You’re an asset manager, and the market’s on fire; Ethereum’s crashing 15%, and clients are watching. One wrong move, and millions vanish. With elite crypto asset management tools, you’re the maestro of this chaos: portfolios rebalance in real time, stop-losses fire with surgical precision, and master strategies cascade across client accounts. In this market, where volatility reigns, the right tools let you act with agility, ensuring your clients’ portfolios thrive amidst the chaos.

As the cryptocurrency market matures, so do the tools required to manage diversified portfolios. Professional traders and asset managers now rely on sophisticated software platforms that offer automated trading, real-time performance tracking, advanced risk management, and compliance reporting. Whether you’re managing millions or billions, the software you choose will play a pivotal role in maximizing returns and minimizing risks in this high-stakes market.

In this article, we’ll explore the best crypto asset management tools, with a focus on their unique features for multi-client asset management, multi-portfolio management, API trading, risk management, and professional-grade management.

What Are Crypto Asset Management Tools or Software?

Asset management software helps asset managers track, manage, and optimize their or their clients’ portfolios. These tools aggregate data from multiple sources; whether from centralized exchanges, wallets, or traditional asset managers, into a single, real-time view. This allows asset managers to make informed, data-driven decisions and optimize performance.

The software also allows them to implement automated strategies, handle risk management, and generate detailed compliance and tax reports for their clients. In essence, these platforms not only help professionals manage their clients’ assets efficiently but also ensure transparency, minimize risks, and streamline complex processes.

Key Types of Asset Management Tools

Crypto asset management tools cater to various needs in the market, whether you’re managing portfolios across multiple exchanges, automating strategies, or ensuring security and compliance. Here’s a breakdown of the most relevant tools in the crypto asset management space:

1. Crypto Portfolio Management Systems (PMS)

Purpose: Track diversification, rebalancing, and performance metrics of crypto portfolios.

Key Features:

- Diversification Tracking: Assess asset distribution across different cryptocurrencies.

- Performance Metrics: Evaluate returns, risks, and exposure.

- Rebalancing Tools: Adjust portfolio allocations to maintain target distributions.

2. Asset Management Software as a Service (SaaS)

Purpose: These platforms offer crypto asset management tools delivered as a service, with subscription-based access. SaaS-based solutions are hosted and maintained by the provider, making them scalable and easy to access without the need for infrastructure management.

Key Features:

- Real-Time Dashboards: View portfolio performance, manage assets, and monitor client accounts across exchanges.

- Scalability: SaaS platforms are designed to scale seamlessly with the growth of portfolios, ideal for asset managers handling multiple clients or large volumes.

- Multi-Exchange Integration: Easily manage assets across several exchanges (e.g., Binance, Coinbase, Bitget) in a single interface.

- Accessibility: Access the platform from anywhere, making it convenient for asset managers to manage portfolios on the go.

3. White-Label Solutions

Purpose: White-label solutions allow businesses, including institutional investors or firms, to brand and offer services under their own name. These solutions are crucial for firms looking to provide tailored services to clients without having to develop software from scratch.

Key Features:

- Custom Branding: Provides businesses the ability to rebrand the platform with their own logo, color scheme, and personalized features.

- Scalability: Suited for firms managing multiple client accounts, as these platforms support large-scale operations.

- Comprehensive Reporting & Compliance: Built-in tools for automated tax reporting, audit trails, and regulatory compliance.

- Client Onboarding & Management: These solutions come with client management tools, enabling asset managers to handle client accounts, track investments, and provide personalized services.

4. Multi-Exchange Multi Account Management Tools

Purpose: These tools integrate multiple exchanges into a single platform, allowing asset managers to track and manage assets across different platforms without having to switch between them.

Key Features:

- Unified Dashboard: Consolidates assets from exchanges such as Binance, Kucoin, Bybit, and others, providing a centralized view of portfolios.

- Cross-Exchange Execution: Execute trades across multiple exchanges without needing to log into each separately.

