“What is copy trading?” is a common question asked by individuals who are active in the trading industry. The challenging and demanding nature of trading has led many to wonder if copy trading can make the process easier and more reliable. As a result, traders often seek to understand the benefits and drawbacks of this innovative approach to trading. By exploring the concept of copy trading, traders and investors can gain a better understanding of how it works and whether it is a viable option for their investment strategy.

This comprehensive guide delves into copy trading, a rapidly emerging trend in various financial markets, including Forex, Stocks, and Cryptocurrencies. This article equips you with the knowledge you need to navigate this innovative trading strategy.

What Is Copy Trading?

Copy trading involves the automatic replication of a trader’s trades & orders on an exchange account or third-party software, into the accounts of their clients or investors who copy them. In more advanced models, the replication of orders is done proportionally, covering all aspects of the trade setup. This comprehensive approach enables non-custodial asset management, simplifying the process for both professional traders and their followers.

It is a distinctive investment strategy gaining popularity because of its unique blend of education and potential profitability. This innovative approach allows investors to follow and replicate the trades of more experienced individuals, creating an intriguing opportunity for financial gains and valuable learning experiences. By aligning with a chosen trader’s investment style and strategic goals, investors can copy selected or all trades, thereby leveraging the expertise of seasoned traders.

How Does Copy Trading Work?

Copy trading apps typically connect to cryptocurrency exchanges, using an API (Application Programming Interface). An API is a way for different software applications to communicate with each other. There are two types of API configurations for connecting an exchange account to a copy trading platform.

The first type is a trade-only API configuration, which allows investors to copy the trades of professional traders. This API access enables the copy trading app to place or cancel orders in the investor’s account based on the trades made by the copied trader.

The second type is a read-only API configuration, which allows the copy trading app to read and copy orders, portfolios, or positions from the connected trader account. This is typically used by copy trading platforms to copy the trades of crypto trader bots, asset management firms, or professional portfolio managers. By using a read-only API configuration, the copy trading app can replicate the trades of the professional trader without having the ability to place or cancel orders in the investor’s account.

In addition to the two types of API configurations mentioned earlier, some copy trading platforms also offer a hybrid API configuration. This configuration allows investors to copy the trades of professional traders while also having the ability to manually place or cancel orders in their own account.

