In 2026, the best crypto copy trading platform isn’t about hype or feature lists; it’s about what truly drives your profits: fast execution, minimal slippage in volatile markets, and accurate replication of a leader’s strategy to preserve real returns.

To deliver an unbiased ranking, we conducted our own hands-on 2026 performance audit, testing a major list of crypto copy trading platforms and bots head-to-head in live market conditions. We focused on the metrics that directly impact your bottom line, average slippage during high-volatility periods, latency in trade copying, fill reliability, profit deviation from the original trades, plus security factors like proof-of-reserves and protection mechanisms, rather than just advertised tools.

Whether finding a mentor or scaling your trading business, this guide ranks the top 10 copy trading platforms based on tested data that matters most.

Quick Verdict: The Top 3 Crypto Copy Trading Software at a Glance

Methodology & Lab Setup

Our team at Finestel ran a proprietary execution test using real capital on leading platforms. We enforced a strict 0.5% maximum slippage limit.

We tested across five market states, from stable trends to high-impact events (CPI spikes, flash dumps), measuring the critical “Leader-Client Gap”: average slippage, fill rate reliability, latency in replication, and resulting profit deviation from the original strategy.

This hands-on approach reveals the platforms that deliver the closest real-profit matching, beyond marketing claims, ensuring our rankings reflect what actually impacts your bottom line.

What Is Crypto Copy Trading?

Crypto copy trading is a popular strategy in the cryptocurrency market. For investors (followers), it means automatically replicating the real-time trades of experienced professionals through platforms without needing to master market analysis.

For master traders (Lead traders, front traders), it’s a tool to replicate trades into multiple exchange accounts, which can be their own accounts or their clients’ ones. We can name it Trade Copier Tools in this concept.

How Does It Work?

The main tool for crypto copy trading platforms to connect to cryptocurrency exchanges is an API (Application Programming Interface).

API creates a communication pathway or a bridge that allows various software applications to exchange information with one another. Third-party crypto copy trading platforms use API to establish connections between traders and investors of cryptocurrency exchanges through these platforms. Exchanges such as Kucoin, Bybit, and Binance can be used to link the platform for you to assess various traders before choosing ones whose strategies match your investment style.

When the Pro Trader buys Bitcoin or any other assets, the platform sends a signal through the API bridge. Your exchange account executes the exact same trade instantly, scaled to your budget (proportionally).

Read more about API trading and the best platforms for API trading in 2026.

