Cryptocurrency trading can be intimidating, especially for beginners. Copy trading offers a simple solution – mirror the trades of experienced investors automatically. However, not all social copy trading platforms are created equal. Choosing the right one is crucial.

TraderWagon promises effortless social crypto copy trading. However, multiple red flags around transparency, fees, and regulation raise concerns. Its custodial model also compromises security. Many traders are now looking for better alternatives.

In this TraderWagon Review, you’ll learn about the key features, fee structures, user experiences, and pros and cons of both TraderWagon and Finestel. Discover which platform’s approach to security, transparency, and customization aligns most closely with your trading style and needs. Read on to make an informed decision in selecting the best crypto copy trading solution for your portfolio goals.

TraderWagon Review

TraderWagon is a cryptocurrency social trading platform founded in 2019 and based in the UK. It aims to make crypto trading accessible for beginners by allowing them to copy trades from experienced traders. TraderWagon allows users to discover, follow, and copy trades made by other investors. TraderWagon is partnered with Binance, so all trading is executed on Binance’s Futures platform.

Pros

- Easy to use: TraderWagon makes copy trading simple for beginners. Users can easily browse top traders and copy their trades with just a few clicks. This convenience can benefit new traders.

- Partnership with Binance: Being partnered with Binance allows TraderWagon to leverage Binance’s liquidity and existing security infrastructure. This takes advantage of an established exchange.

- Useful features: TraderWagon provides tools to analyze lead trader performance, manage risk, and optimize your portfolio when copy trading. This helps inform trading decisions.

Cons

- Custodial platform: As a custodial platform, TraderWagon holds user assets on their behalf, creating risks if hacked or mismanaged. Users must trust the platform.

- Limited assets: TraderWagon only supports trading on Binance Futures currently. This restricts opportunities compared to platforms offering multiple exchanges and spot trading.

- Varying trader performance: The traders you can copy will have varying track records and performance. Not all may be profitable to copy long-term. Research is required.

- Single exchange: Being limited to Binance restricts what markets and assets can be traded. Other platforms allow copying trades across various exchanges.

In summary, while convenient for beginners, TraderWagon has some inherent risks and limitations to consider. Traders should weigh the pros and cons before using this platform. Discover more about the best crypto copy trading platfroms.

Trading Features Offered by TraderWagon

TraderWagon focuses primarily on basic social trading tools, though advanced traders may find the features limited.

Social Trading

The main feature of TraderWagon is its social trading system. Users can browse top traders, view their profiles and track records, and copy their trades automatically. This allows beginners to benefit from the experience of seasoned traders potentially.

However, there are risks involved in blindly copying other traders without proper due diligence. Traders should research the background and past performance of traders before copying them.

Cryptocurrency Trading Options

TraderWagon offers trading in major cryptocurrencies like Bitcoin, Ethereum, Litecoin, and Ripple. However, the selection is limited compared to other leading crypto exchanges that may offer hundreds of coin options. There is no margin or derivatives trading available.

The limited cryptocurrency selection makes TraderWagon unsuitable for traders interested in diverse altcoins or using advanced trading strategies.

Traditional Trading Instruments

In addition to crypto, users can trade CFDs on stocks, forex, commodities, and indices. However, traditional trading accounts must be specifically requested and approved. They are not natively integrated like on other platforms.

The CFD offerings are also limited compared to specialized CFD brokers. The included assets seem to be an afterthought rather than a core offering.

Trading Tools and Analysis Features

TraderWagon provides basic trading tools like price charts, technical indicators, and order types. However, advanced features like depth charts, Level 2 data, and analytics are lacking. The analysis tools are rudimentary compared to leading platforms.

The lack of robust tools presents challenges for investors interested in doing thorough technical and fundamental analysis before trading. It is geared more toward casual traders.

How Does TradeWagon Connect to Binance?

TraderWagon does not use API keys to integrate with Binance accounts. Instead, it appears to use a direct login integration that allows users to access their Binance accounts through TraderWagon directly.

Upon further research, this is likely made possible through Binance’s Single Sign-On (SSO) functionality.

- TraderWagon has integrated with Binance using Binance’s SSO functionality. This allows direct account access rather than API keys.

- When a user signs up on TraderWagon, they can choose to “Login with Binance” using their existing Binance credentials.

