3Commas Review; What is 3Commas?

In a nutshell, 3Commas is a trading terminal and crypto bot platform that lets you automate your crypto trading. It works with over 23 major crypto exchanges, including Binance, Coinbase, and KuCoin.

3Commas stands out as one of the most popular trading bot platforms. The platform offers an impressive suite of automated trading bots, advanced order types, portfolio trackers, and other tools to streamline trade execution across more than 20 top crypto exchanges.

From dollar cost averaging bots to automatically capitalize on dips to grid bots that profit from volatility, 3Commas aims to have a trading bot suited for any market condition or crypto trading strategy. Let’s discover the best crypto trading bots.

Founding and Growth

3Commas was founded in 2017 by developers Yuriy Sorokin, Mikhail Goryunov, and Egor Razumovskii. The founders aimed to create an intuitive platform that made sophisticated trading automation accessible to all crypto traders.

The company has seen rapid growth, attracting over 220,000 users as of 2022. It raised $37 million in funding from Alameda Research in 2022. This has enabled the expansion of platform capabilities and supported global user growth. 3Commas is headquartered in Tallinn, Estonia.

3Commas Key Features and Tools for Automated Trading

In the following sections, we will take a closer look at some of 3Commas’ key automated trading bots and how they work.

- DCA Bots: Dollar-cost averaging (DCA) bots allow you to automate buying at regular set intervals into selected cryptocurrencies. You can choose to DCA daily, weekly, or monthly and set your purchase amount. DCA aims to reduce the impact of volatility on your buys.

- Grid Bots: It automates grid trading strategies by placing buy and sell orders at pre-defined price intervals around a price range. This allows you to benefit from volatility and market swings within that range through buying low and selling higher.

- Smart Trading Terminal: The Smart Trading terminal provides a full-featured trading dashboard that lets you execute advanced trades like trailing stops, take profits, and bracket orders across your connected exchanges through one window.

- Paper Trading: Practice trading risk-free by backtesting strategies or running bots using virtual funds. This allows you to evaluate performance before committing to real capital.

- Portfolio Tracker: View a consolidated dashboard of all your crypto holdings across exchanges and wallets in one place. This saves you from having to track holdings and performance manually.

- Mobile Apps: 3Commas mobile apps for iOS and Android give you the ability to access and manage your trading from anywhere. Bots and orders can be tweaked on the go.

- Crypto Base Scanner: Find potential trading opportunities by screening for cryptos based on technical analysis factors and events like upcoming launches.

- Marketplace: Access a marketplace of pre-made profitable trading bots and signals created by experienced traders that you can purchase and integrate with your account.

Discover the best crypto Telegram bots in 2025.

3Commas User Reviews: Reddit, YouTube & Trustpilot (2025 Update)

3Commas holds a solid 4.4/5 on Trustpilot (1,756+ reviews as of Oct 2025). Users love the automation for reducing stress and enabling beginners to copy proven strategies, but some report bugs during high volatility.

Positives

- Bots & Ease of Use: “4+ years in—features are mature, new ones polished. Trading without staring at charts.” (Trustpilot, Jul 2025) Reddit: Week 1 2025 bot profit of $20.59 on small capital.

- Support: Fast fixes via 24/7 chat/Telegram. “API issue resolved in hours.”

- YouTube: “Best crypto bot in 2025? AI signals and backtesting work for pros and beginners alike.” (50k+ view review, Jul 2025)

Negatives

- Bugs/Outages: Crashes during market corrections. “No alerts when service drops.”

- Pricing vs. Reliability: “Bots are powerful, but stability needs improvement before Pro fees feel justified.”

3Commas Pros & Cons; User Perspectives (2025)

Pros (Most-Cited by Users)

- Time-saving automation: DCA and Grid bots run 24/7, eliminating manual monitoring.

- Beginner-friendly setup: Intuitive interface and pre-built bots allow novices to start in minutes.

- Strategy copying: Marketplace lets users replicate top-performing bots with verified P&L.

- Strong backtesting: Free paper trading with real slippage and 3-year historical data.

- Fast support: 24/7 live chat and Telegram resolve issues quickly (average <2h response).

- Multi-exchange control: Unified dashboard for 23+ exchanges (Binance, Bybit, Coinbase, etc.).