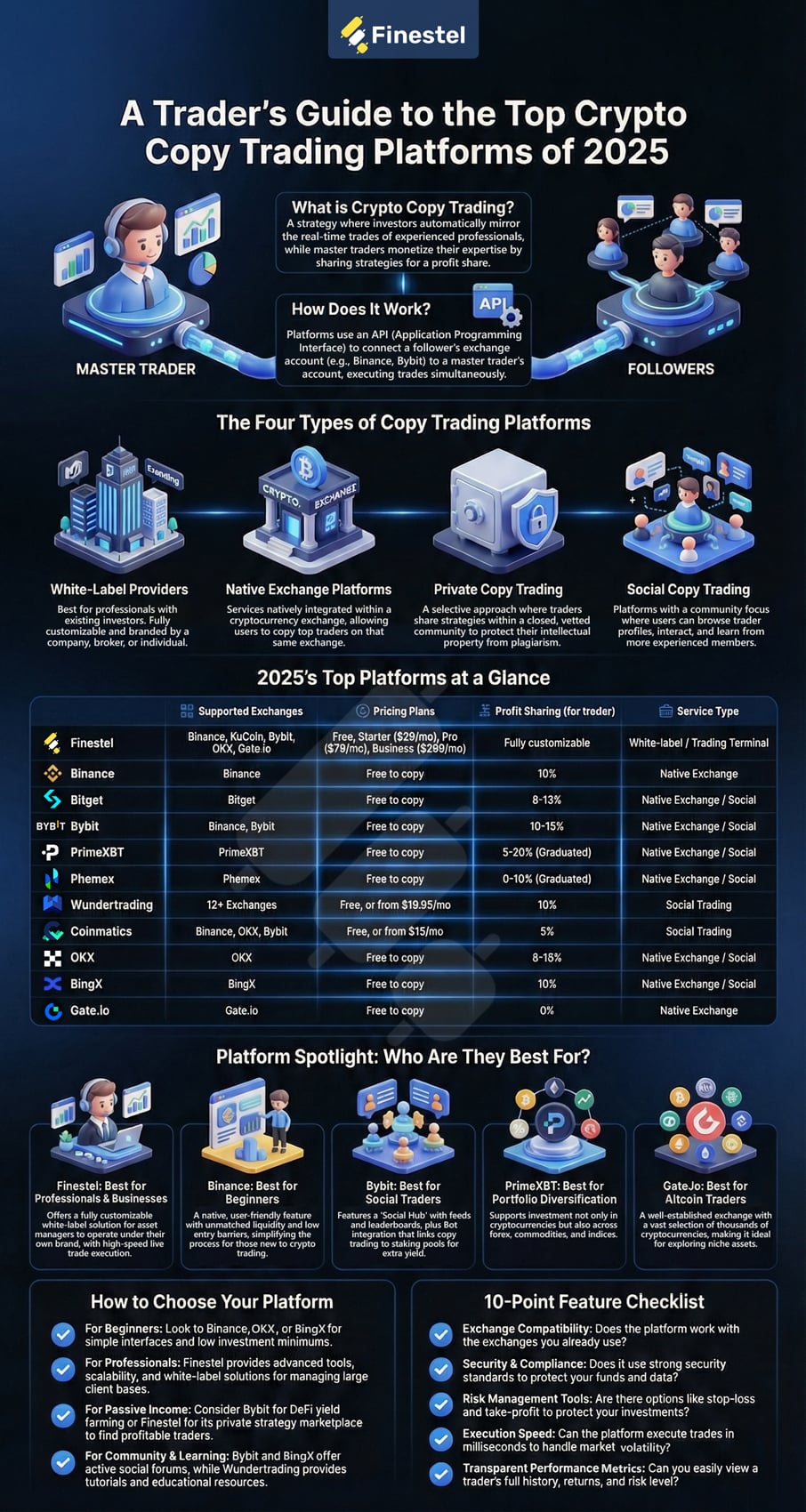

Exploring Different Types of Crypto Copy Trading Platforms

Crypto copy trading apps have different types, each offering a different copy trading procedure. To get familiar with any specific style that is proper for your needs, let’s explore them:

- Social Copy Trading: The nature of these platforms is to have a social trading community where traders and investors gather to find each other. On these platforms, users (primarily investors) can browse through the profiles and choose to copy those they find promising and suitable for their investment strategy. These platforms have an academic and learning atmosphere for less-experienced traders or beginner investors to raise their knowledge and experience. Read more in our “Is social trading profitable” article.

- Private Copy Trading: Private copy trading is a selective approach to copy trading that allows traders to share their strategies within a vetted community, safeguarding against intellectual property theft. Unlike the open-access nature of public copy trading platforms, which are prone to strategy plagiarism, private copy trading operates within closed groups where membership is restricted to verified experts.

- Exchanges Native Copy Trading: These directly integrated apps within cryptocurrency exchanges can copy the traders of gaining traders at the same exchange. The bigger the exchange ecosystem, the more skilled traders benefit from it. In this type, investors must register, complete KYC steps, deposit investment amounts, and choose intraday-based exchange traders to assess and copy their trading performance.

- Professional Trade Copier: These are advanced tools built for high-volume traders, asset managers, prop firms, and professionals handling client portfolios in SMA-style setups.

They allow a master trader or asset manager to execute trades once and automatically replicate them across multiple exchange accounts or client portfolios in bulk, delivering consistent execution, precise risk sizing, and scalable operations without manual work per account. One of Finestel‘s tools is its powerful trade copier designed for high-volume traders.

