There is no lack in the number of CFD brokers worldwide. You can trade forex, crypto, stocks, and indices on these brokers, and they typically serve traders from all around the world. One of these brokers is Darwinex and in this article, I’ll provide a comprehensive Darwinex review. Yet, I’ll not stop at analyzing their broker services but also their additional features like Darwinex Zero.

I’ll begin the article by providing an introduction and background about Darwinex. Then’ I’ll move on to provide a detailed Darwinex broker review and evaluate their features and services as a CFD broker. In the later parts of the article, I’ll turn my attention to Darwinex Zero, which is the Darwinex funding program that helps traders raise AUM.

What Is Darwinex?

If you are here, you should already know what a CFD broker is. If not, a CFD broker offers a specific financial instrument, a Contract for Difference (CFD), which allows you to trade almost all common markets. Darwinex is a CFD broker entering the broker industry in 2012. Its headquarters are in London, one of the primary financial hubs in the world, and is operated by Tradeslide Trading Tech.

On Darwinex, you can trade forex pairs, indices, commodities, stocks, and so on. So, like most CFD brokers, there is no shortage of tradeable instruments. Yet, unlike most CFD brokers, it is a highly regulated broker. Darwinex is regulated by the UK’s Financial Conduct Authority (FCA). So, the question “Is Darwinex legit?” can go out the window right now because the fact that the Darwinex CFD broker is regulated by the FCA is no joke.

Darwinex is operated by Tradeslide Trading Tech. offers a unique trading and investment platform that connects traders with investors. The platform allows users to trade forex, CFDs, stocks, commodities, cryptocurrencies, and indices through MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the Darwin API. Additionally, Darwinex’s partnership with Interactive Brokers enhances its offerings, providing access to futures trading and a broader range of financial instruments. This partnership combines Interactive Brokers’ extensive market access with Darwinex’s innovative risk management and investment products.

Read more about crypto trading on MT4 and MT5.

Darwinex Broker Review

Now, let’s see how the Darwinex broker really works by analyzing the key metrics like trading platforms, spread, commissions etc.

Darwinex Trading Platforms

Let’s begin our Darwinex broker review with its trading platforms. Just like all CFD brokers, Darwinex supports various trading platforms. These include MetaTrader 4, MetaTrader 5, and FIX. You can also get Darwin API if you want to implement API trading.

In order to download each of these platforms, you can simply search for these terms on Google:

- For MT4: “Darwinex MT4 download” or “Darwinex MetaTrader4 download”

- For MT5: “Darwinex MT5 download” or “Darwinex MetaTrader5 download”

- For Fix: Use the FIX API available on the Darwinex platform

Darwinex Account Types

Darwinex primarily offers one standard account type for its users. This provides access to the Darwinex platform and features. Here’s a quick overview of the account types and their features:

Standard Account

On the Darwinex standard account, you can trade on MetaTrader 4 (MT4), MetaTrader 5 (MT5), or using the Darwin API. This Darwinex live account allows you to trade asset classes, including Forex, stocks, commodities, cryptocurrencies, and indices. Moreover, the client funds are protected under the Financial Services Compensation Scheme (FSCS). Note that no separate Darwinex ECN account is available at the moment.

Darwinex Pro Account

The Darwinex Pro account is not a separate account type. It’s designed for experienced traders who qualify as professionals and can apply for Darwinex Pro status. This account offers reduced Darwinex commissions, higher leverage, a dedicated account manager, and monthly volume-based rebates.

Darwinex Demo Account

Again, similar to almost any broker, you can practice your trading on the Darwinex demo account. It’s a simulated trading environment with virtual funds, so no risk. Yet, the market conditions almost perfectly mirror the real conditions. Yet, the demo account is only available on the Darwinex MetaTrader 5 and MetaTrader 4 platforms.

Darwinex Fees Review

Now, here’s the most important section in any Darwinex broker review. Before working with any broker, you should check out their fee structure. Here’s a quick look at the Darwinex spread, commissions, fees, and leverage.

| Asset Class | Darwinex Spread | Darwinex Commission | Darwinex Leverage |

| Forex | From 0.3 pips | 2.5 currency units per contract order | Up to 1:30 |

| Indices | From 0.7 points | 0.275 to 2.75 currency units per contract | Up to 1:20 |

| Commodities | From 0.03 points | 0.0025% order value | Up to 1:10 |

| US Stocks | From 0.00 points | 0.02 USD per contract | Up to 1:5 |

Note that for Darwinex forex pairs, the minimum spread of 0.3 pips is for EUR/USD. Likewise, when trading Darwinex stocks indices, commodities, and US stock, the base spread mentioned above is for the most liquid instrument in the asset class.

There are also Darwinex fees applied to their asset management service, which are as follows:

- Management Fee: 1.2% per annum on invested equity

- Performance Fee: 20% on profits, distributed as 15% to the provider and 5% to Darwinex

For Darwinex futures trading fees, you should check out Interactive Brokers fees, because of the ongoing partnership between these to companies for Futures, ETFs and Stock trading.

