OKX is one of the top centralized cryptocurrency exchanges with millions of users around the world. The platform provides fundamental trading services, including spot and derivatives trading. OKX also offers access to several crypto bots and automated trading solutions. Considering the exchange’s reputation and its top-notch services, it is one of the attractive choices for traders looking to utilize trading bots. In this article, we comprehensively analyze the best OKX trading bots.

First, we begin by introducing the best OKX bots offered by the exchange. We explain how they work and who they are for. We also mention the pros and cons of using each bot and then present some alternative trading bots for OKX users developed by other businesses. So, if you are curious about OKX trading bots, make sure to stick with us until the end of the article.

Best OKX Bots for Grid Trading

OKX is known for the wide range of trading bots it offers to users. In this section, we introduce OKX grid bots, explain how they work, and guide you in finding the most suited bot depending on your goals and preferences.

Spot Grid Bot

The OKX spot grid bot operates by utilizing the grid trading strategy. The grid strategy is designed to capitalize on the significant volatility of cryptocurrencies. OKX’s spot grid bot divides the initial capital between two assets of the chosen trading pair. The bot establishes a grid of price points between upper and lower bounds.

Then, it further distributes the funds among the designated number of grids equally. As the market price fluctuates, the bot automatically executes sell orders when the price reaches the upper grid. On the other hand, it buys the asset when its price hits the lower grid line. The OKX spot grid bot allows you to profit from the price differentials between executed buy and sell orders during volatility.

The spot grid trading bot OKX offers is best suited for traders who are short-term traders and intend to capitalize on market volatility. If you prefer an automated and systematic approach to crypto spot trading, the OKX spot grid bot is for you.

Futures Grid Bot

The OKX futures grid bot is quite similar to the spot grid bot. It is also based on the grid trading strategy and exploiting the price fluctuations of cryptocurrencies. However, it executes leveraged futures contracts within a specified range. The futures grid bot systematically engages in buying low and selling high, according to the preset intervals by the users.

You can use different directional approaches, including a long futures grid (for bullish markets, a short futures grid (for bearish markets), or a neutral futures grid (using both long and short positions). OKX users can either set up the futures grid bot manually by entering their parameters of choice or use AI-driven strategies.

OKX’s futures grid bot trading is for short-term traders with a higher risk appetite. Yet, the inclusion of leverage in this strategy not only elevates the level of risk you are taking but also your potential profits. So, if you are willing to generate profits based on crypto market fluctuations and are able to bear more risk for higher gains, the OKX futures grid bot would be an optimal choice.

Infinity Grid Bot

The OKX infinity grid bot takes the grid trading strategy to the next level. It is an upgraded version of the spot grid bot. The infinity grid concept eliminates the need for users to set an upper price limit when setting the bot up. In contrast to the traditional spot grid strategy, it allows traders to hold on to their cryptocurrencies during bull markets. This would help them maximize profits and lower trading fees.

Unlike the spot grid and futures grid bots, the OKX infinity grid bot is suitable for traders with a longer-term vision. For instance, consider the scenario that you are expecting the crypto market to rally in the upcoming months. If you seek to invest and accumulate crypto during the bullish trend for the long run, you can utilize the OKX infinity grid bot. This bot automates this process and removes the need for constant market analysis and complex calculations.

Moon Grid Bot

The OKX Moon grid bot is an automated cryptocurrency trading system. Just like other grid trading bots, the moon grid strategy aims to capitalize on the inherent price volatility of the crypto market. Specifically tailored for medium to long-term positions, this bot operates similarly to the spot grid bot. Yet, the main distinction is that the Moon grid bot trades within a broader price range. It also simplifies the user experience with the removal of stop-loss and take-profit levels.

Furthermore, the OKX Moon grid bot utilizes artificial intelligence and historical market data for backtesting and performance optimization. Again, if you are a longer-term crypto trader looking to generate profits from the volatility of the cryptocurrency market and do so automatically, the Moon grid bot offers a simple and effective solution.

Top DCA and Investment OKX Bots

In this section, we introduce the best OKX trading bots for dollar-cost averaging and long-term investments. In case you are interested in playing the long game, these bots are for you.

Spot DCA Bot (Martingale)

The OKX spot DCA bot is a trading bot designed to implement the dollar-cost averaging strategy. This strategy, also known as DCA, involves buying a fixed amount of a particular crypto asset at regular, predetermined intervals. Note that the DCA bot operates regardless of market price.