- TraderWagon then uses encrypted mechanisms behind the scenes to authenticate this login using Binance’s SSO system.

- Upon successful SSO login, the user can access their Binance account directly through the TraderWagon interface without needing to re-enter credentials or generate API keys.

- This SSO integration allows seamless access to Binance while keeping API keys private. The user logs in once with their Binance credentials.

- TraderWagon never receives the user’s Binance password or API keys through this SSO system. It eliminates that attack vector.

Is TraderWagon Custodial?

Yes, based on TraderWagon’s Single Sign-On integration that allows direct access to Binance accounts, it does imply that TraderWagon operates on a custodial basis rather than non-custodial.

Some key implications of TraderWagon’s custodial model:

- TraderWagon likely has access to withdraw, deposit, and trade on behalf of users directly on their Binance accounts based on the SSO integration.

- This means users are essentially giving full control over their Binance account to TraderWagon when they enable the SSO login.

- TraderWagon can withdraw from user accounts without needing their manual approval for each withdrawal.

- User funds would be stored custodially by Binance, but accessible to TraderWagon through the SSO system.

- This custodial access gives TraderWagon control of user funds, unlike non-custodial platforms where users retain sole control.

- There is an inherent security and trust factor associated with giving TraderWagon custodial access in this manner.

So, in summary, yes TraderWagon does appear to operate as a custodial platform that has access to user accounts and funds based on the SSO integration. Users must trust TraderWagon to manage their assets responsibly when enabling the direct Binance login. This type of custodial model contrasts with non-custodial platforms, where users never give up full control of their funds and accounts.

TraderWagon’s Regulatory Standing and Security Review

TraderWagon makes claims about being regulated and securing user funds, but gaps in transparency create doubts.

Regulation Concerns

TraderWagon claims to be regulated by the UK’s Financial Conduct Authority (FCA). However, there are no records of TraderWagon on the FCA register. The company does not appear to be authorized or registered. This raises serious concerns about the platform’s legitimacy and legal standing.

Security of Funds

User funds are held in segregated accounts according to TraderWagon. Other security features like 2FA authentication are supposedly in place. But the lack of transparency around regulation makes it difficult to ascertain the security of user assets on the platform.

Overall Risks

The unclear regulatory status and lack of audits or third-party oversight create doubt about the platform’s security standards. Traders should be very cautious about trusting TraderWagon with large amounts of capital given these uncertainties. Reputable platforms provide legal clarity and transparency.

Fee Structure on TraderWagon

| TraderWagon | Lead Trader | Copy Trader |

| Minimum deposit | 10,000 USD | 500 USD |

| Maximum deposit | 50,000 USD | 50,000 USD |

| Number of active portfolios | 2 | 2 |

| Number of copy traders per portfolio | 50 | 50 |

| Profit-sharing model | Up to 10% of copy trader profits | None |

| Fees | 0.05% copy-trading fee | Standard Binance futures trading fees |

| Trading rules | Minimum investment of 10,000 USD, maximum of 50 copy traders per portfolio | Minimum investment of 500 USD, maximum of 50,000 USD |

| Additional benefits | Can become a crypto trading influencer and earn additional revenue | No prior experience is required |

| Lead Trader 3-Month Trading Fee Rebate Program | Yes | No |

- Lead traders must apply to become lead trader and must deposit 10,000 USD to activate a portfolio.

- Copy traders must apply to become a copy traders and must deposit 500 USD to qualify.

- All user funds are secured on Binance. When a user copies a lead trader’s portfolio, their funds move to the TW wallet.

- Selecting a portfolio to copy from a lead trader can be tricky. It is important to research the lead trader’s performance history, risk management strategies, and trading style before copying any trades.

User Experience Offered by TraderWagon

The platform interface is easy to use but has limited functionality and customer support.

Interface and Ease of Use

The TraderWagon platform interface is simple and easy to use. The design is clean and intuitive for beginner traders. Signing up and starting to trade is straightforward.

However, experienced traders may become quickly frustrated with the lack of information density and powerful tools. The interface is geared purely towards simplicity rather than functionality.

Mobile Trading

Mobile apps are available for iOS and Android. But like the desktop platform, the mobile experience is stripped down and focuses on simplicity. The apps are sufficient for basic order execution on the go but lack advanced features.