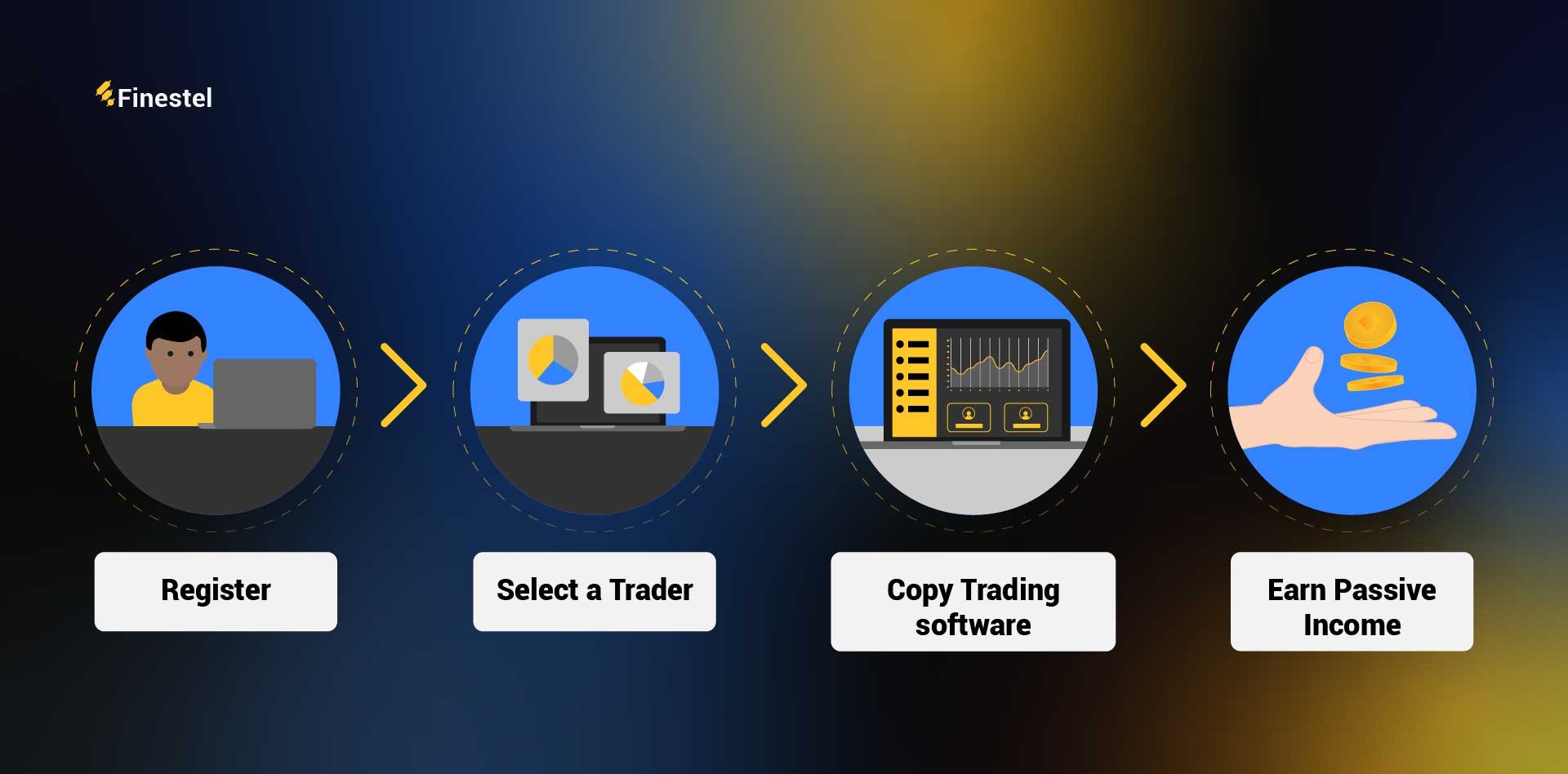

Steps to Follow for Copy Trading

Here is the flow of starting:

