I’ve been following CoinRoutes since they started making noise in the institutional crypto space. This isn’t your retail trading platform, not even close. It’s algorithmic execution infrastructure built for firms moving serious size across fragmented crypto markets. The kind of thing hedge funds and asset managers use when a single large order could move the market if executed poorly.

Before diving into the Coinroutes features review, understand what problem this solves. Crypto markets are a mess from an institutional perspective. You’ve got 50+ exchanges, each with different liquidity, pricing, and fee structures. A coin might trade at $100 on Binance, $100.50 on Coinbase, $99.80 on Kraken. If you’re trying to buy $10 million worth, you can’t just market buy on one exchange without getting terrible slippage. CoinRoutes addresses that fragmentation through smart order routing and algorithmic execution.

What CoinRoutes Actually Does

Think of it as an order execution management system (EMS/OEMS). You connect through their API, specify what you want to trade, and their algorithms figure out how to execute across multiple exchanges simultaneously to get you the best effective price.

The workflow breaks down like this: Their system aggregates real-time order book data from dozens of exchanges. When you submit an order, algorithms analyze where liquidity exists, what execution methods minimize slippage, and how to split the order across venues. Orders get routed to multiple exchanges simultaneously. You get consolidated reporting showing actual execution versus benchmarks.

The system’s built for volume. We’re talking institutional traders moving millions per order, not retail accounts trading a few thousand. The entire architecture assumes you need sophisticated execution because your order size matters to market impact.

CoinRoutes Review: Core Features That Actually Matter

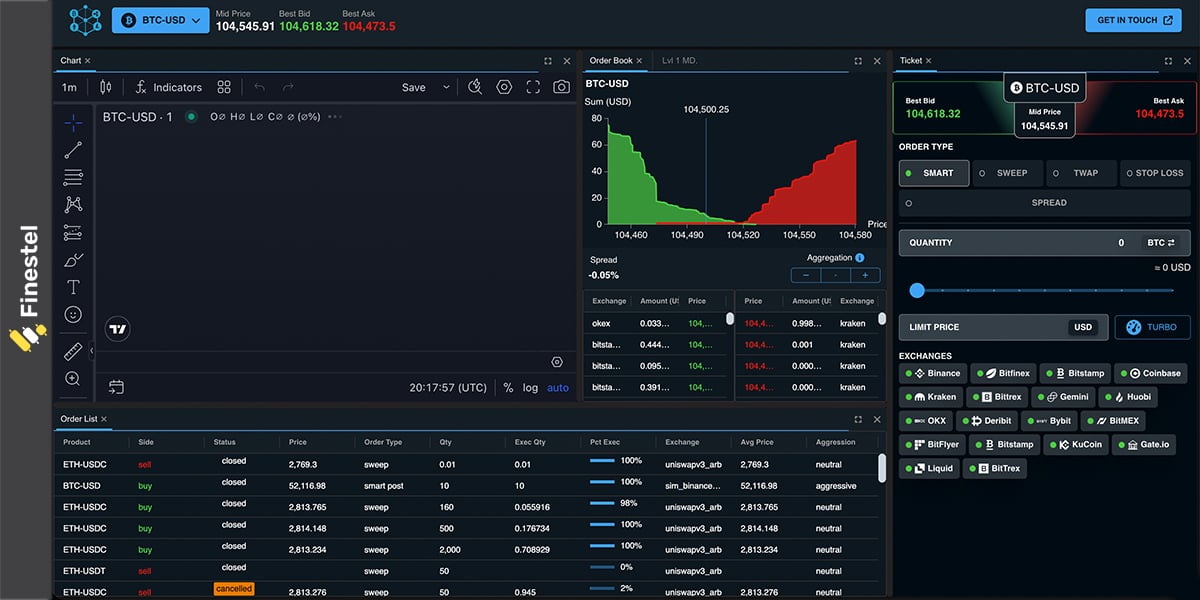

Smart Order Routing Across 50+ Venues

According to their patent filing and recent announcements, CoinRoutes connects to over 50 centralized exchanges, decentralized protocols, and liquidity providers. That covers more than 3,000 digital assets. The routing algorithm decides in real-time how to split orders across venues based on liquidity, fees, and expected slippage.

The system makes sub-second decisions about order placement across venues simultaneously. It’s processing what they claim is terabytes of market data daily to identify where liquidity actually exists versus where it appears to exist.