Yet, the OKX spot DCA bot takes things to another level by placing additional orders with increased position size when the market moves against the direction of the trade. The Martingale strategy aims to quickly recover losses by increasing the position size. This bot is suitable for traders with a long-term vision and investing mindset.

Futures DCA Bot (Martingale)

The futures DCA bot that OKX offers operates on the basis of the Martingale strategy. It is an automatic futures trading strategy that sets up a series of orders with increasing position sizes. In case of a loss on a closed position, the bot automatically initiates a new order with a larger position size. This cycle continues until a profitable position is closed, and a new cycle begins afterward.

With the OKX futures DCA bot, you can utilize up to 100x leverage to navigate market fluctuations. The bot also offers the flexibility to use stop-loss orders in order to cap potential losses. If you are interested in the Martingale strategy and are looking for an automated solution with higher potential returns (and, of course, higher risk), you can opt for the OKX futures DCA bot.

Smart Portfolio Bot

The OKX smart portfolio bot is for crypto traders and investors seeking a simple approach to portfolio management. The bot creates and automatically rebalances your cryptocurrency portfolio to maintain a balanced exposure. Users allocate percentages to each crypto asset, and the bot will automatically buy and sell assets to maintain the predefined proportions amid market price fluctuations of each asset.

Supporting up to 10 different cryptocurrencies, the OKX smart portfolio bot ensures optimal diversification. This bot is also better suited for long-term investors who seek to create a portfolio of cryptocurrencies but do not want the associated issues with rebalancing and active portfolio management.

Best OKX Trading Bots for Arbitrage

Arbitrage is generally known as a trading strategy that exploits price differentials of the same asset on different exchanges or markets. Yet, OKX implements arbitrage differently in the crypto market. In this section, we introduce the best OKX arbitrage bots and explain how they work.

Funding Rate Arbitrage Bot

The OKX funding rate arbitrage bot aims to capitalize on the differences in funding rates between spot pairs and their equivalent perpetual futures contracts. Each arbitrage portfolio includes a spot pair and its perpetual swap contract. This provides traders with opportunities to profit from funding rate differentials.

The bot automatically manages the execution of arbitrage orders after receiving initial parameters from the user. The strategy involves taking advantage of positive funding rates by shorting the asset and longing it when funding rates are negative. if you are looking for a low-risk strategy with consistent, small gains, the OKX funding rate arbitrage bot is a decent choice.

Spread Arbitrage Bot

The OKX spread arbitrage bot is a sophisticated trading tool that operates on the basis of the spread between two futures contracts or a futures contract and a spot position. The spread arbitrage bot automatically takes opposing positions to profit from the price differences (spread).

Similar to the funding rates arbitrage bot, the OKX spread arbitrage bot offers consistent gains with limited risk. OKX also offers leverage to magnify gains. However, leverage not only increases potential profits but also elevates the level of risk. Therefore, remember to approach leveraged arbitrage trading with caution.

Best OKX Slicing Bots

Large investors with considerable amounts of funds cannot execute their trades at once. Their massive supply or demand might cause the market price to move adversely and lead to unfavorable entry prices. OKX introduces slicing bots to cater to the requirements of these individuals or institutions. Below are the best slicing bots developed by OKX.

Iceberg Bot

The OKX Iceberg trading bot is a powerful tool for executing large buy or sell orders in a discrete manner. It does so to minimize the impact on market prices. Iceberg orders help avoid significant price slippage in illiquid markets. This bot automatically breaks down large orders into smaller parts and conceals the full order size to prevent adverse price movement.

The Iceberg bot by OKX is a well-suited option for traders and investors with large amounts of capital or those seeking to execute substantial trades relative to the market size of the chosen crypto asset.

TWAP Bot

The OKX TWAP (Time-Weighted Average price) bot is for traders seeking to execute large trades over a specified. Similar to the Iceberg bot, this bot also prevents significant price movements in the target asset. Yet, the key distinction lies in the execution strategy.

The TWAP bot places individual orders periodically throughout a predetermined period. Meanwhile, this bot is also suitable for large investors and trade execution in small crypto assets.

Best Third-Party Trading Bots for OKX

While OKX offers various trading bots natively on the platform, several third-party businesses develop trading bots for OKX users. These businesses are dedicated trading solution providers who offer automated tools for crypto trading. In this part, we present the best third-party trading bots for OKX.