Darwinex Withdrawals, Deposits, and Account Currencies

The supported currencies for trading on the Darwinex CFD broker are USD, EUR, and GBP. Moreover, trading on the Darwinex platform requires an initial minimum deposit of 500 EUR, USD, or GBP for individual and joint accounts. Meanwhile, for corporate accounts, the Darwinex minimum deposit is 10,000 EUR, USD, or GBP to begin Darwinex live trading.

Subsequent minimum deposits are 100 EUR, USD, or GBP, except for bank wire transfers, which always require a minimum of 500 EUR, USD, or GBP.

The minimum Darwinex withdrawal amount is also 10 EUR, USD, or GBP. Yet, on the higher end, no Darwinex withdrawal limit is mentioned. Yet, all deposit methods (bank transfers, credit/debit cards, Skrill, etc.) are available for withdrawals as well. Withdrawal fees also depend on the method used, with typical fees being around 2 EUR, USD, or GBP for most methods.

Darwinex Interactive Brokers Partnership

A very positive development for the Darwinex community has been its partnership with Interactive Brokers (IBKR). Therefore, Darwinex traders can have access to a wider range of financial instruments and Darwinex futures trading. The Darwinex Interactive Brokers collaboration allows Darwinex traders to trade stocks, futures, and ETFs directly through the Interactive Brokers’ platform.

What Are Darwinex DARWINs?

DARWINs are a unique financial product offered by the Darwinex CFD broker that combines traders’ strategies with a proprietary risk management algorithm. To break it down further, DARWIN mirrors the trades of a specific trading strategy but with risk management adjustments. It implements the Darwinex copy trading service to achieve this goal.

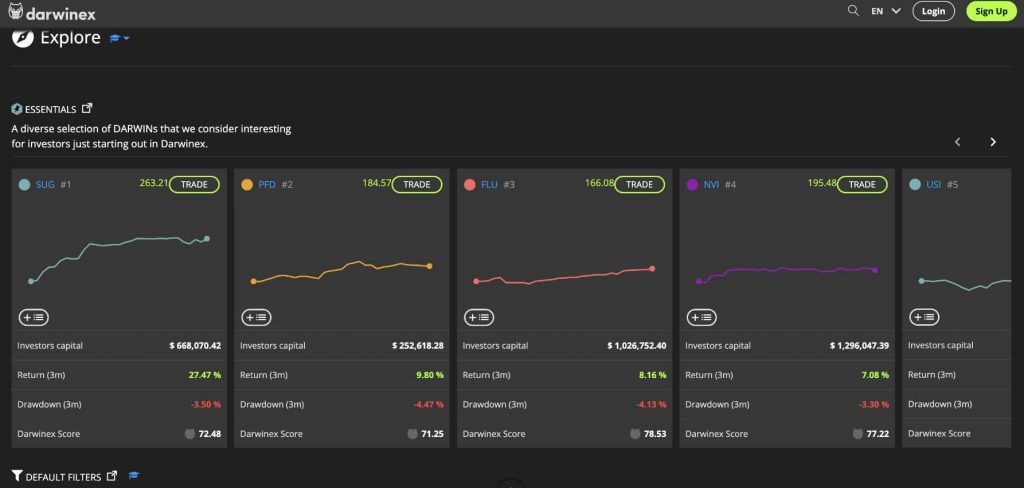

Each Darwinex DARWIN starts with a base quote of 100, which fluctuates based on the performance of the underlying strategy. The DARWIN’s quote shows the return an investor would have achieved if they had invested in the DARWIN from the start.

The Darwinex copy trading system protects the intellectual property of the traders. Yet, it provides enough transparency and real-time performance data to investors. As the team claims, investing in Darwinex DARWINs can diversify your portfolio and minimize risk significantly.

Some top-performing DARWINs include Darwinex Thales, managed by the trader “finbou” and Darwinex JTL, managed by “okcm2019”. Both of these Darwinex traders are very successful and renowned.

The Darwinex Thales strategy has been recognized for its strong performance, including receiving awards from The Hedge Fund Journal. Moreover, the JTL Darwinex strategy has also been able to get an impressive return of more than %130 over five years. You can easily view other top-performing DARWINs via the Darwinex explore page.

What Is Darwinex Zero?

Darwinex Zero, also known as D-Zero, is a subscription service launched by Darwinex in 2023. It is designed to help traders build a legit track records and attract investor capital without any risk. In other words, the Darwinex Zero subscription offers you a demo account with a legit track record.

Darwinex Zero traders start with a demo account to practice and develop their strategies. As they progress, they can participate in Darwinex DarwinIA competitions for seed capital allocations and eventually manage real investor funds. The Darwinez Zero service costs $38 per month after completing the initial training stage.