Algorithm Suite for Different Execution Needs

They offer various execution algorithms depending on what you’re trying to accomplish:

- Smart: Intelligently routes orders across venues to minimize slippage by analyzing real-time liquidity and executing where conditions are most favorable

- Sweep: Aggressively executes across multiple venues simultaneously when you need immediate fills and speed matters more than incremental price improvement

- TWAP (Time-Weighted Average Price): Spreads orders evenly over a specified time period to reduce market impact and avoid signaling large position builds

- Stop Loss: Automated exit orders that trigger at predetermined price levels across connected venues for risk management

- Spread: Executes multi-leg strategies simultaneously, useful for arbitrage or pairs trading where timing between related orders matters

Their 1H 2025 performance report claimed the Smart algorithm achieved substantially lower slippage than comparable equity market orders. That’s their internal data, so take it with appropriate skepticism until you test with your own orders, but it’s at least a measurable claim.

The algorithm choice matters based on what you’re trading. High-liquidity pairs like BTC/USDT might work fine with Sweep for immediate execution. Lower-liquidity alts require Smart or TWAP to avoid moving the market. Spread becomes critical when you’re running arbitrage strategies where execution timing between legs determines profitability.

Risk Management Integration

October 2025 brought a significant development; CoinRoutes acquired QIS Risk, a portfolio and risk monitoring platform. This combines execution infrastructure with risk analytics in one system.

For asset managers, that integration is valuable. You’re executing trades and monitoring portfolio risk through the same platform rather than stitching together separate tools. Real-time risk monitoring can catch position limit breaches or concentration issues before they become problems.

RealPrice Reference Pricing

CoinRoutes developed something they call RealPrice; a fee-adjusted, multi-venue aggregated benchmark for crypto asset valuation. Instead of using a single exchange’s last trade price as your benchmark, RealPrice looks at consolidated order books across venues and adjusts for trading fees.

Why this matters: If you’re evaluating execution quality, you need an accurate benchmark. Saying you “beat the market price” is meaningless if your benchmark was from a low-liquidity exchange with stale pricing. RealPrice attempts to provide a more realistic reference point for post-trade analysis.