Finestel

What is Finestel? Finestel is a Canada-based trading technology provider that offers various solutions to cryptocurrency traders, including OKX traders. The exchange’s users can easily utilize Finestel’s services for automated trading.

Finestel’s trading solutions for OKX users include a copy trading bot, portfolio tracking tools, Telegram bots, Tradingview webhook, and finally, the top-notch white-label copy trading service. The copy trading bot allows OKX traders to onboard their investors and let them copy their automated trading strategies.

Moreover, the white-label OKX copy trading includes our cutting-edge copy trading bot in addition to maximum customization options sophisticated performance evaluation features, and portfolio management tools. The white-label solution is suitable for professional traders and bot developers looking to offer their services under their own brand.

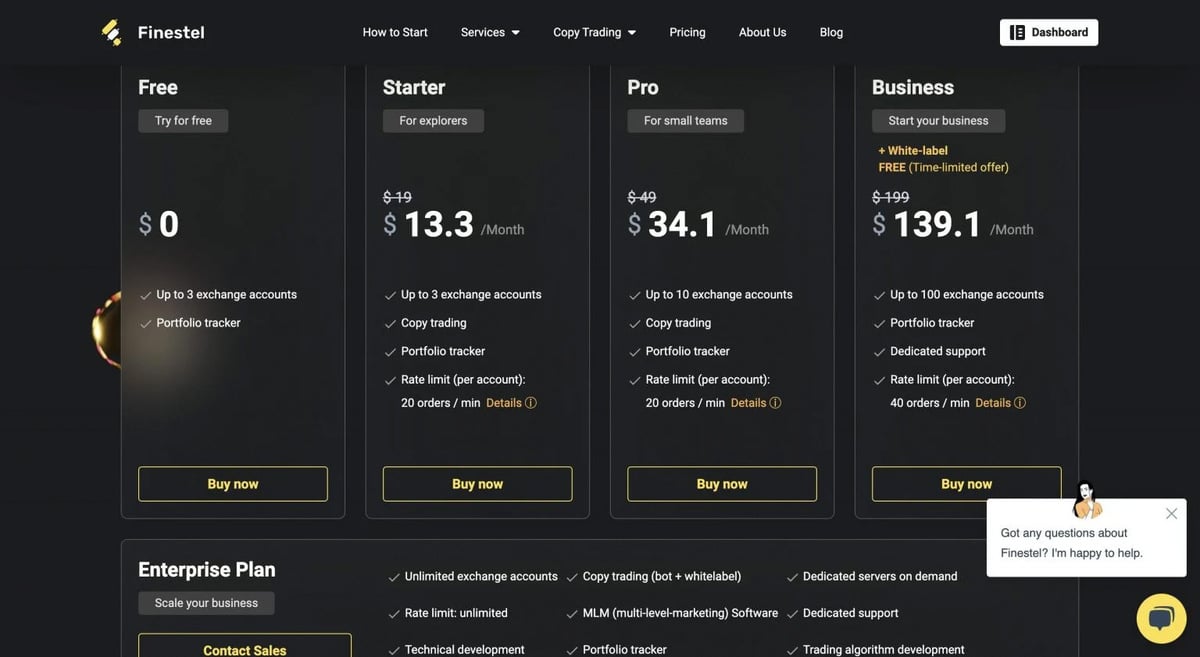

Finestel’s pricing plan is a straightforward one. You can choose your favorable plan according to your preferences, expertise, and assets under management. The full pricing plan is described below.

Free Plan

This plan provides connections to up to 3 exchange accounts and the portfolio tracker. The free plan is suitable for individual traders who want to try out Finestel’s services and find out how well they work.

Starter Plan

The starter plan comes at a cost of $19 per month (or $13.3 per month billed annually). It allows users to use Finestel’s copy trading bot. You can also benefit from a rate limit of 20 orders per minute (per account), a portfolio tracker tool, and up to 3 exchange accounts.

Pro Plan

Professional traders or owners of small asset management businesses can opt for the pro plan. It includes up to 10 exchange account connections and all the features in the starter plan. This plan costs $49 per month (or $34.1 per month billed annually).

Business Plan

For users who are willing to take their asset management business to the next level, Finestel’s business plan is an optimal choice. You can leverage maximum customization options, dedicated customer support, up to 100 exchange connections, and a free white-label setup, which is a limited-time offer. The price of this plan is $199 per month (or $139.1 per month billed annually).