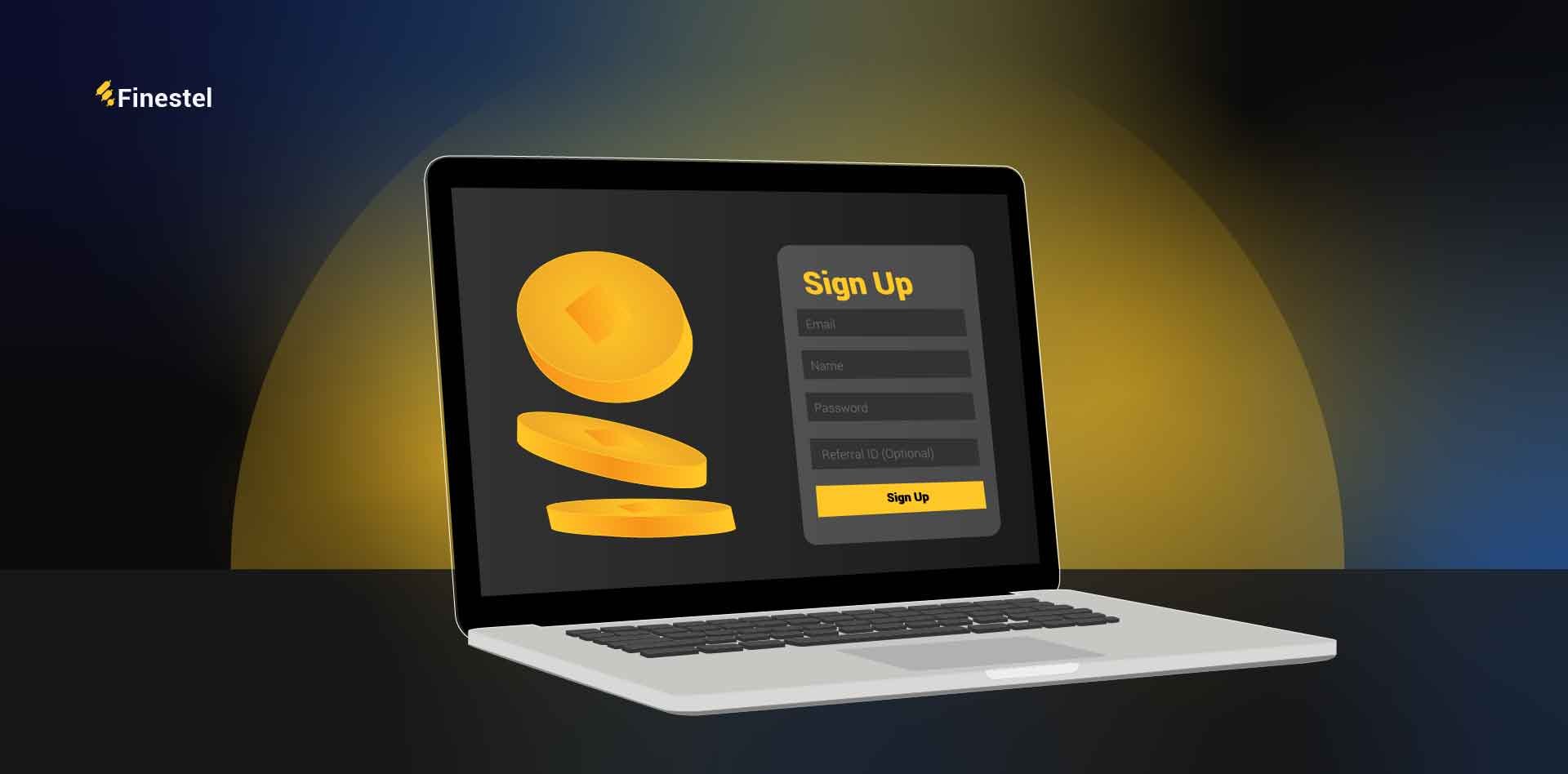

- Registration: Register an account in the proper copy trading platform to find and follow other followers. Some platforms may allow you sub-accounts based on the trading strategy, which may interest you.

- Capital: After registration, you should buy the number of assets you desire to bring. Now, It is simple to select a trader, and by clicking one button, you can start your journey.

- Risk Management: As a trader or investor, you are always recommended to examine selected traders via little capital as a low-risk act. As risk management, you should implement setting suit for goals and risk tolerance.

- Just Watch: Hereafter, you are required to monitor happenings, calculate profit and loss (PNL), track performance to ensure having a consistent margin, find a community of traders to share experiences, and make better possible decisions in the future.

Copy Trading Strategies and Approaches

Let’s assume three parties and talk about possible strategies:

- Provider (Trader): The trader that users of the platform try to copy his performance.

- Copier (Investor): Users of the platform who copy the Provider’s performance.

- Platform (Broker in Forex): An environment in which providers and copiers gather.

Strategies

- Copying all trades: In this way, the platform allows the copier to take all the Provider’s trades, regardless of what assets make up what percentage of their capital. In this method, the platform may also ask the copier whether to arrange the assets exactly according to the Provider’s assets or not, which has its complications and depends on the strategy of the copier.

- Copying Only new trades: Sometimes, the copier wants to avoid following the Provider’s basket and following the Provider’s trades from a certain time. The copier adjusts so that since the start of the copying operation, the Provider’s strategy is followed. Still, and no changes are made to match the amount and percentage of the assets of the two parties.

- Copy Stop-Loss (CSL): CSL is an important feature in risk management that allows you to control the risk in any copy trading operation concerning immediate profit and loss. This tool gives you full risk control over your copier by efficiently managing your smart trading portfolio. It is an automated system where you can optimize risk control by setting a dollar amount for the entire copy operation.

Each trading platform can automatically set the CSL at a pre-determined percentage of the total value of your copied investment. Once the copy value reaches this percentage, CSL will activate and stop the copy operation and return any remaining funds to your account. You can manually adjust your CSL range between 5% and 95%. This 5% safety net only occurs when almost all your copied operation’s money is gone.

- Others: Copied Trades SL, Pause Copy, and Stop Copy: These are other methods provided by copy trading platforms that have their complexity, and their explanation is beyond the scope of this article.

Copy Trading for Pro Traders

-

Become a signal provider: Pro traders can become signal providers on copy trading platforms and earn additional income by allowing other investors to copy their trades. This can be a good way to monetize their trading expertise and generate passive income.

-

Diversify their portfolio: Pro traders can use copy trading to diversify their investment portfolio by copying the trades of other successful traders in different markets or asset classes. This can help them spread their risk and potentially increase their returns.