Cons (Common User Complaints)

- Occasional outages: Platform glitches during extreme volatility; missed fills reported.

- Steep learning curve for advanced bots: Grid and AI settings require tuning to avoid losses.

- Subscription cost: Pro plan feels high if bots underperform due to bugs.

- Limited free tier: Only 1 bot active; full features locked behind paid plans.

- Security concerns (historical): Past API leaks (pre-2025) still raise caution despite IP whitelisting.

3Commas Pricing and Fees Review

3Commas offers flexible plans starting free, with paid tiers unlocking unlimited bots, backtesting, and multi-exchange support. All paid plans include TradingView integration, iOS/Android apps, demo accounts, signals/strategies, webhook execution, and 15+ exchanges (e.g., Binance, Bybit). Note: Plans may vary during testing phases.

|

Plan |

Monthly Price |

Annual Savings (25% off) |

Key Limits & Features |

|

Free |

$0 |

N/A |

– Paper trading – 3 Active SmartTrades – 10 Running Grid Bots – 10 Running DCA Bots – 2 Linked Accounts (View Only) – No Futures Trading |

|

Pro |

$37 |

Save $144 ($333/year) |

– 50 Active SmartTrades – 50 Running Signal Bots – 10 Running Grid Bots – 50 Running DCA Bots (Multi-pair) – 500 Active DCA Trades – 10 DCA Backtests/mo |

|

Expert |

$59 |

Save $240 ($531/year) |

– Unlimited Active SmartTrades – 250 Running Signal Bots – 50 Running Grid Bots – 250 Running DCA Bots (Multi-pair) – 2,500 Active DCA Trades – 500 DCA Backtests/mo |

|

Asset Manager |

$374 |

Save $1,500 ($3,366/year) |

– Multi-client management – Advanced portfolio tools for pros – Unlimited bots & custom scaling |