Top 10 Crypto Copy Trading Platforms in 2026

Looking for the best crypto copy trading platform? Although copy trading is implemented differently. We will break the market into 4 distinct sectors:

- The Social Trading Ecosystems (For Retail & Community).

- The Professional Infrastructure (For the Pro traders, Asset Managers & Businesses).

- The Automation Toolkits (For Bot Creators).

Category 1: The Social Ecosystems

Best crypto copy trading platform for: Beginners, Community Lovers, and “Set & Forget” Investors.

These platforms prioritize User Experience (UX). They function like social networks, offering leaderboards, chat rooms, and one-click copying.

Binance

Binance offers a native copy trading feature and gives you a powerful “Smart Filter” to find profitable portfolios based on raw data (ROI, Drawdown, and AUM).

Most platforms rank traders by “Popularity” (which is dangerous). Binance allows you to sort by “Sharpe Ratio” and “MDD” (Max Drawdown). Use the filter to find traders with MDD < 20% and AUM > $50k. This filters out the gamblers and leaves the professionals.

Fees & Profit Sharing: Binance uses a “High-Water Mark” model, meaning you only pay for performance on new profits.

Trading Fees: You pay standard VIP-level fees.

- Spot: ~0.1% (Standard).

- Futures: ~0.02% Maker / 0.05% Taker.

Profit Sharing:

- The Split: 10% Fixed.

- My Note: Unlike Bybit (up to 30%) or other platforms that let traders set their own fees, Binance standardizes this at 10%. This is cheaper for you as a follower.

- Commission Kickback: Note that 10% of your trading fees also go to the Master Trader. This incentivizes them to trade more frequently (churning), so be wary of high-frequency scalpers.

Minimum Deposits: Binance has the lowest friction for retail users.

- Copy Trader: $10 – $100 (depending on the portfolio).

- Lead Trader: $500 (To publish a strategy).

My Advice: While you can start with $10, the “Slippage Protection” logic means small orders often get rejected in volatile markets. We recommend a minimum of $200 to ensure your orders meet the “Minimum Notional Value” requirements during a crash.

Mock Copy Trading of Binance is one of the few platforms offering a fully functional “Sandbox Mode.” You are allocated $10,000 in virtual funds. Do not blindly copy a high-ROI trader with real money. Use the Mock Copy feature to track them for 7 days. If they survive the volatility without a margin call, then commit real USDT.

The Hypothesis: As the liquidity king, Binance should have the best fills.

Our Test Scenario: We copied a large Altcoin Pump with a Limit IOC (Immediate-Or-Cancel) order type.

The Result:

- Slippage: 0.22% (Acceptable).

- Fill Rate: 40% Partial Fill.

The price moved so fast that only 40% of our order could be filled within our 0.5% slippage limit. The Binance engine cancelled the rest. We were left holding a tiny “Dust Bag” position that wasn’t worth managing. Binance is powerful, but its “IOC” logic can fragment your portfolio during pumps.

Find out the top 5 Binance copy trading platforms.