- Portfolio Aggregation: Provides consolidated real-time tracking of holdings, including trades and balances, across all integrated exchanges.

- Trading Terminal: It enables multi-account management across its supported exchanges. It offers bulk actions for margin, leverage, and orders, TradingView charting with automation. Built for professionals, it prioritizes function over retail polish.

5. Automated Trading & Rebalancing Tools

Purpose: These platforms automate trading strategies, allowing asset managers to implement predefined rules for buying, selling, and rebalancing portfolios based on market conditions.

Key Features:

- Trading Bots: Deploy bots for strategies like Dollar-Cost Averaging (DCA) and grid trading.

- Portfolio Rebalancing: Automatically adjust asset allocations based on market trends or predefined schedules.

- 24/7 Operation: Ensure portfolios are actively managed around the clock, capitalizing on market movements even when the asset manager is offline.

Who Benefits from Crypto Asset Management Software?

Crypto asset management software serves a diverse audience, each with distinct needs shaped by expertise, scale, and objectives. Understanding these personas ensures tools align with specific workflows.

- Institutional Clients: Hedge funds and corporations managing billions prioritize enterprise-grade features like compliance tools and multi-account oversight. They require robust risk models to handle regulatory scrutiny, such as SEC filings, and white-labeling for client-facing branding. For them, platforms must integrate with FX markets via MT4/MT5 for diversified portfolios.

- High-Net-Worth (HNW) Traders and Asset Management Teams: Wealthy individuals or teams seek customizable, non-custodial solutions for personalized strategies. They value admin panels for monitoring family offices or friends and family funds, with automation to execute trades without constant vigilance. Security is paramount, avoiding centralized risks.

- Professional Fund Managers: These pros handle client portfolios, demanding crypto fund management software with PAMM modules for proportional allocations. White-labeling allows branding, while API-trading connects to Bitget or Coinbase for efficient execution. Forex integration is key for those diversifying into FX markets.

- Retail Traders and Individual Crypto Investors: Smaller-scale users favor user-friendly automation and low barriers. They benefit from bots that simplify entry, like DCA for volatile assets, and educational resources to build skills.

- Forex Asset Managers: Bridging traditional and digital, they need MT4/MT5-compatible platforms for cross-asset management. Tools must handle forex leverage alongside crypto swings, with real-time monitoring across exchanges like Coinbase.

Expertise levels differ: Beginners need intuitive interfaces; pros demand advanced analytics. Scale influences choices, free tiers for small portfolios, premium for large. For instance, an institutional manager’s day involves compliance checks and bulk trades, while a retail trader focuses on mobile apps for quick adjustments.

Best Crypto Asset Management Tools in 2026

As the crypto trading ecosystem matures, a significant shift has been taking place toward developing tools tailored specifically for asset managers. The growing sophistication of crypto markets, the increasing influx of institutional investors, and the demand for advanced automation have all driven the need for platforms that help professionals manage large-scale portfolios with ease and precision.

This shift is largely due to the rising complexity of the crypto space, including the integration of DeFi protocols, NFTs, and stablecoins, alongside more traditional cryptocurrencies.

Here’s a detailed comparison table of the top crypto asset management tools in 2025, highlighting key features, launch dates, trust scores, mobile app functionality, and the ideal audience for each platform. In the following sections, we will explain each feature in detail to help you better understand which platform suits your needs the best.

|

Platform |

Launch Date |

Key Features |

Asset Class Coverage |

Advanced Reporting |

Multi-Client Management |

Bulk Trade Execution |

Mobile App (Android/iOS) |

Trustpilot Score |

|

Finestel |

2021 |

– White-label solution – Unlimited multi-client management – Copy trading bots & Trade Copier – Bulk OESM, Bulk action, Bulk bot management, PMS, Trading terminal, Large Order Smart Execution – Automated reporting/compliance |