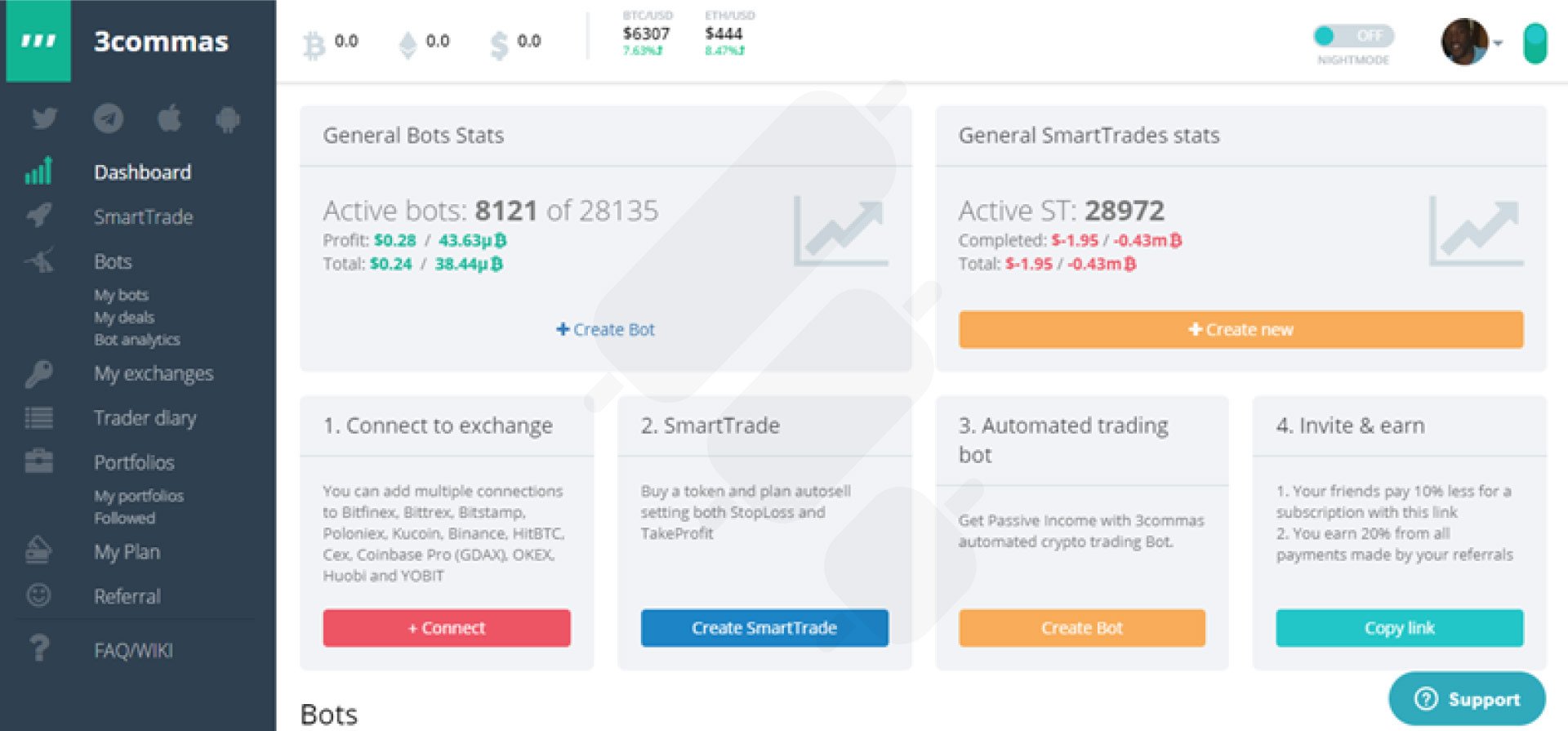

3Commas Dashboard Review

The 3Commas dashboard provides a central interface to manage your trading bots, analyze performance, and execute trades. Here’s a quick tour:

Upon logging in, you land on the main Portfolio page. This overview shows your account balance, 24h change, and asset allocation across the exchanges you have connected. The Deals tab logs all your bot and manual trades with sortable columns showing extensive stats like profit, duration, and more. Analytics provides visual charts tracking your portfolio balance, asset dominance, and bot performance over custom periods.

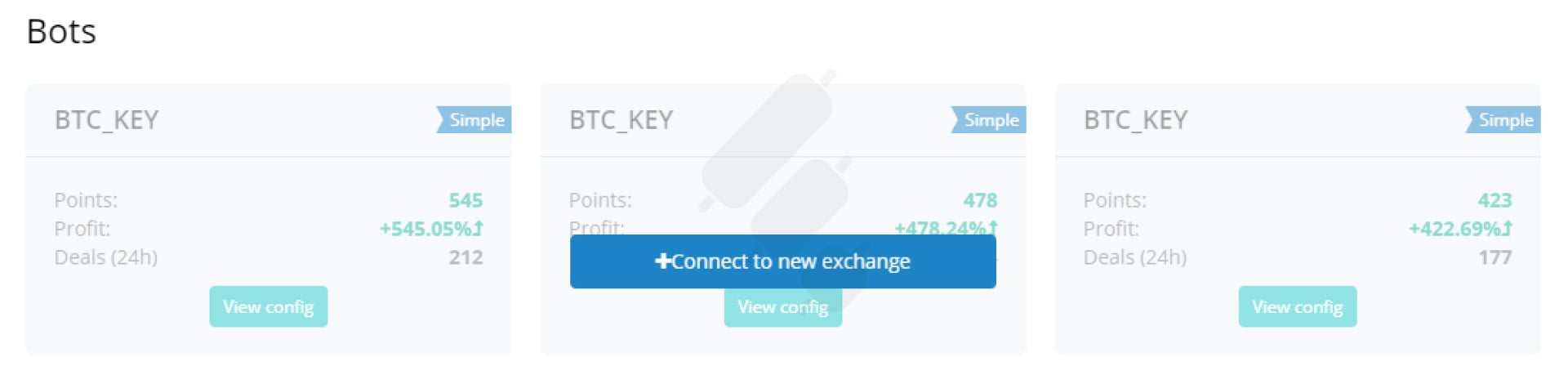

On the left sidebar, you can quickly access the Bots menu.

This is where you can activate pre-made bots or create new ones. Configure settings like an exchange, pair, order amounts, and schedule.

The Smart Trades menu allows you to manually set up advanced order types like trailing stops and take profits across your connected accounts. Under Accounts, you can connect new exchanges via API keys. You’ll also see a consolidated view of all your exchange accounts in one window. Finally, Settings allows you to configure account security, alerts, linked apps, billing details, and more.