Enterprise Plan

The enterprise plan is for already established crypto asset management businesses that are looking to increase their market share and scale up their operations. It offers unlimited exchange account connections, white-label copy trading, unlimited rate limits, and trading algorithm development. For detailed information regarding the pricing of the enterprise plan, contact Finestel’s sales team.

3Commas

3Commas is also a renowned crypto trading automation platform. It offers a user-friendly interface to OKX traders who seek trading bots and automation. With the 3Commas management interface and OKX API keys, you can create algorithms and automated trading strategies.

The 3Commas platform supports various trading bots, including long, short, and composite (multi-pair) bots. OKX users can also backtest their bots within the 3Commas platform using historical market data. You can also utilize bots and algorithms developed by fellow users to diversify your portfolio of trading bots.

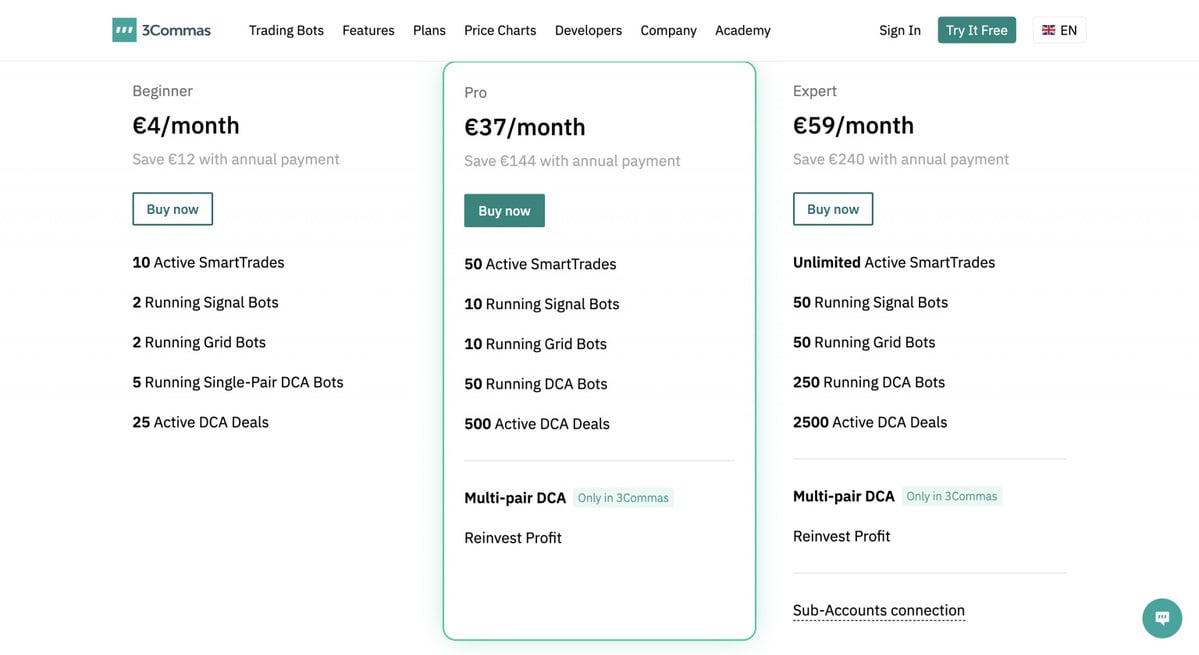

3Commas offers its services through three different pricing plans. These plans are analyzed below:

Beginner Plan

The 3Commas beginner plan offers ten active SmartTrades, two running grid bots and signal bots, five running single-pair DCA bots, and 25 active DCA deals at once. This plan comes at €5 per month (€4 per month billed annually).

Pro Plan

Experienced OKX traders can subscribe to the pro plan. It offers 50 active SmartTrades, 10 running signal bots, 10 running grid bots, 50 running DCA bots, and up to 500 active DCA deals. You can also utilize the 3Commas multi-pair DCA bot. The pro plan is €49 per month (€37 per month billed annually).

Expert Plan

Expert traders who are looking for sophisticated trading automation solutions can choose the expert plan. This plan provides unlimited active SmartTrades, 50 running signal and grid bots, 250 running DCA bots, and 2500 active DCA trades. The multi-pair DCA bot from the pro plan is also included.

WunderTrading

WunderTrading is also a top trading automation platform operating in the crypto environment. This platform offers a variety of automation services and bots to OKX traders. The platform has a user-friendly interface, and traders can create and automate trading strategies with OKX API keys.

