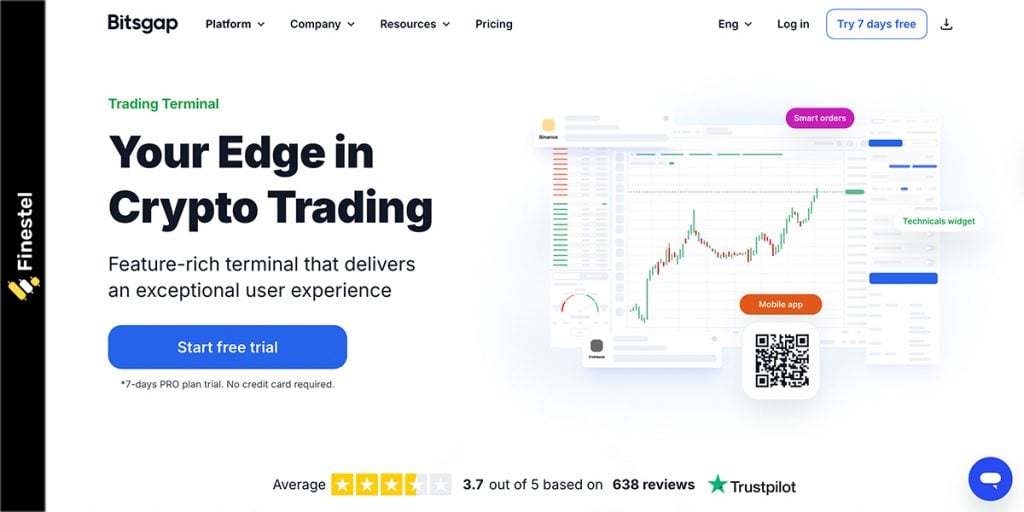

Trading Terminal

The most straightforward step to write a Bitsgap review was testing out their terminal. Just like many other solutions, the Bitsgap trading terminal gives you a single dashboard to trade on multiple exchanges. All the common order types are also there. So, everything a retail trader might ask from a trading platform is basically there.

But there’s a catch. Bitsgap’s terminal is still built mainly for individual retail traders. If you’re managing external capital, running a fund, or need deeper portfolio and client-level analytics, tools like the Finestel trading terminal feel more professional.

Demo Trading

Finally, the Bitsgap demo mode is really what it seems to be. You can practice manual trading with virtual funds in real market conditions using the Bitsgap demo account.

You can also test Bitsgap bots in the demo mode and experiment with new strategies. It’s just a regular demo account, but the main advantage is that you test all their products on it.

Bitsgap Pricing

Another important part for anyone who’s reading this Bitsgap review is definitely the pricing. Well, Bitsgap pricing is quite simple, divided into four plans, starting from a free one. You’ll need to choose your Bitsgap plan based on what you want. Here’s an overview:

|

Plan |

Price / Month |

Active Grid Bots |

Active DCA Bots |

AI Assistant |

Futures Bots |

Backtesting |

|

Free |

$0 |

0 |

0 |

No |

No |

No |

|

Basic |

$29 |

3 |

10 |

Yes |

No |

Up to 30 days |

|

Advanced (Most Popular) |

$69 |

10 |

50 |

Yes |

Yes |

Up to 180 days |

|

Pro |

$149 |

50 |

250 |

Yes |

Yes |

Up to 365 days |

All these plans also come with unlimited manual trading, unlimited smart orders, 24/7 cloud execution, 16+ supported exchanges, and access to both desktop and mobile versions.

If you want to subscribe to a paid plan, you can always search the web for Bitsgap promo codes to lower the price a bit.

Bitsgap Reviews and User Feedback

Now, if you truly want to know if Bitsgap is legit or not, we should take a look at others’ feedback online. Well, Bitsgap reviews on places like Reddit and Trustpilot are generally positive.

Most users point out how simple the interface and bots are. The Bitsgap sign up process is also quick, which is nice. There’s definitely a learning curve, but it’s manageable even without taking any Bitsgap courses.