Read more in 3commas copy trading tutorial and review.

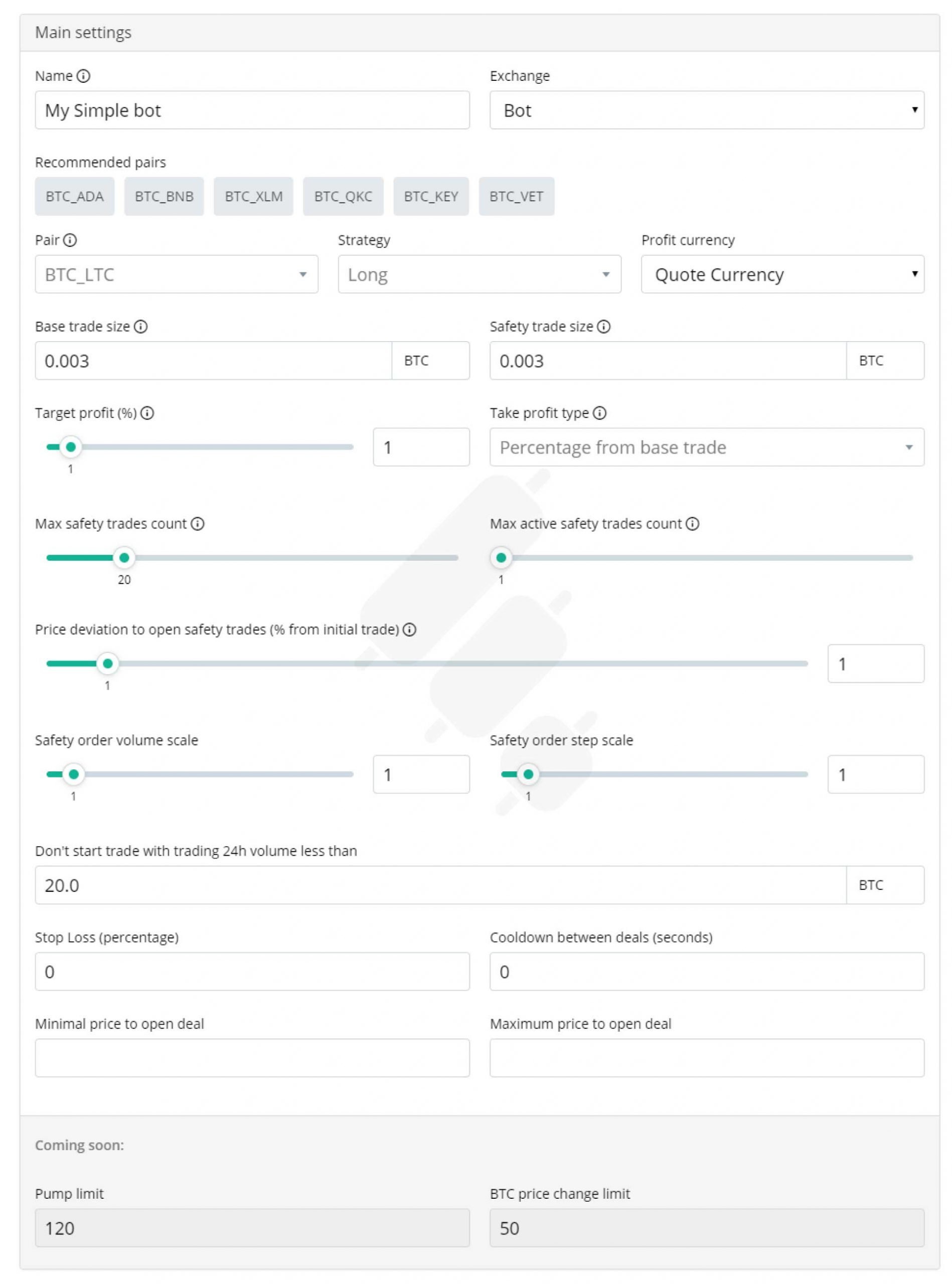

Guide to Setting Up 3Commas Bots

Configuring DCA Bots:

To set up a DCA bot, first, choose the cryptocurrency pair you want to trade from the list of available options on 3Commas. This could be BTC/USDT, ETH/USD, etc. Next, determine the purchase interval – whether you want the bot to buy daily, weekly, or monthly. Then input the fixed dollar amount you want the bot to invest during each period.