-

Save time: Copy trading can save pro traders time by allowing them to automate their trading strategies and focus on other aspects of their business or personal life.

-

Learn from other traders: Pro traders can use copy trading to learn from other successful traders and improve their own trading strategies. By analyzing the trades of other traders, they can gain insights into different markets, trading strategies, and risk management techniques.

Since professional traders have experience trading different assets in different markets, as well as experience in recognizing when to enter a position, they may decide to make only one type of trade on one asset or currency pair. it will also be a success for the copier and the Provider because the professional trader will gain experience even in choosing the Provider and discover safe and low-risk margin strategies.

When they reach the desired level of confidence, they can invest any amount without restrictions and provide it to the Provider for a gradual profit. For example, the CSL strategy suits only pro traders who seek to touch certain rewards of their known tangible risks.

Copy Trading for Beginners

Copy trading can be a great tool for beginners who want to get started in investing. Here are some ways that beginners can use copy trading:

1. Learn from successful traders: Copy trading allows beginners to learn from successful traders by copying their trades. By analyzing the trades of successful traders, beginners can gain insights into different investment strategies, risk management techniques, and market trends.

2. Diversify their portfolio: Copy trading allows beginners to diversify their investment portfolio by copying the trades of successful traders in different markets or asset classes. This can help beginners spread their risk and potentially increase their returns.

3. Save time: Copy trading can save beginners time by allowing them to automate their investment strategies and focus on other aspects of their life. Instead of spending time analyzing the markets and making investment decisions, beginners can simply copy the trades of successful traders.

4. Start with a small investment: Copy trading allows beginners to start with a small investment and test the waters before committing more capital. This can help beginners gain confidence and experience in investing without risking too much money.

5. Monitor their copy trading operation: It’s important for beginners to monitor their copy trading operation regularly to ensure that it is performing as expected. Beginners should keep track of their profits and losses and adjust their investment strategy if necessary.

Newbies have some challenges. One of these challenges is the need for proper criteria for choosing a provider that meets the needs of the copier. The copier may take help from others to choose the right Provider, but their other weakness is their need for more patience in copy trading, which may not bring them to the appropriate profit margin.

For this reason, newbies should investigate and test the providers on the platform with a small amount of capital and gain more experience and knowledge while observing the Provider’s decisions to pass the difficult time of starting the process slowly and avoid harmful emotions.

Copy Trading vs. Traditional Trading: Which Strategy is Right for You?

The financial markets are very wide, and anyone interested in trading should choose the market they are interested in and then devote personal resources like time, energy, and capital to it. According to any economic or social conditions a trader has, he decides in which market he is looking for a business. Still, the more the economic conditions change, the more people flock to the trading market.

Despite their previous Studying needs, some of these people seek to accelerate the learning process and gain experience. Here is a solution apart from traditional trading called copy trading. By knowing the advantages and disadvantages of copy trading, you can decide whether to consider copying as a source of market monitoring and touch. If you want to know what copy trading is, it can be said in one sentence: Accelerating the absorption of the experience of touching the market.

Copy Trading in Forex Explained

Due to its nature, the forex market can be receptive to copy trading, and it is even easier than copy trading in the crypto market because the number of currency pairs is less than the number of cryptocurrencies. Also, since the forex market opens the markets around the axis of time in different parts of the globe, copyists can follow the providers in the market in the early hours without being influenced by the fundamental news. How this is done depends largely on the broker’s services, and the copier should see if he can find such an advantage.

If yes, traders can start copying their trades after selecting a trader to emulate. The financial commitment to this process depends on the trader’s risk tolerance; one can start with a smaller investment and gradually increase as they grow more comfortable with the process. Copy trading offers a valuable avenue to learn about the forex market and make money without becoming a trading expert. However, as with any investment activity, it’s crucial to acknowledge the inherent risks involved. Before venturing into copy trading, proper research and understanding of these risks are necessary.

What Are the Best Forex Copy Trading Platforms Available for Traders?

The forex market is a complex and dynamic environment operating on various software platforms. Each of these platforms is designed with unique features that cater to the varying needs of forex traders. The most commonly used software platforms in forex trading include MetaTrader, ZuluTrade, DupliTrade, Pelican Trading, and Myfxbook.