Bitsgap Trustpilot reviews also mention that the community is active, though the official Bitsgap Discord group isn’t heavily promoted or central to the experience.

On the downside, some Bitsgap reviews complain about inconsistent profits and slow support responses. The bots also reportedly perform worse in choppy conditions. But I think it’s understandable, as many crypto trading automation tools lack in these conditions.

Finestel: Bitsgap Alternative for Pros

As I’ve already mentioned in this Bitsgap review, it’s a great solution for retail automation. Yet, professional traders, asset managers, and teams usually need more than GRID and DCA bots.

This is where Finestel will stand out. Let’s have a head-to-head comparison:

|

Feature |

Bitsgap |

Finestel |

|

Primary Users |

Retail traders |

Pro traders, asset managers, funds |

|

Automation Type |

Grid, DCA, BTD, Futures bots |

Copy trading, TradingView bots, signal bots |

|

Trading Terminal |

Multi-exchange retail terminal |

Pro terminal with multi-account execution |

|

Copy Trading |

Not available |

Full copy-trading suite (private & public) |

|

White-Label System |

No |

Yes. full white-label asset-management platform |

|

Investor Management |

No |

Full dashboards, analytics, and fee automation |

|

Bot Strategies |

Grid, DCA, futures strategies |

Any strategy via TradingView alerts or signals |

|

Scaling |

Good for individuals |

Built to scale trading businesses and AUM |

|

Best For |

Beginners to mid-level bot users |

Professionals running client capital |

Finestel’s copy trading software and asset-management infrastructure are not just bots. You can run a private or public copy trading system, offer managed accounts, use TradingView bots, and deploy signal bots, We also offer the option to launch a full white-label copy trading platform under your own brand.

Finestel also offers a pro-level trading terminal, multi-account execution, risk controls for followers/investors, performance dashboards, fee automation, an institutional-style backend, and more. Bitsgap can automate your own bots, but Finestel lets you scale a trading business.

Bitsgap Alternatives for Retail Traders

Now, not everyone is an asset manager, and after going through this Bitsgap review, you might be looking for retail alternatives. Well, Bitsgap competitors include familiar names like 3Commas, Pionex, Cryptohopper, and even KuCoin’s built-in bots. They offer similar features with different strengths.

Some platforms focus on easier presets, others on cheaper pricing, and some provide more advanced strategy customization. These alternatives are ideal if you want to try different bot styles or prefer a platform that fits your budget and trading style better.

|

Platform |

Key Strength |

Bot Types |

Best For |

|

Bitsgap |

Balanced mix of bots and simplicity |

GRID, DCA, BTD, Futures |

Retail traders who want clean automation |

|

Advanced customization & smart trading |

GRID, DCA, options bots |

Traders who want deep settings & AI signals |

|

|

Pionex |

Free built-in bots, lowest cost |

GRID, DCA, leverage grid |

Beginners and cost-conscious traders |

|

Marketplace for strategies |

DCA, trend bots, signals |

Traders who prefer buying ready-made strategies |

|

|

Native exchange bots |

GRID, DCA, Infinity Bot |

Traders who want a simple, built-in solution |

These Bitsgap alternatives give retail traders plenty of options. But it really depends on whether you want low fees, more bot variety, or deeper customization. I personally think Bitsgap sits in the middle. It’s easy to use, feature-rich, and flexible. But it’s neither the cheapest nor the most advanced.

Conclusion

In this Bitsgap review, I’ve made it clear that the platform is a solid choice for retail traders who want simple automation. Bitsgap grid, DCA, and futures bots work well for hands-off strategies. The platform actually offers enough tools for beginners and intermediate traders to stay productive without getting overwhelmed.

But if you’re a professional trader, signal provider, or crypto asset manager, you’ll eventually outgrow what Bitsgap offers. Platforms like Finestel deliver the advanced infrastructure that serious traders need. So while Bitsgap is great for retail automation, the “next level” sits elsewhere.

Leave a Reply