You’ll also need to select which crypto exchanges to trade on by connecting your API keys. Common choices are Binance, FTX, KuCoin, and Coinbase Pro. Once the pair, interval, amount, and exchanges are configured, you can optionally set a start and end date for the bot. Finally, review all the settings and activate the bot to begin automated DCA purchases.

Configuring Grid Bots:

Grid bots require a bit more customization. First, pick the trading pair and timeframe you want to base the strategy on, such as BTC/USDT on the 1-hour chart. Then, input the specific price intervals to place your buy and sell limit orders, such as $1 apart. You’ll also need to choose the order types, whether market, limit, or stop orders.

It’s highly recommended to backtest the strategy first using the paper trading feature before risking real funds. Backtesting allows you to see how the strategy would have performed historically. Make any necessary adjustments to the intervals or order types based on backtest results.

Once optimized, set take profit and stop loss percentages to lock in gains and cut losses on open positions. Finally, connect the API keys for your chosen exchange. Then, activate the grid bot and let it automatically place orders as the market moves up and down within the configured price range.

3Commas vs. Finestel: When to Switch (And When to Use Both)

Let’s cut to the chase: 3Commas dominates the retail bot market for good reason. But if you’re managing client money, running a prop desk, or building a trading business, it’s missing critical infrastructure. That’s where Finestel comes in as a purpose-built alternative for professional asset managers.

This isn’t about which one’s “better”, it’s about recognizing when you’ve outgrown retail tools and need professional infrastructure. Here’s how they compare and when Finestel becomes the smarter choice.

What Each Platform Does

3Commas: The Retail Bot Champion

Operating since 2017, 3Commas gives individual traders sophisticated automation without coding. DCA bots, Grid bots, Options bots, all with deep customization, backtesting, and connections to 20+ exchanges. Perfect for optimizing your personal trading strategies.

Best for: Traders managing $1k to $1M+ of their own capital who want hands-on bot control.

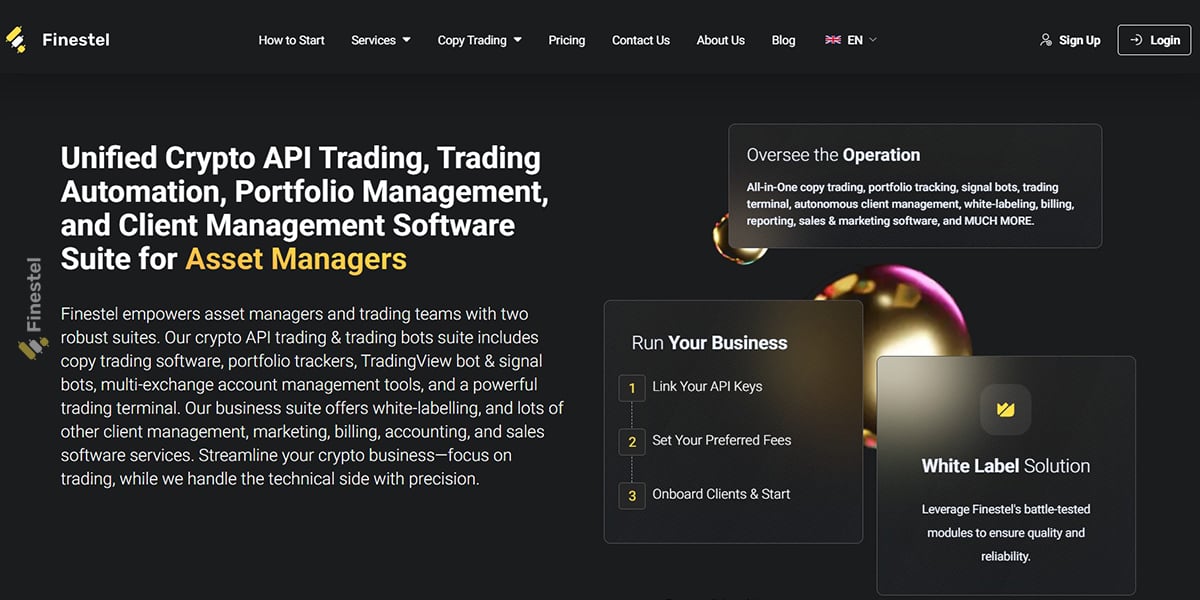

Finestel: Infrastructure for Asset Managers

Launched in 2021 specifically for professionals managing capital. Copy trading with proportional sizing, white-label solutions, automated billing, and compliance reporting. Over $50 billion in replicated volume proves the infrastructure works at scale.