Customer Support

Customer support on TraderWagon is limited to email and chat. Support hours are unclear. There is no phone support available, which can be inconvenient for traders needing immediate assistance. Overall, customer service seems mediocre based on user reviews.

TraderWagon Review on TrustPilot

Trustpilot TraderWagon reviews with a total score of 2.8 raise some serious red flags about potential issues with TraderWagon’s copy trading functionality, transparency, fees, security, and customer support. The problems appear widespread based on multiple similar complaints.

- Several reviewers mention that TraderWagon does not copy all of the lead trader’s trades, resulting in copiers losing money even when the lead trader is profitable. There appears to be a disconnect between the lead trader’s performance and the copier’s results.

- A reviewer claimed TraderWagon manipulates lead trader profiles by hiding open positions and changing entry prices to make their track record look better than it is. This raises concerns about transparency.

- The commission structure of charging both the lead trader and copier fees is seen as one-sided by a reviewer. The high fees make it difficult to profit.

- Multiple reviewers mention very poor customer service that is slow to respond or ignores issues. Some felt their concerns were never properly addressed.

- There are complaints about losses incurred where the copier had stop losses in place that did not trigger as expected. The risk management tools seem unreliable.

- A reviewer alleges their Binance spot balance was improperly deducted despite using isolated margin accounts. This raises concerns about the security of funds.

- Overall, many reviewers felt TraderWagon lacks transparency, the copy trading mechanism is flawed, fees are too high, and support is inadequate. Most leave very negative 1-star reviews about their experiences.