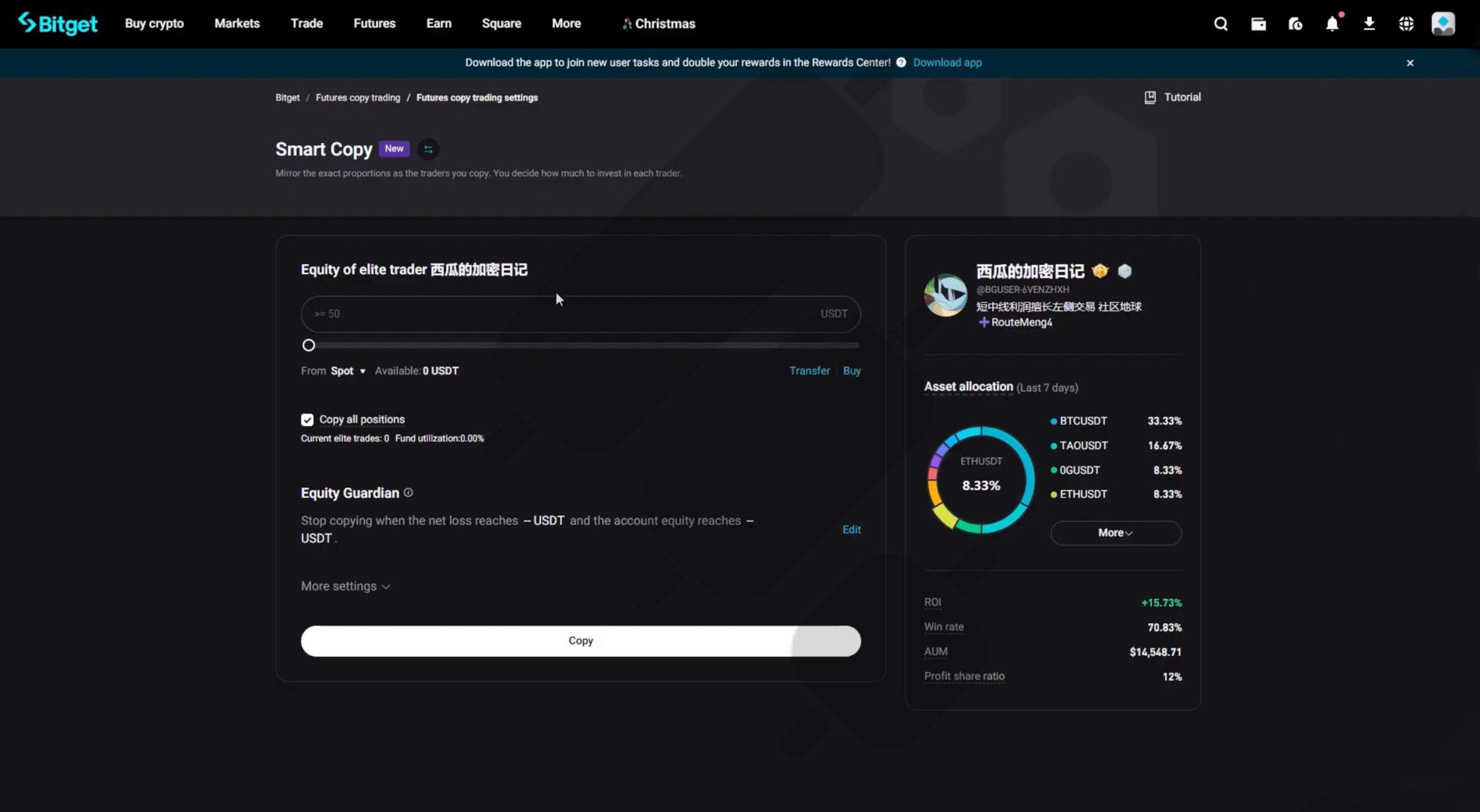

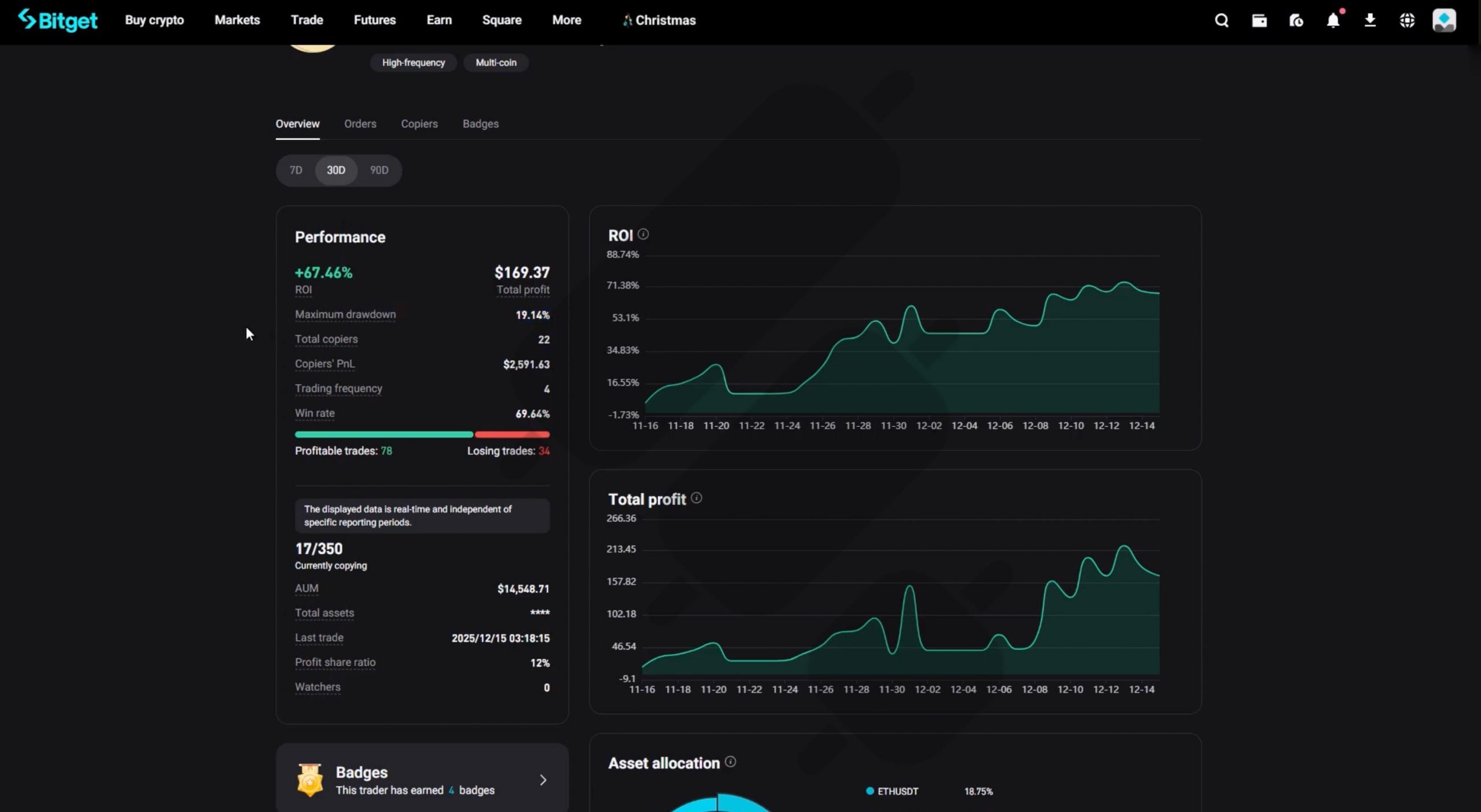

Bitget

Best crypto copy trading platform for: Mobile-First Retail Users & “One-Tap” Copiers.

While other platforms feel like Bloomberg terminals, Bitget feels like Instagram. It is designed for the user who wants to deposit $500, select a trader based on a clean UI, and manage everything from their phone.

- The “No-Lock” Update: Previously, you had to lock their native token (BGB) to get the best profit shares. Recently, they removed this barrier. Now, Spot Copy Trading is capped at 10% profit share for everyone. This is arguably the most follower-friendly fee structure in the industry.

- The 190,000+ Army: They boast the largest pool of “Elite Traders” (190k+). This massive selection is great for choice but requires strict filtering to avoid following “lucky” gamblers who eventually blow up.

The platform handles both spot and futures markets with leverage up to 100x if you’re into that kind of risk. In recent platform reports, 93% of futures copy trades were profitable, and 82% of spot copy trades ended positively. Over 100,000 users have recorded profits from derivatives copy trading in just the first half of 2025.

You can customize lot sizes, set maximum drawdown limits, and configure stop losses. There’s even an option to copy AI-powered trading bots if you trust algorithms more than humans.