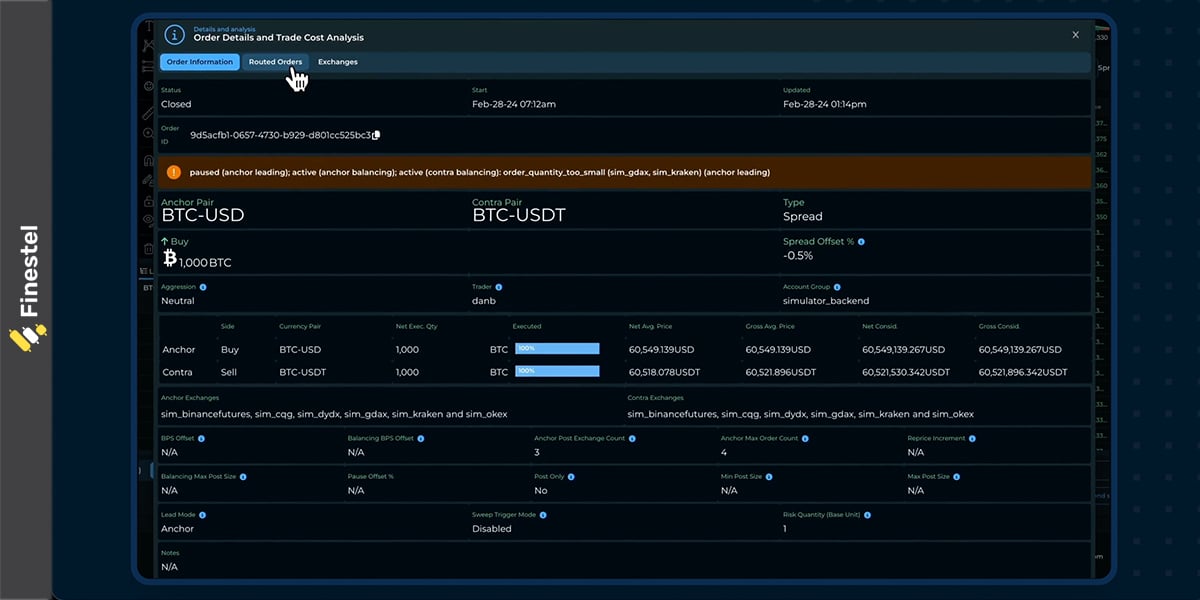

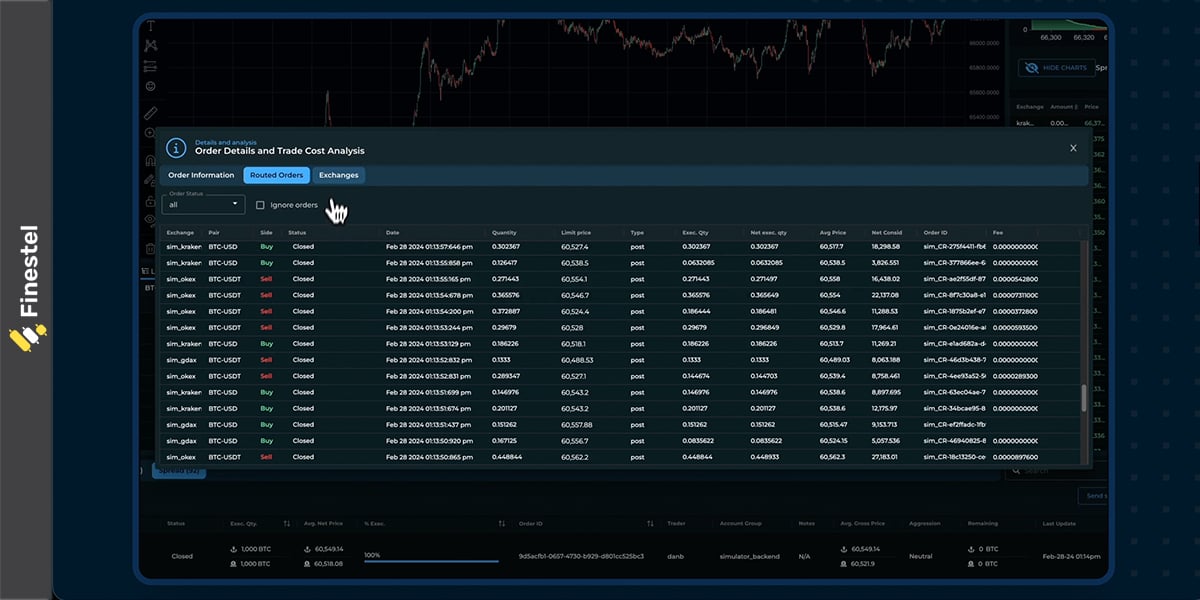

Transaction Cost Analysis and Reporting

Post-trade analytics show you actual execution performance versus benchmarks. You can see where slippage occurred, how fees impacted total cost, and which algorithms performed best for specific instruments.

For institutional traders, this reporting is essential. You’re accountable for execution quality when managing client funds. Detailed TCA lets you demonstrate you achieved best execution and helps refine strategies over time.

Where It Falls Short

Zero pricing transparency: No published pricing means you’re negotiating blind. Likely not cost-effective unless trading substantial volumes where execution quality savings matter.

Performance variability: As with any execution infrastructure, real-world results depend on actual routing, liquidity conditions at time of trade, venue connectivity, and market conditions. Claims are claims until proven with your own order flow.

Limited public validation: Case studies and client testimonials are sparse, which is common in enterprise software but makes independent verification difficult. You’re relying on direct engagement and potentially references from existing clients.

Moderate trust rating: Scamadviser rates and reviews Coinroutes domain at 61 (medium-to-low risk). That’s not a red flag, but it’s not a perfect endorsement either. Enterprises should conduct thorough due diligence on security, regulatory jurisdiction, operational resilience, and vendor risk.

Finestel: A Powerful Alternative for Asset Managers

While CoinRoutes focuses on execution infrastructure, there’s another angle to institutional crypto trading that matters just as much: managing client capital and distributing strategies across multiple accounts. That’s where Finestel comes in as a different kind of institutional solution.