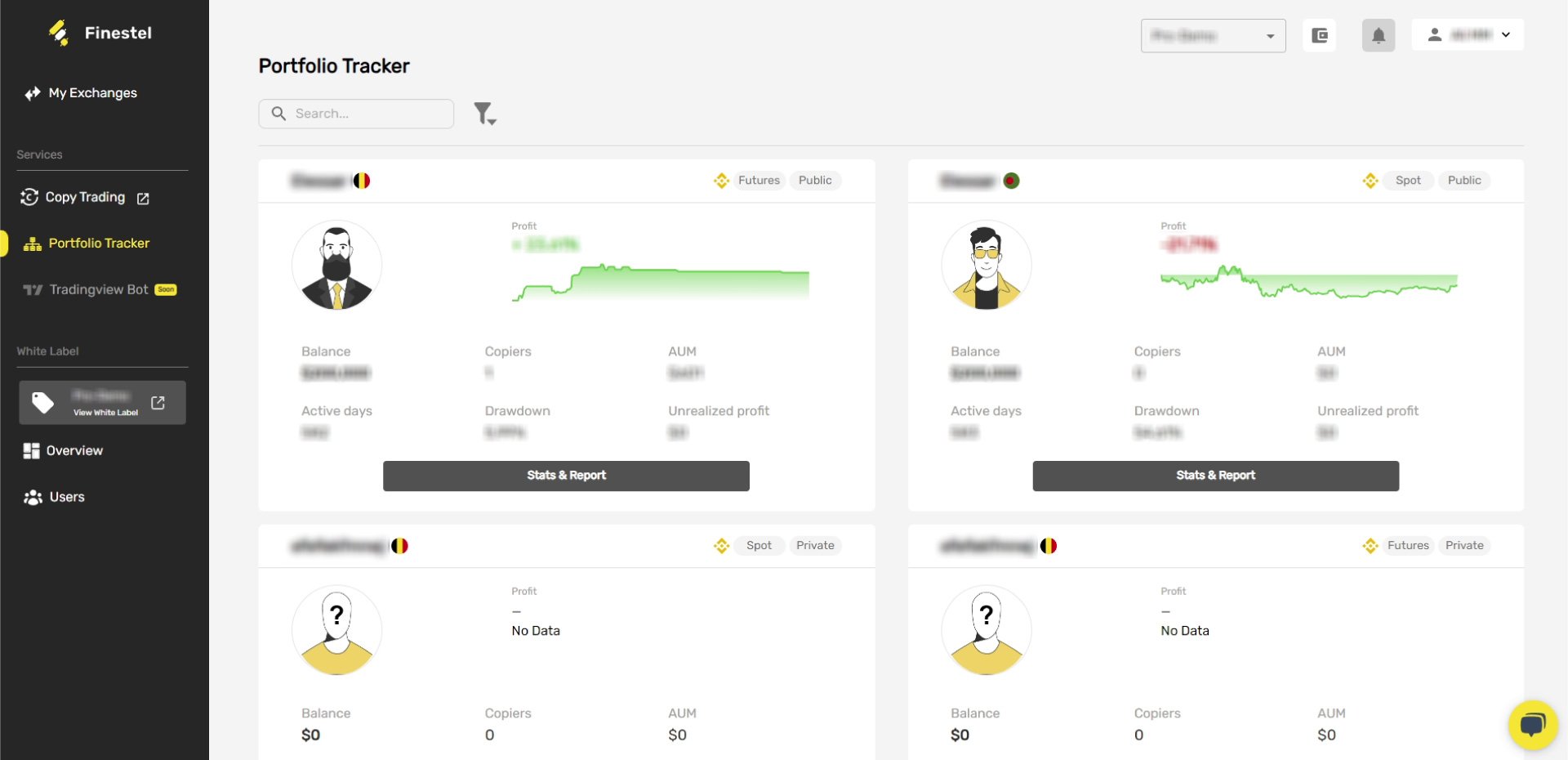

Finestel: A Powerful Crypto Copy Trading Alternative to TraderWagon

Copy trading is taking the crypto world by storm, and for good reason. Unlike social trading, copy trading lets investors automatically duplicate the actual trades of experienced traders. It’s an incredibly powerful tool, but still hard to find a truly great platform.

That’s where Finestel comes in.

Copy Trading Done Right

The team at Finestel set out to create the ultimate crypto copy trading experience. Their platform lets traders seamlessly connect exchange accounts to start managing investor capital. No custody risks – your funds stay secure.

This isn’t your typical “copy trading” with delays and errors. Finestel’s bots deliver lightning fast execution with laser accuracy. We’re talking identical entries, exits, and sizing on every trade, both spot and futures, on the most popular exchanges, including Binance copy trading, OKX copy trading, Bybit copy trading, Kucoin copy trading, etc.

Build Your Own Branded Trading Business

The white label product from Finestel is a game-changer for experienced traders who want to launch their copy trading services under their brand.

Rather than building a platform from scratch, Finestel provides the infrastructure to hit the ground running. Access their technology and user base while keeping your look and feel.

Design your personalized interface with custom colors, logos, and styles. Integrate your domain or use a Finestel subdomain. You choose.

With your branded platform, you have complete control over managing your users and community. The back-end admin panel provides powerful tools to track client performance, communicate with users, send updates and gifts, and optimize your trading strategies.

You also get access to Finestel’s elite customer support via a private Telegram group for any platform questions or requests.

Next-Level Money Management

Finestel’s white label product goes far beyond copy trading capabilities. Finestel equips you with everything needed to run a prosperous asset management business.

Flexible billing options allow you to set customized subscription fees, performance fees, minimum investments, and more. Automated accounting and invoicing saves you time on back-end paperwork.

Robust analytics provide insights into your trading performance. View risk metrics, returns, and drawdowns across user portfolios to identify areas for improvement.

Marketing and sales tools help attract new users through promotions, affiliate programs, and email newsletters. And integrated support options keep users satisfied and engaged.

Let Your Trading Do the Talking

Finestel handles the platform so you can focus on trading. For experienced managers looking to start their fund or grow an existing business, the white label copy trading platform is a game-changer.

Stop wasting time on operations and software issues. With Finestel, your trading expertise is the core product. So let the platform do the heavy lifting while you concentrate on making profitable moves.

This is a fintech innovation built for traders by traders. Check out Finestel’s white label solution if you’re ready to launch the next big thing in crypto money management. The possibilities are endless.

Conclusion

In closing, this comprehensive TraderWagon review aimed to provide an in-depth assessment of the platform’s offerings, capabilities, and user experiences based on currently available information. As outlined throughout the TraderWagon review, while the platform has some benefits, particularly for beginners, legitimate concerns exist around transparency, security standards, and overall service quality.

Traders are encouraged to carefully weigh all the pros and cons before deciding if TraderWagon is optimal for their needs compared to alternative copy trading solutions. Ultimately, performing due diligence reading objective TraderWagon reviews can help determine if the platform truly aligns with your trading style and goals.

Leave a Reply