The best forex copy trading platforms are eToro, FP Markets, Tickmill, Vantage, AvaTrade, Pepperstone, and FXCM. The following table illustrates their support of trading software for traders:

| Platform/Software | MetaTrader | ZuluTrade | DupliTrade | Myfxbook | Pelican Trading |

| eToro | * | * | * | * | |

| FP Markets | * | * | |||

| Tickmill | * | * | * | * | |

| Vantage | * | * | * | * | |

| AvaTrade | * | * | * | ||

| Pepperstone | * | * | * | ||

| FXCM | * | * |

Copy Trading in Stock Market Definition

The stock market, like the forex market, is big. On the other hand, it is a market affected by fundamental events, the consequences of which lead to the separation of traders into different types, such as daily traders, swing traders, Etc. Each of these traders has distinct personalities. Have. Copy trading in the stock market is possible, especially when the copyist has a daily trading strategy and wants to find a provider who is present in the market during the opening hours, regardless of geographical location.

What Are the Best Stock Copy Trading Platforms Available for Traders?

As much as there are more assets in a market for trading, copy trading has the potential to have more presence, profit, and users in that market. In this sense, stock market traders can use the same Forex market tools for copy trading and adjust their strategies. Table No. 1 well represents the features of different platforms.

What Is Copy Trading in the Cryptocurrency Market?

The cryptocurrency market has similarities and differences with forex and stocks. Distinctions and similarities are as follows:

Distinctions:

- This market has more tradable assets than the other two markets.

- This market has more fluctuations and has a higher level of influence than fundamental events

- This market has attracted the attention of ordinary people and is full of amateur users

- Although this market has a much smaller volume than forex and stocks, it is also young and is still in its infancy. As a result, there are more gaps for traders to make a profit in this market.

- Traders of this market can have all assets in one dashboard, even by choosing providers in different cryptocurrency exchanges’ SPOT and FUTURES markets.

Similarities:

- Exchanges have the same role as brokers.

- Some platforms like Cobra support crypto and stocks, ETFs, Etc.

- It has expert traders in the spot and futures markets, illuminating the fortune of copy trading in this market.

What Are the Best Crypto Copy Trading Platforms Available for Traders?

Since this section needs a more detailed explanation, investors would better study more about them. According to the differences in the crypto market, refer to this article to compare and view the full introduction of the best copy trading platforms, including Finestel.

Copy Trading VS Mirror Trading

Copy trading and mirror trading are both automated trading strategies that allow traders to copy the trades of other successful traders. These two terms are sometimes used interchangeably. However, there are some differences between the two. The table below brightly illustrates the concept:

| Feature | Mirror Trading | Copy Trading |

| Automation | Fully Automated | Semi-automated |

| Risk | High | Medium |

| Potential Return | Low, due to high trading fees | High, due to low trading fees |

| Control | Low | Medium |

Copy Trading VS Social Trading

Copy trading and social trading are both strategies that allow traders to follow and copy the trades of other successful traders. However, there are some differences between the two:

| Feature | Copy Trading | Social Trading |

| Traders Feed | Not necessarily | Yes |

| Trade Execution | Yes | Not necessarily |

| Time-Saving | High | Low |

| Trade Automation | Yes | No |

Notably, social trading platforms often have unique features such as boards for messaging, chatrooms for sharing trades, and voting polls for choosing strategies. In addition, it allows investors to get various investing resources by contributing to the community.

Advantages of Copy Trading

Copy trading is a remarkably flexible, efficient, transparent, and diversifying method that caters to many traders.

- Its flexibility allows traders to control their risk per trade, adjusting the trade size of their account balance even when the Provider trades large lot sizes.

- As for efficiency, copy trading is ideal for those who can dedicate only a few hours daily to trading. By copying top performers, traders can ensure efficiency, provided risk parameters are properly set up and monitored.

- The transparency of copy trading comes from its leaderboard system, which lets traders compare providers and their performances, making wins and losses visible to all.

- The diversification aspect of copy trading enables traders to copy someone using a different trading strategy, potentially compensating for any shortcomings in their strategy or lack of trading opportunities.

- Non-custodial asset management is another advantage for copy trading as it allows participants to keep control of their funds and manage them independently. Participants can use the API copy trading method, keeping their funds in their own exchange accounts while still benefiting from the copy trading strategy.