Crypto, DeFi, NFTs (Forex soon) |

Yes |

Yes (Unlimited) |

Yes |

Yes |

4.7/5 |

|

3Commas |

2017 (Platform); 2025 (Asset Module) |

– Unified dashboard & bots (DCA/Grid) – Multi-exchange support (20+) – AI strategy backtesting – Real-time analytics |

Crypto only |

Yes |

Yes (Institutional) |

Yes |

Yes |

4.5/5 |

|

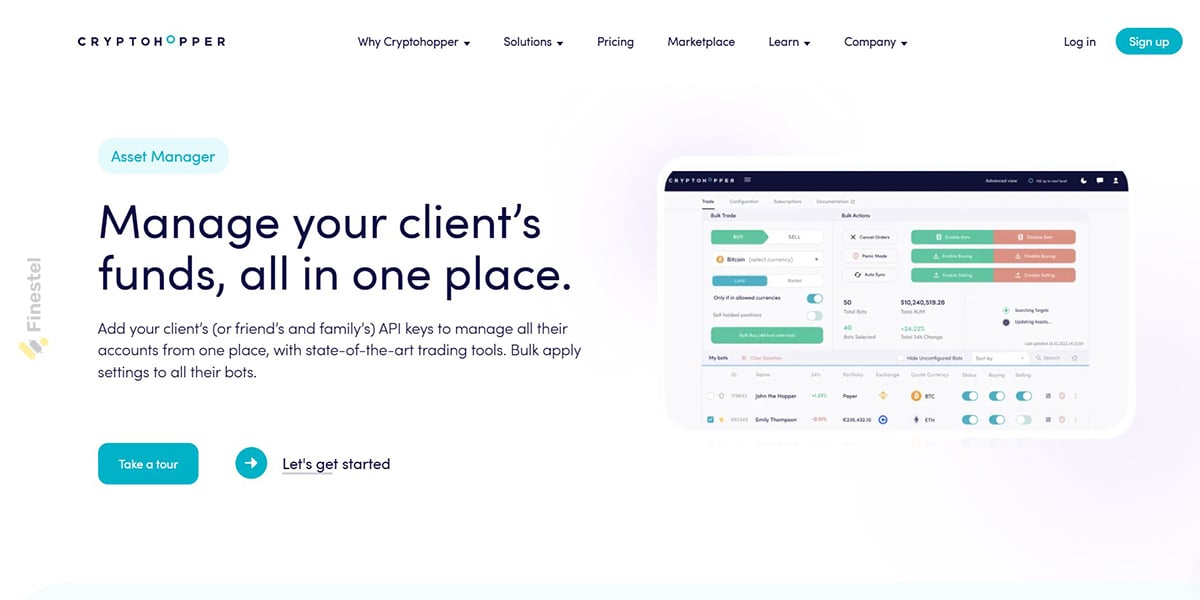

CryptoHopper |

2017 (Platform); 2019 (Asset Manager) |

– Strategy designer & bots (arbitrage) – Social/copy trading marketplace – Trailing risk tools – Multi-client API oversight |

Crypto only |

Yes |

Yes |

Yes |

Yes |

3.7/5 |

|

Talos |

2018 |

– OEMS/PMS with VaR risk – Liquidity aggregation (60+ venues) – Algo execution & settlement – On-chain analytics (2025) |

Crypto, DeFi, Derivatives, Tokenized Assets |

Yes |

Yes (Enterprise) |

Yes |

Limited |

N/A (B2B) |

|

Enzyme Finance |

2019 |

– Tokenized vaults & DeFi automation – Chainlink compliance reporting – Strategy backtesting – On-chain options/staking |

Crypto, DeFi, RWAs |

Yes |

Yes (Unlimited) |

Yes (On-chain) |

Web-only |

4.4/5 (Sparse) |

|

Clapp Finance |

2023 |

– Backtesting & auto-rebalancing – Multi-collateral credit lines (2025) – CeFi/DeFi aggregation – Zero-commission trades |

Crypto, DeFi, Stablecoins |

Yes |

Yes (Teams) |

Yes |

Yes |

4.5/5 |

1. Talos

Launch Date: 2018 Trustpilot Score: N/A Mobile App: Limited (mostly web-based)

Talos is a trading and portfolio management platform used by hedge funds, banks, ETF issuers, and prime brokers. It offers algorithmic execution (TWAP, VWAP, smart routing) & real-time risk monitoring (VaR, margin, TCA).