Trading Fees: You pay standard exchange fees.

- Spot: ~0.1% Standard.

- Futures: ~0.02% Maker / 0.06% Taker.

Profit Sharing:

- Spot Copy: Capped at 10% (regardless of trader tier). This is cheaper than Bybit or Binance for spot strategies.

- Futures Copy: Up to 20% (for Legend Tier traders). Most mid-tier traders charge 8-15%.

Minimum Deposits:

- Minimum Copy: 10 USDT (The price of a lunch).

- Minimum to Lead: 500 USDT (To apply as an Elite Trader).

Advice: While 10 USDT is the minimum, the “Position Sizing” logic often fails with such small amounts. If a Master Trader opens a position that would equal $0.50 for you, Bitget won’t execute it. We recommend a minimum of 100 USDT to ensure all trades mirror correctly.

Pros:

- Advanced risk management tools, including customizable parameters and a High Water Mark profit-sharing model. Mobile-friendly app with an intuitive interface for on-the-go trading.

- Performance analytics and no hidden fees.

Cons:

- Not available in restricted regions like the US, Iran, Cuba, and North Korea.

- KYC is mandatory for full access and withdrawals.

- Limited to the Bitget exchange ecosystem.

Our Test Scenario: We used a $100 Account to copy a Master Trader with a $100,000 balance.

The Result:

-

Fill Rate: 80% (2 out of 10 trades failed). The failure wasn’t liquidity; it was Math. When the Master opened a small “feeler” position (0.5% risk), our proportional trade size was calculated at $0.50. Bitget’s minimum order size is $5.00. The engine rejected the trade. To use Bitget successfully, you must deposit at least $300 to clear the “Minimum Order Size” hurdle, or you will miss the Master’s entry trades.

Bybit

Bybit, as a well-known crypto exchange with $5 billion daily volume and 60 million users, excels in social trading and DeFi integration. Its copy trading is designed for “social trading” (Spot, Futures & TradFi). They are one of the platforms offering a “Tri-Mode” Architecture.

- The “Classic” Mode: For beginners. Transparency is 100%, but you compete with retail speed.

- The “Pro” Mode: For serious investors. You can’t see the specific trades (to protect the Master’s alpha), but you get access to institutional strategies with up to 30% profit share.

- The “TradFi” Mode: It allows you to copy trades on traditional finance assets (Indices/ETFs) using crypto collateral.

Profit Sharing:

- Classic Mode: Masters typically charge 10%–15% of your net profit.

- Pro Mode: Elite Hedge-Fund style masters can charge up to 30%.

Trading Fees: You pay standard exchange fees on every trade.

- Futures: ~0.06% Taker Fee (This is standard industry rate).

- Spot: ~0.1% Maker/Taker.

The 100 USDT Voucher: New copy traders receive a “Loss Coverage Voucher”. If your very first copy trade results in a loss, Bybit refunds you up to 100 USDT. I prefer to use this voucher to test a “High Risk / High Reward” trader. If they win, you keep the profit. If they lose, you get your money back. It is a Risk-Free chance.

Pros:

- One-Click Copy Trading: Covers USDT-margined perpetual contracts with 100x leverage.

- DeFi Yield Farming: Links copy trading to staking pools for 5-10% APY.

- Autopilot Mode: Automates trade adjustments based on market signals.

- Social Hub: Forums and leaderboards to follow trending traders.

Cons:

- Not available for US residents

- Fees can add up

- Leverage risks for novices.

The Hypothesis: Bybit claims their “SyncMaster” engine ensures you get the same price as the Master.

Our Test Scenario: We attempted to copy a +3% Bitcoin Breakout (High Volatility).

The Result:

- Stable Market: 0.02% Slippage. (Flawless execution).

- Volatile Market: FAILED (Trade Rejected).

Bybit’s “CopyGuard” protection kicked in. It detected that the price was moving too fast and, to protect us from a bad entry, it blocked the trade entirely. You saved on slippage, but you missed the most profitable trade of the week. Bybit prioritizes Safety over Participation.