Moreover, this trading method is beneficial for first-time and new traders, allowing them to familiarize themselves with the financial markets and learn from the actions of experienced traders. Busy traders can also participate in the market without spending as much time and research. It’s possible to copy trades and portfolios on diverse instruments, such as currencies, commodities, indices, stocks, etc. Last, copy trading promotes forming a community of traders, where ideas and strategies can be exchanged, fostering the collective improvement of trades.

Pros for Traders

Copy trading benefits for traders:

- More followers, more profit

- Enhanced reputation and credibility

- Increased fees from followers

- Boosts income and credibility

- Ability to test several advanced strategies, such as CSL, Copied SL, Paused Copy, and Stop Copy.

Pros for Investors

- Access to expert traders

- Diversification of portfolio

- Passive income generation

- Time-saving

- Low minimum investment

- Transparency into trader performance

Disadvantages of Copy Trading

“Maybe you must know the darkness before you can appreciate the light.”

-Madeline L’Engle.

Despite any gains that copy trading has, it also contains disadvantages that traders and investors should know. These disadvantages are:

Cons for Traders

- Reputation risk: If the copiers do not make a profit, the professional trader’s reputation may be damaged. This can lead to a loss of clients and a reduction in income.

- Legal and regulatory risks: Copy trading may be subject to legal and regulatory requirements, which can be complex and time-consuming to navigate. Professional traders may need to seek legal advice to ensure they are compliant with all relevant regulations.

- Increased competition: Copy trading can increase competition among professional traders. This can lead to a reduction in profits and a loss of clients.

Cons for Investors

- In-depth research is needed by investors (especially beginners) to find proper Providers on platforms

- Persistent monitoring of PNL, using automatic software

- No guarantee for the positions, which may backfire

- Difficulty in finding an appropriate trader

- Unbeknownst risks due to lack of enough experience or knowledge

- Extra Costs as subscription fees for some traders

Types of Fees in Copy Trading

Copy trading platforms typically charge fees for their services, which can vary depending on the platform and the specific features offered. Here are some of the most common types of fees associated with copy trading:

- Performance fees: Some copy trading platforms charge a performance fee, which is a percentage of the profits earned by the investor. This fee is typically charged on a monthly or quarterly basis.

- Spread fees: Copy trading platforms may also charge a spread fee, which is the difference between the buy and sell price of an asset. This fee is typically charged on each trade and can vary depending on the asset being traded.

- Subscription fees: Some copy trading platforms charge a subscription fee, which is a fixed amount paid by the investor on a monthly or yearly basis. This fee may provide access to additional features or services on the platform.

- Withdrawal fees: Copy trading platforms may also charge a fee for withdrawing funds from the investor’s account. This fee can vary depending on the platform and the withdrawal method used.

- Inactivity fees: Some copy trading platforms may charge an inactivity fee if the investor does not use their account for a certain period of time. This fee is typically charged on a monthly or yearly basis.

It’s important to carefully review the fee structure of any copy trading platform before deciding to use their services. Investors should also consider the potential returns and risks associated with copy trading, as well as any additional costs such as taxes or trading fees.

Best 5 Copy Trading Software List

We will separate the names, although a trader may be active in the forex and crypto markets. In short, the following are recommended for forex traders:

- HFM

- BlackBull Markets

- FP Markets

- Pepperstone

- BDSwiss

And here are the apps mentioned in other articles as the top 5 crypto copy trading platforms:

- Finestel

- Coinstats

- Kubera

- Cointracker

- Coin market manager

Features to Look for in Copy Trading Software

Everyone who steps into crypto tracking platforms seeks goals achievable via various features, such as assistive properties. Any copy trading platform is expected to include the following features:

- Ease of Use: e.g., having a user-friendly design and all-in-one dashboard

- Reliability: Smooth performance away from any failure

- Customer Support: Available and quick response to challenges of users

- Protection of Capital: Avoid cooperating with traders who exaggerate in self-definition

Is Copy Trading Legal?

YES. Copy trading is a legal practice in most jurisdictions. It is investment advice where investors copy the trades of other, more experienced traders. Some regulations may apply to copy trading, depending on the jurisdiction. In the United States, copy trading is regulated by the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC). Read more here.

For Muslims’ consideration: It is halal and is not haram.