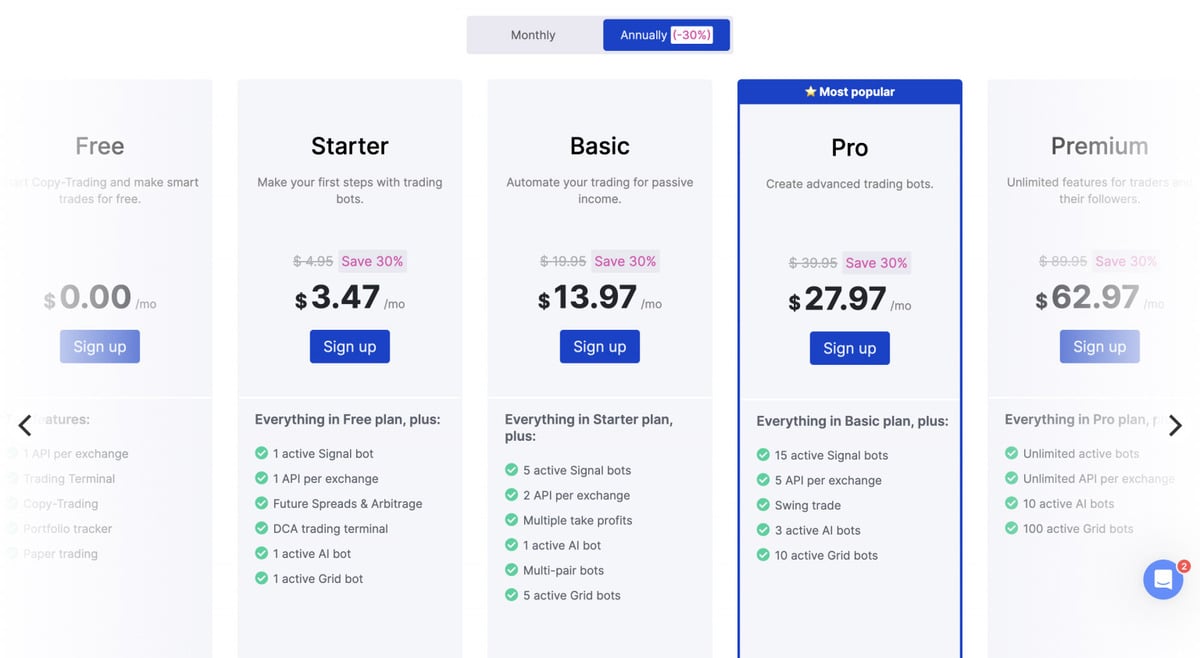

In order to utilize Wundertrading’s OKX bots, you should subscribe to their services. They offer five different plans, each suitable for a specific group of OKX traders.

Free Plan

WunderTrading’s free plan allows OKX traders to use one API connection. You can also access copy trading, paper trading, a portfolio tracker tool, and a dedicated trading terminal. This plan is only suitable for copy traders.

Starter Plan

If you are new to trading bots, the Starter plan is for you. It offers one active signal bot, perpetual futures spread trading bots, arbitrage trading bots, a DCA trading terminal, one active AI bot, and one active grid bot on top of the features from the free plan. This plan costs $4.95 per month (or $3.47 per month billed annually).

Basic Plan

WunderTrading’s basic plan includes five active signal bots, two APIs, multiple take profit orders, five grid bots, and multi-pair bots in addition to the Starter plan. The Basic plan is $19.95 per month (or $13.97 per month billed annually).

Pro Plan

The pro plan is WunderTrading’s most popular one, as it allows users to create sophisticated trading bots. The plan offers 15 active signal bots, 5 APIs, swing trading, three active AI trading bots, and 10 active grid bots. Subscribing to the pro plan comes at a rate of $39.95 per month (or $27.97 per month billed annually).

Premium Plan

For professional traders looking for the best crypto trading automation services, the premium plan is the one. The plan provides unlimited active bots and API connections. Moreover, you can benefit from 10 active AI bots and 1000 active grid bots.

Cryptohopper

Cryptohopper is a popular cryptocurrency trading bot that allows users to automate their trading strategies across various exchanges, including OKX. The mention of Cryptohopper and OKX in the same context suggests that Cryptohopper can be integrated with OKX for automated trading.