However, Talos does not publish prices. It’s always “contact sales” → custom quote. Industry sources and leaked contracts show the floor is usually $150 k–$400 k per year minimum, plus a percentage of trading volume or a per-trade fee on top. Smaller shops have reported being quoted $250 k+ just for the first year.

Talos is built for institutions that trade hundreds of millions to tens of billions per month.

It is not a SaaS you sign up and start using in 10 minutes. Typical onboarding stackis more complex than others.

Best for

- Banks and ETF providers running systematic strategies

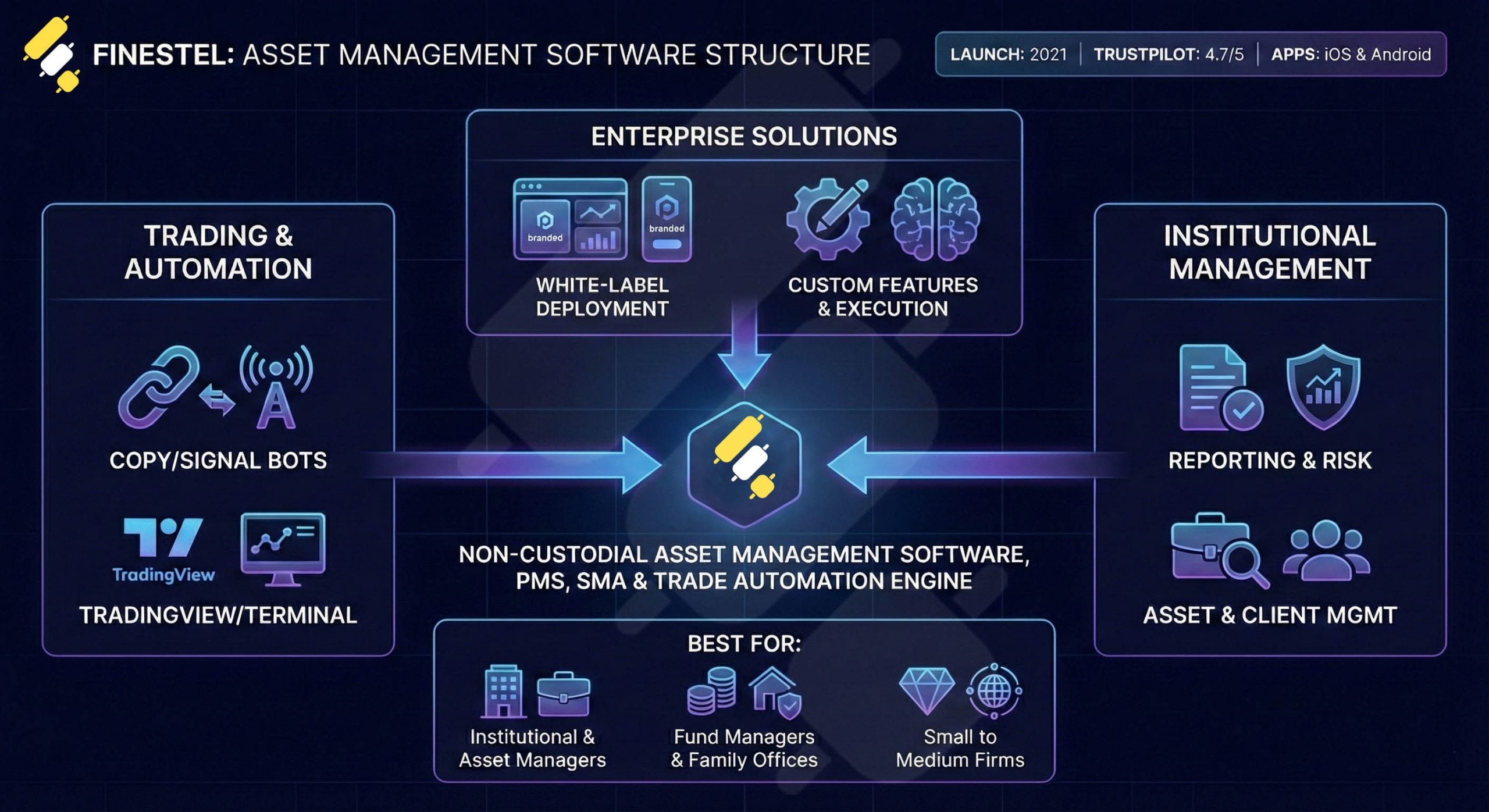

2. Finestel: The All-in-One Asset Management Software

- Launch Date: 2021

- Trustpilot Score: 4.7/5

- Mobile App: Available on Android and iOS

Finestel operates as a non-custodial, API-driven portfolio management system (PMS), SMA, and bulk order replication bot designed specifically for professional asset managers, prop trading firms, signal providers, and RIAs who manage third-party capital in crypto.

It provides a comprehensive suite of features that meet the demands of institutional clients, including automated trading bots (Copy trading bot, signal bot, TradingView bot), smart trading terminal, advanced reporting, risk management, asset tracking, and compliance.

One of the standout features of Finestel is its unlimited client management capabilities, there are no limits to the number of clients that can be managed on the platform. This makes it ideal for fund managers, family offices, and institutional traders who need to scale their operations seamlessly.

Its full white-label deployment lets asset managers run the entire stack (web dashboard + iOS/Android apps) under their own branding, domain, and corporate identity. Clients never see the Finestel name.

Additionally, Finestel’s enterprise plan offers tailored solutions based on the specific needs of asset managers. The support team works closely with clients to develop custom features; for example Finestel implements its Large Order Smart Execution model for its asset managers needs, which adapts trade execution based on live market data to prevent significant price slippage.