How To Raise AUM with Darwinex Zero?

Well, almost every profitable trader’s goal is to raise more capital to trade on. With Darwinex Zero, you can definitely do that. However, it takes time. That is because you should pass multiple stages, which we will discuss in this Darwinex Review. Here’s an overview of the Darwinex funding stages with D-Zero:

Stage 1: Training Stage

You will receive a demo account on the Darwinex platform after signing up. The purpose of this stage is for Darwinex traders to practice and build an initial track record. The Trading Stage lasts a minimum of two weeks.

Stage 2: DarwinIA Silver

After the Training stage, you will progress to the Darwinex DarwinIA Silver period. From this moment, you are eligible to participate in monthly seed capital allocation competitions and achieve Darwinex funding. If you are successful, you will receive capital ranging from $30,000 to $375,000 to manage for three months. Your performance fee is 15% at this stage, which means that you will keep 15% of the profits you gain.

Stage 3: DarwinIA Gold

If you are a top performer in the Darwinex DarwinIA Silver stage, you will advance to DarwinIA Gold. Here, you can receive monthly Darwinex funding allocations of up to $500,000 to manage for six months with the same 15% performance fee. Yet, your primary goal will be to attract external investors and build a personal investment brand.

Finestel: A More Comprehensive Darwinex Alternative

While Darwinex Zero offers a very structured roadmap for you to attract investor capital, there are better alternatives. No, I’m not talking about prop firms like FTMO, Fundednext, etc. The most comprehensive solution to raise AUM, especially for crypto traders, is Finestel.

Finestel is a crypto technology provider based in Canada. Our services are primarily based on our outstanding copy trading bot. You can simply connect your exchange account and that of your investors to Finestel via API keys. Therefore, you will be able to run your non-custodial asset management business conveniently.

Yet, not everyone has investors willing to invest in them from the get-go. Using our white label copy trading service, you will also be able to create a branded website and fully personalize it. You can also customize anything, including performance fees and subscriptions you will charge from your investors. Also, with the CRM and marketing tools we offer inside the white-label service, you will be able to reach out to potential customers and grow your brand awareness.

Moreover, with our advanced portfolio tracker and performance reporting feature, you can easily build a verifiable track record. So, you won’t approach potential investors empty-handed.

Finally, on Finestel’s Strategy Marketplace, you can copy strategies by other professional traders or list your strategy for potential investors to invest in. Yet, note that we are not a social copy trading platform, and your trading strategy data will remain private.

Get started today and build your digital crypto hedge fund with Finestel.

Darwinex Zero Review: Pros and Cons

Like every service, Darwinex Zero has its fair share of benefits and drawbacks. Let’s start with the pros:

- Almost Risk-Free for Traders: As a Darwinex trader on D-Zero, your risk is limited to the monthly subscription fee you pay.

- Structured Progression: Darwinex Zero is a very systematic and structured method to acquire investor capital. This is very helpful for beginner traders.

- Performance-Based Rewards: Traders earn a percentage of the profits they gain as performance fees. While these fees are much lower compared to prop firm profit splits, they are a competitive percentage in the real asset management industry.

There are also disadvantages associated with using the Darwinex Zero program. Here are the most prominent cons:

- Very Competitive: There are numerous different types of traders. It would be very hard to put them all in a single competition, and can make things very challenging for some profiles of traders.

- It Takes a While: Getting significant capital that could make you earn a considerable amount of income can take a long time with Darwinex Zero, as you must progress through multiple Darwinex DarwinIA stages.

- Short Asset Management Periods: The three and six month periods in Darwinex DarwinIA Silver and Gold stages are relatively short period, especially for fair performance evaluation.

Darwinex Reviews on Reddit

I will end this Darwinex review article by analyzing what Darwinex Reddit reviews have to say. The Darwinex community on Reddit is generally positive toward the platform. The positive points they mention are the broker’s security and regulated status. Achieving Darwinex funding through Darwin Zero has also been a plus for many ex-prop firm traders.

However, some users of the Darwinex Reddit community express frustration with the performance of certain Darwinex DARWINs. They say that it is difficult to identify consistently profitable strategies. Some minor issues with trade execution, especially during periods of low liquidity or high market volatility, have also been reported. Some Darwinex Reddit users also feel that the management and performance fees can be high, particularly if the DARWINs do not meet performance expectations.

Conclusion

In this article, we talked about Darwinex, a CFD broker located in London and Regulated by the FCA. After providing a detailed Darwinex broker review, we progressed to one of its most popular services, Darwinex Zero. Using this service, traders on the Darwinex platform can attract investor capital and build a legit track record.

While this article was primarily a Darwinex review, we also talked about Finestel and how it can be a more comprehensive solution for crypto traders. Using our services, you can create a hedge fund of your own and begin your asset management career the right way. Click here to find out more about Finestel.

Leave a Reply