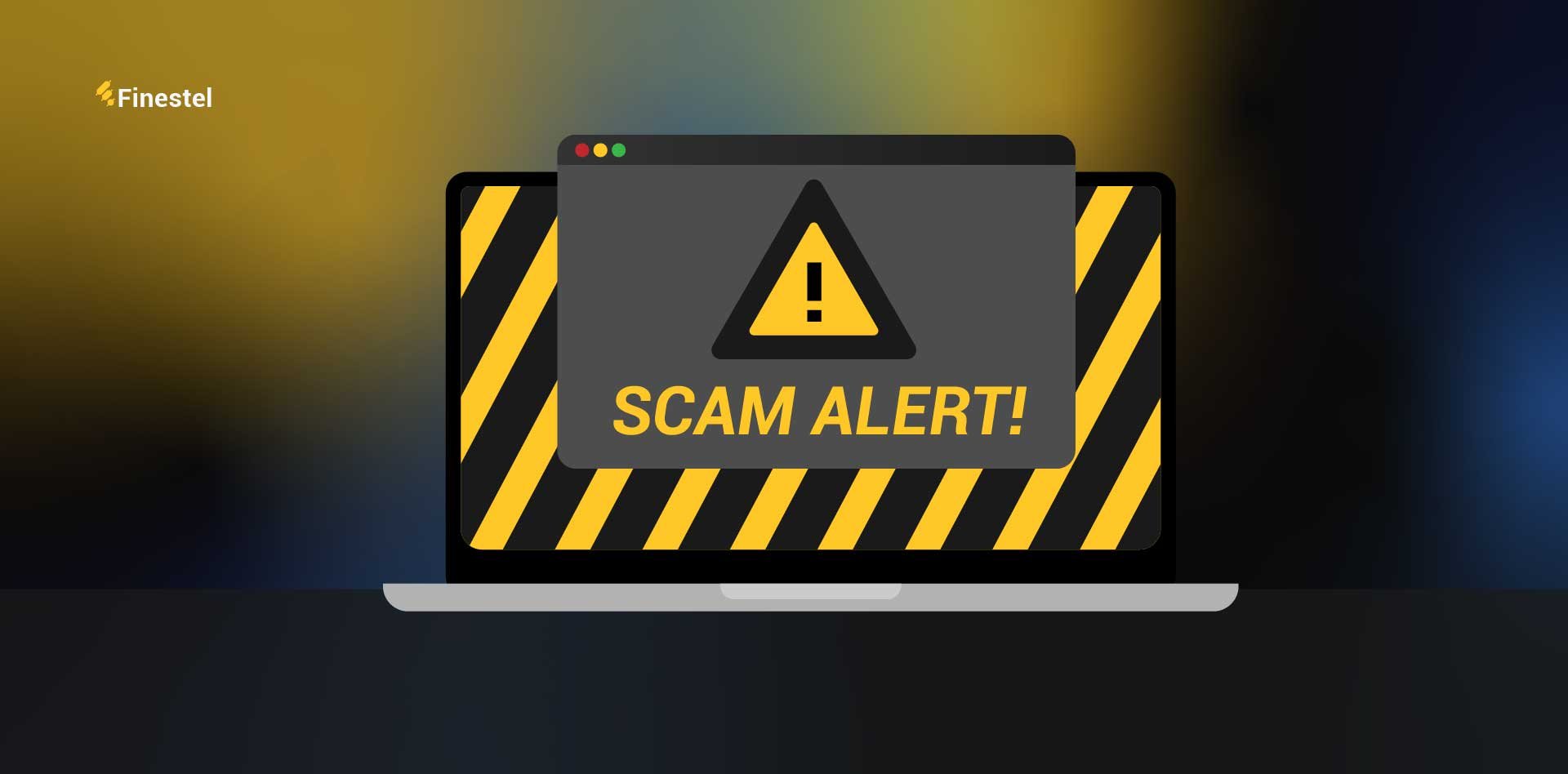

How can traders avoid scams and fraudulent copy-trading schemes?

Several scams target copy traders. Here are some tips on how to avoid scams in copy trading:

- Due Diligence

- Make sure of guarantees.

- Examine platforms with low capital.

- Do not follow exaggerating providers.

Risks of copy trading

Everyone who tries copy trading will encounter risks. To avoid unsuccessful copying, Here are some risks of copy trading to be aware of:

Risks for Traders

- Technical Issues: Despite machines being designed to work perfectly, glitches are inevitable and can cause order execution slippages.