Best for: Anyone managing client funds, running trading firms, or building branded autotrading services.

Feature Comparison: Where They Overlap and Diverge

|

Feature |

3Commas |

Finestel |

|

Primary audience |

Solo traders, bot enthusiasts |

Fund managers, prop firms, asset managers |

|

Bot variety |

Extensive (DCA, Grid, Signal, Options, AI) |

Focused (Signal bot, TradingView bot, Trade Copier) |

|

Exchange coverage |

20+ exchanges |

10+ major exchanges (expanding) |

|

Execution speed |

Standard API latency (1-3 sec) |

<0.5 sec for 1,000+ orders |

|

Client management tools |

None |

Full CRM, onboarding, AUM limits |

|

Billing automation |

None |

Performance fees, management fees, subscriptions |

|

White-label branding |

Not available |

Custom domain, logo, client portals, Mobile Apps |

|

Strategy privacy |

Public marketplace (strategies visible) |

Private by default (no marketplace) |

|

Mobile access |

Yes |

Yes |

|

Support |

24/7 chat/email |

24/7 VIP Telegram + dedicated manager |

|

Track record |

Years of retail stability, 3.8-4.0/5 ratings |

$50B+ volume, 100M+ orders, 4.7/5 rating |

Where Each Platform Shines (Based on Your Situation)

Understanding which platform fits your needs depends on what you’re actually trying to accomplish:

Managing Client Capital

3Commas is designed around individual trading accounts. You can create signal groups for friends or small communities to follow your trades, but there’s no infrastructure for proper client management, individual performance tracking, or investor documentation.

Finestel’s architecture centers on multi-account management. Built-in client management services handles all under your own name and brand. Proportional copy trading automatically sizes positions correctly across accounts based on individual capital allocations. Each client gets separate performance tracking and reporting. If you’re managing external funds, this infrastructure is either essential or completely unnecessary depending on whether that’s what you’re doing.

Branding and Client Perception

3Commas operates under its own brand. When you work with clients, they’ll see they’re using a third-party platform. For many traders, this doesn’t matter. For others building a professional firm, it affects positioning.

Finestel offers complete white-label customization; your domain, logo, and branding throughout client portals. Clients log into what looks like your platform, not a resold service. Whether this matters depends entirely on how you’re positioning your trading operation.

Fee Collection and Billing

3Commas doesn’t handle billing since it’s not designed for client fund management. If you’re charging fees, you’ll handle invoicing, performance fee calculations, and payment collection separately through your own systems.

Finestel automates billing for any fee structure; performance fees (with high-water mark tracking), management fees, or subscription models. Calculation and collection happen automatically based on actual trading performance. This either saves significant administrative work or is completely irrelevant depending on your business model.

When to Choose What

Stick with 3Commas alone if:

- Trading personal capital only (no clients)

- Want maximum bot variety and customization

- Don’t need business infrastructure

- Happy with public marketplace dynamics

Switch to Finestel if:

- Managing client funds or investor capital

- Need white-label branding and privacy

- Require automated billing and compliance reporting

- Building a scalable trading business

- Client management is essential

Use both if:

- Want 3Commas’ advanced bots + Finestel’s asset management software

- Serious about fund management or prop trading

- Want best-in-class tools for execution AND operations

Conclusion

In summary of the 3Commas review, it provides crypto traders with an extensive suite of trading automation capabilities through bots and advanced order types. The platform aims to make sophisticated trading strategies accessible to all skill levels.

The range of bots from DCA to grid and paper trading features allow you to automate everything from simple dollar cost averaging to complex volatility harvesting. Portfolio analytics and tracking provide insights into asset correlations and performance.

However, effective utilization still requires understanding how to configure and backtest bots properly. The subscription plans also add to overall trading costs. But the discount offers and free trials help alleviate this.

Yes thats right! 3Commas doesn’t have any real copy trading service