Best for:

- Institutional Traders

- Asset Managers

- Fund Managers

- Family Offices

- High-Net-Worth Asset Managers

- Small to Large-Scale Asset Management Firms

3. 3Commas Asset Management Solutions

- Launch Date: 2017 (The Platform); 2025 (Asset Management Module)

- Trustpilot Score: 4.5/5

- Mobile App: Available on Android and iOS

3Commas was founded and publicly launched in October 2017 as a core crypto trading automation platform (e.g., bots for DCA, grid trading, and signals). The “asset management features” (e.g., multi-client oversight, unified dashboards for portfolio management) were introduced in February 2025 via the “3Commas for Asset Managers” module, as part of ongoing enterprise expansions.

3Commas provides a unified dashboard for multi-client management, allowing asset managers to manage and monitor multiple portfolios across 20+ exchanges. The platform offers trading bots along with real-time portfolio analytics and bulk trade execution.

It is well-suited for traders who require automated trading strategies, multi-client management, and portfolio analytics. It’s especially valuable for those who manage portfolios across multiple exchanges and need real-time monitoring.

Best for:

- Professional Traders

- Low Volume Asset Managers

- Retail Traders with Advanced Needs

4. CryptoHopper

- Launch Date: 2017 (Platform); 2023 (Asset Manager Solution)

- Mobile App: Available on Android and iOS

- Trustpilot Score: 3.7/5

CryptoHopper is a robust crypto trading platform designed for automation and bot trading. Initially launched in 2017, CryptoHopper began offering multi-client portfolio management with further enhancements rolling out in 2023–2024.

It provides bulk bot management, asset managers can create unlimited bots (e.g., DCA for averaging buys, grid bots for range trading, arbitrage for cross-exchange opportunities) and deploy them across multiple client accounts. Bulk actions include pausing/resuming all bots during market events.