- Slow Replication: The speed of trade replication is crucial in copy trading software. Some platforms execute replications accurately and at lightning speed, while others lack speed, leading to significant execution price slippages.

- Liquidity: Copy trading platforms can send massive orders for trading pairs to crypto exchanges, causing sudden price movements. In such cases, orders, especially market orders, may fill at different price points on some copy trader exchange accounts.

- Terminal of Choice: Traders may need to use the platform’s terminal to implement strategies instead of their exchange account terminal.

- Lack of Communication with Clients: Communication between traders and clients is often limited to chat boxes, comment sections, or private messengers, leading to a lack of connection.

- Lack of Customizations: Many copy trading platforms have fixed pricing models and cycles for traders and lack reporting modifications.

- Lack of Non-Custodial Asset Management Ability: Some copy trading platforms require participants to deposit funds into the platform for copy trading instead of using the API copy trading method.

- Lack of Private Copy Trading Service: Some traders may prefer to provide their services only to their community and not share their clients with the copy trading platform. Additionally, traders may not want their private community to see other traders on the platform. Note: these issues are more common on social trading platforms.

Risks for Investors

- Less Control: Copy trading aims to have professional trading operations on your exchange account without manipulation after execution. It’s not recommended to trade on the account that you’re copying a trader with.

- The Trader’s Faults: Professional traders are not always profitable and can make mistakes, lose trades, and money too, even if they have a good track record.

- Technical Issues: Bugs and glitches may occur between copy trading platforms and connected exchanges at times.

How can traders mitigate the risks of copy trading?

There are several solutions to mitigate risks associated with copy trading:

- Diversify your investments by copying a variety of copy traders

- Set stop-loss orders to limit your losses in conditions of the market’s opposite trend

- Monitor investments closely and be prepared to take necessary actions

What Is Copy Trading Infographic

Conclusion

Copy trading, a trending strategy in financial markets, offers investors the chance to replicate the moves of seasoned traders. This approach can be convenient and effective, provided one fully acknowledges the inherent risks. Before utilizing copy trading, thorough research is crucial to select a credible broker and a successful copy trader. Risk awareness is also pivotal, including the important principle of investing in what one is prepared to lose.

Copy trading presents an attractive prospect for navigating financial markets with the potential for effective returns. However, it’s vital to be cognizant of the risks, to ensure the selection of a trustworthy broker and an accomplished copy trader, and to maintain a cautious investment strategy that preserves your financial security.

FAQ

What is the subscription fee for copy trading apps?

Copy trading platforms charge a subscription fee to cover the costs of providing their services, including the development and maintenance of their platform, customer support, and other operational expenses. Subscription fees for copy trading apps vary depending on the platform and the specific features offered. They can range from a few dollars per month to several hundred dollars per year.

Is copy trading a reliable investment strategy?

Copy trading can be a reliable investment strategy if done correctly. It involves copying the trades of successful traders, which can potentially lead to profits. However, it is important to thoroughly research and choose a reputable copy trading platform and to carefully select the traders to copy.

How can I find successful traders to copy?

Investors can identify them by searching the platforms and studying the portfolio of traders who have been slowly and steadily gaining. They can also analyze the trader’s trading history, risk management strategies, and performance metrics to determine if they are a good fit for your investment goals and risk tolerance.

What are the risks associated with copy trading?

Cryptocurrencies have high price volatility, which can lead to market risk and potential loss of capital. Copiers who do not define their maximum drawdown may also face liquidity risk. Additionally, there is a rare but possible systematic risk where capital could get locked up, and traders may not be able to exit positions.

How can copy trading help investors generate additional income streams and achieve financial independence?

Copy trading can help investors generate additional income streams and achieve financial independence by allowing them to follow and copy the trades of successful traders, potentially leading to profits. It can also save time and effort by automating the trading process and allowing investors to focus on other income-generating activities.

Is copy trading guaranteed to make me money?

Copy trading is not guaranteed to make you money. While it can potentially lead to profits by copying the trades of successful traders, there are also risks involved, such as market volatility, hidden fees, and the potential for losses. It is important to carefully research and choose a reputable copy trading platform and only to invest what you can afford to lose.

The information provided in this blog post is highly valuable.