Who Finestel Actually Serves

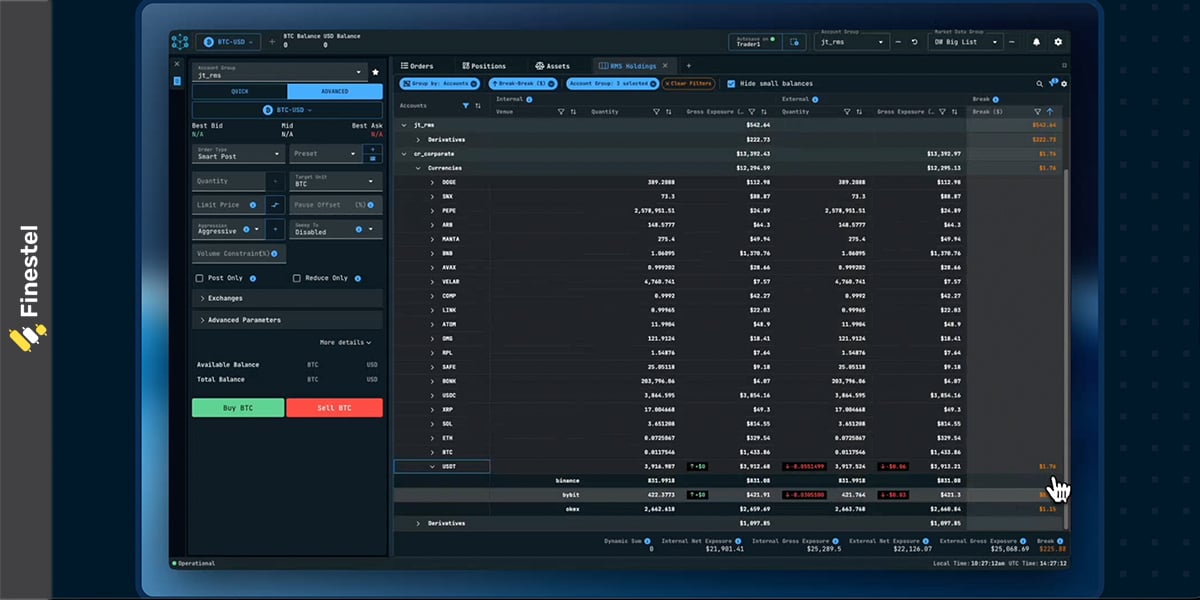

Finestel’s built for asset managers, prop trading firms, and traders running client money or building trading businesses. If you’re managing external capital rather than just executing your own institutional trades, the problems you’re solving are different from what CoinRoutes addresses.

Think fund managers distributing a single strategy across dozens or hundreds of client accounts. Prop desks managing multiple trader portfolios. Signal providers monetizing strategies through copy trading services. These operations need infrastructure beyond just execution quality; they need client management, proportional trade replication, billing automation, and compliance reporting.

Where Finestel Differs Fundamentally

Copy trading at institutional scale: Finestel replicates your master account trades proportionally across unlimited client accounts. When you take a position, it automatically sizes correctly for each client based on their capital allocation. Client with $50k gets 1/10th the position of a client with $500k. The math happens in real-time with individual risk controls per client.

Auto trading Bots: Finestel’s Signal Bot converts trading alerts from various sources into real-time orders on exchanges. The TradingView Bot integrates with the TradingView platform to turn strategy alerts into automated trades executed in milliseconds, supporting scaling without manual input.

Business operations infrastructure: CoinRoutes provides execution tools. Finestel includes everything needed to run an automated trading business:

- White-label branding: Custom domain, your logo throughout, branded client portals. Clients log into yourfirm.com, not a third-party platform

- Automated billing: Performance fees (with high-water mark), management fees, subscription models, all calculated and collected automatically

- Compliance reporting: Real-time P&L per client, drawdown monitoring, export capabilities for accounting

Trading Terminal for manual intervention: Finestel includes a full Trading Terminal alongside automation. When algorithmic execution isn’t appropriate or you need hands-on control, the terminal provides:

- Ladder orders for scaling into positions

- OCO (one-cancels-other) orders for complex risk management

- Trailing stops with custom offsets

- Bulk order execution across multiple exchanges

- Unified multi-exchange view

This matters because not everything should be automated. Sometimes market conditions require manual adjustment or intervention that algorithms can’t handle optimally.

Execution speed designed for replication: CoinRoutes optimizes single large orders across venues. Finestel executes sub-0.5 seconds for 1,000+ simultaneous orders when replicating across client accounts. Different infrastructure solving different bottlenecks.

Large Order Smart Execution: For enterprise users, institutional traders, asset managers, and large portfolio handlers, executing high-volume trades without market impact is crucial. Our dynamic algorithm adapts execution to real-time market volume, filling orders at a pace aligned with available liquidity. By intelligently spreading trades over time, it minimizes disruption, prevents unfavorable price shifts, and ensures efficient completion.

Final Thoughts

Institutional crypto trading has matured beyond just finding an exchange with decent liquidity. CoinRoutes delivers on its core promise: sophisticated execution across fragmented crypto markets with measurable improvements in slippage and cost for large orders. The patent-protected routing, extensive venue connectivity, and integration with risk management tools (via QIS Risk) create a legitimate institutional platform. But it’s expensive, complex, and only justifies itself at serious volume.

Finestel addresses more institutional needs equally critical: turning trading strategies into scalable businesses. If you’re managing external capital, the client infrastructure, proportional replication, automated billing, white-label branding, compliance reporting; becomes just as important as execution quality.

Neither platform suits retail traders or small funds. Both require institutional scale to justify costs and complexity. The real insight? These aren’t either/or decisions for many institutional operations. Execution infrastructure and client management infrastructure solve different problems in the same business. Understanding which you need; or recognizing you need both, is the first step toward building proper institutional crypto operations.

Leave a Reply