Best for:

- Asset Managers Seeking Automation

- Traders Wanting Advanced Bot Trading

5. Enzyme Finance

- Launch Date: 2019

- Trustpilot Score: 4.4/5

- Mobile App: Web-only

Enzyme Finance is an on-chain infrastructure platform for tokenized crypto funds, enabling pros to launch and automate vaults across Ethereum/Polygon/Solana (350+ assets, 30+ DeFi protocols). Since 2019, it’s focused on back/middle-office automation. It automates back- and middle-office processes via smart contracts, allowing asset managers, fund sponsors, DAOs, and institutions to create, manage, and scale tokenized investment vehicles without traditional intermediaries.

For asset managers specifically, Enzyme acts as a modular toolkit to launch and operate compliant, on-chain funds at a fraction of traditional costs. It replaces manual ops with programmable vaults.

Best for:

- DeFi Fund Managers/DAOs

- Tokenized Crypto Issuers

- Compliance-Focused Pros

6. Clapp Finance

- Launch Date: 2023

- Trustpilot Score: 4.5/5 (emerging reviews)

- Mobile App: Available on Android and iOS

Clapp Finance is a regulated EU-based CeFi platform for crypto portfolio management and trading, launched in 2023 as an all-in-one app combining CeFi/DeFi access, fiat on/off-ramps, and liquidity tools.

Key features include real-time portfolio dashboards (holdings, P&L, allocations), backtesting via “Time Machine” (simulate historical performance with rebalancing scenarios), and automated rebalancing to maintain targets (e.g., ±5% drift triggers).

Clapp is optimized for solo users or small personal setups, with no dedicated sub-accounts, client onboarding portals, or bulk management tools for teams. You can’t securely connect multiple client APIs (like in Finestel or CryptoHopper) or delegate permissions for shared oversight, everything runs through a single wallet. For asset managers handling 5+ clients, this means manual workarounds (e.g., separate logins or exporting data), which defeats the “all-in-one” promise and scales poorly for pros.

Best for:

- Active Portfolio Managers

- Yield/Liquidity-Seeking Pros

- EU-Regulated Individual Traders

7. CoinStats

- Launch Date: 2022

- Trustpilot Score: 4.3/5

- Mobile App: Full functionality on Android and iOS

CoinStats is a crypto portfolio management platform that empowers users to efficiently track, analyze, and manage their digital assets. It excels in its versatility, allowing users to manage a diverse range of assets, from traditional cryptocurrencies like Bitcoin and Ethereum, to NFTs, DeFi positions, and staking. The platform’s advanced analytics provide detailed insights into asset performance, enabling traders to track P&L, market trends, and other critical metrics. Additionally, CoinStats’ integration with DeFi protocols gives users the ability to track lending positions, staking rewards, and yield farming, providing a holistic view of their portfolio.

For asset managers, CoinStats’ AI-powered tools offer portfolio optimization and exit strategy recommendations based on real-time market data.

Best for:

- Retail Traders

- Small Teams

- Individual Crypto Investors

- DeFi Enthusiasts

- NFT Collectors

8. Kubera

- Launch Date: 2019

- Trustpilot Score: 4.7/5

- Mobile App: No dedicated mobile app

Kubera is a personal wealth tracker that allows users to monitor their net worth across various asset classes, including crypto, stocks, real estate, and more. It’s designed for individuals and financial advisors. It connects to over 20,000 banks and brokerages worldwide, automatically syncing balances via aggregators like Plaid, Yodlee, and Salt Edge. Kubera Tracks traditional assets (stocks, bonds, funds, retirement accounts), alternative assets (cryptocurrency, DeFi, NFTs, precious metals, real estate, vehicles, art, domain names), and liabilities (mortgages, loans, credit cards).

Best for:

- Family Offices

- Financial Advisors

- Personal Wealth Managers

Leave a Reply