Cryptohopper offers OKX users different features like bot trading, market making, and arbitrage. It is suitable for both beginner and advanced traders. Users can set parameters for buying, selling, stop-loss, and take-profit orders to execute trades based on their preferences.

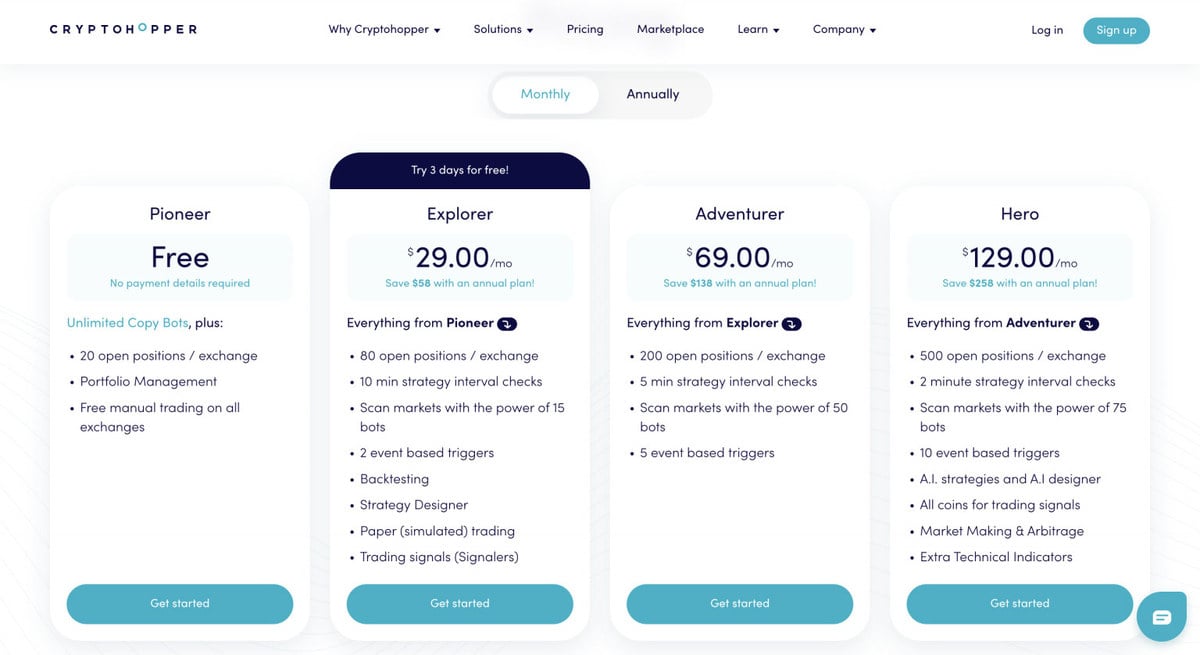

The Cryptohopper platform’s subscription has four different plans. Traders can select the optimal plan based on their goals.

Pioneer Plan

The Cryptohopper pioneer plan allows users to test the platform and its services for free. It offers 20 open positions per exchange, portfolio management tools, and free manual trading.

Explorer Plan

The explorer plan offers everything from the pioneer plan plus 80 open positions per exchange, 15 bots, backtesting and strategy design, and trading signals. This plan costs $29 per month ($24.16 per month when billed annually).

Adventurer Plan

The next plan is the adventurer plan, which provides access to all features from the explorer plan plus 200 open positions per exchange, 50 trading bots, and five event-based triggers. The adventurer plan comes at a rate of $69 per month ($57.50 per month when billed annually).

Hero Plan

The hero plan is the most complete plan Cryptohopper has to offer. It includes 500 open positions per exchange, 75 trading bots, ten event-based triggers, AI strategy designers, market-making, and arbitrage bots. The Hero plan is quite expensive, costing $129 per month ($107.50 per month billed annually).

Conclusion

In this article, we analyzed the best OKX trading bots. First, we introduced the best OKX bots by category and explained how they work. We also clarified who each bot is suitable for. Moreover, we presented the best crypto trading bots offered by third-party businesses and thoroughly described their pricing plans.

While OKX itself offers a wide range of trading automation tools and bots, Finestel’s trading bot services are the best compliment for them. Finestel allows users to utilize professional tools, cutting-edge copy trading and bots, and a fully customizable white-label solution. In case you are a serious OKX trader seeking investor capital and willing to run an asset management business, Finestel is here for you.

Leave a Reply