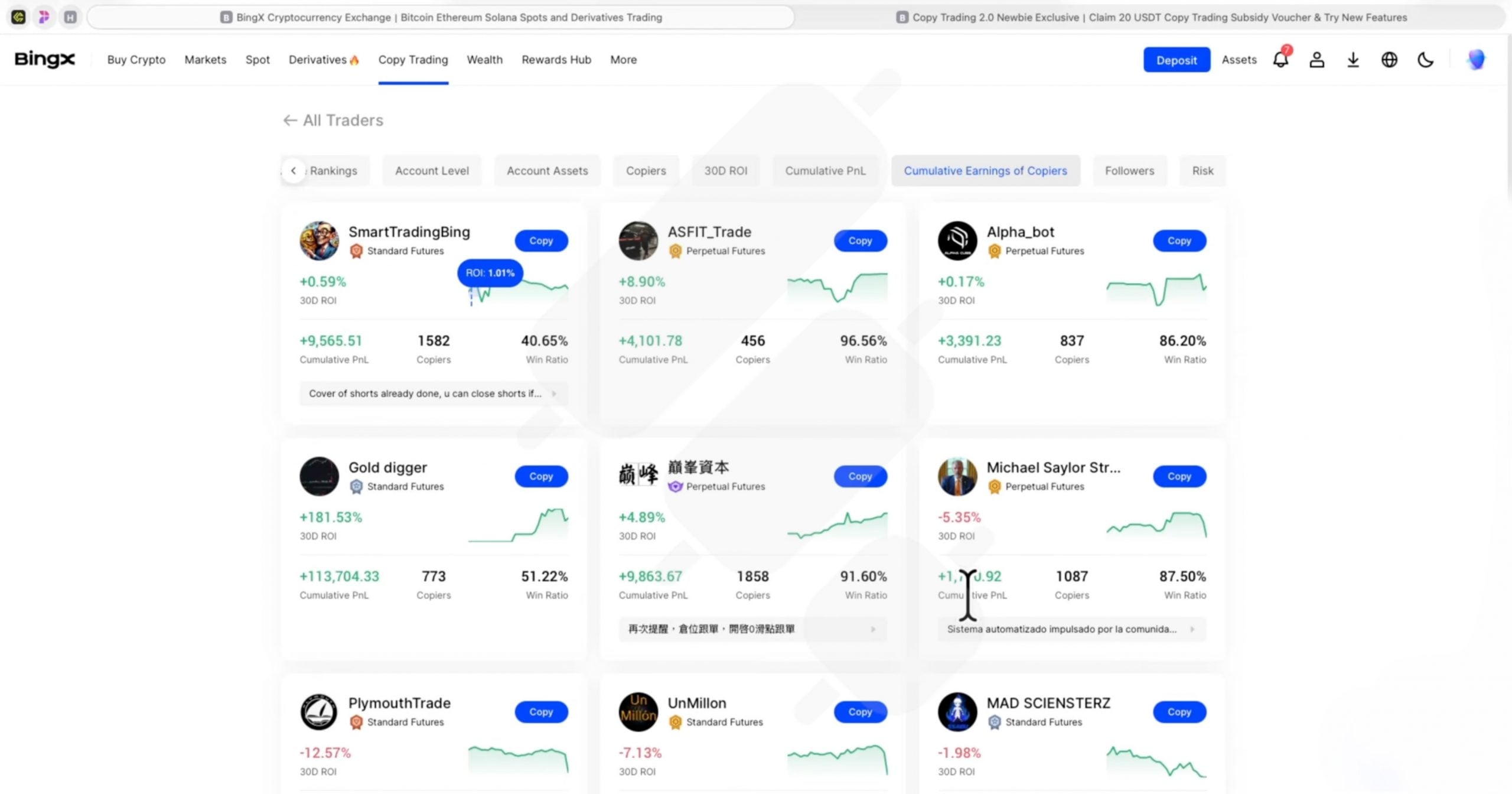

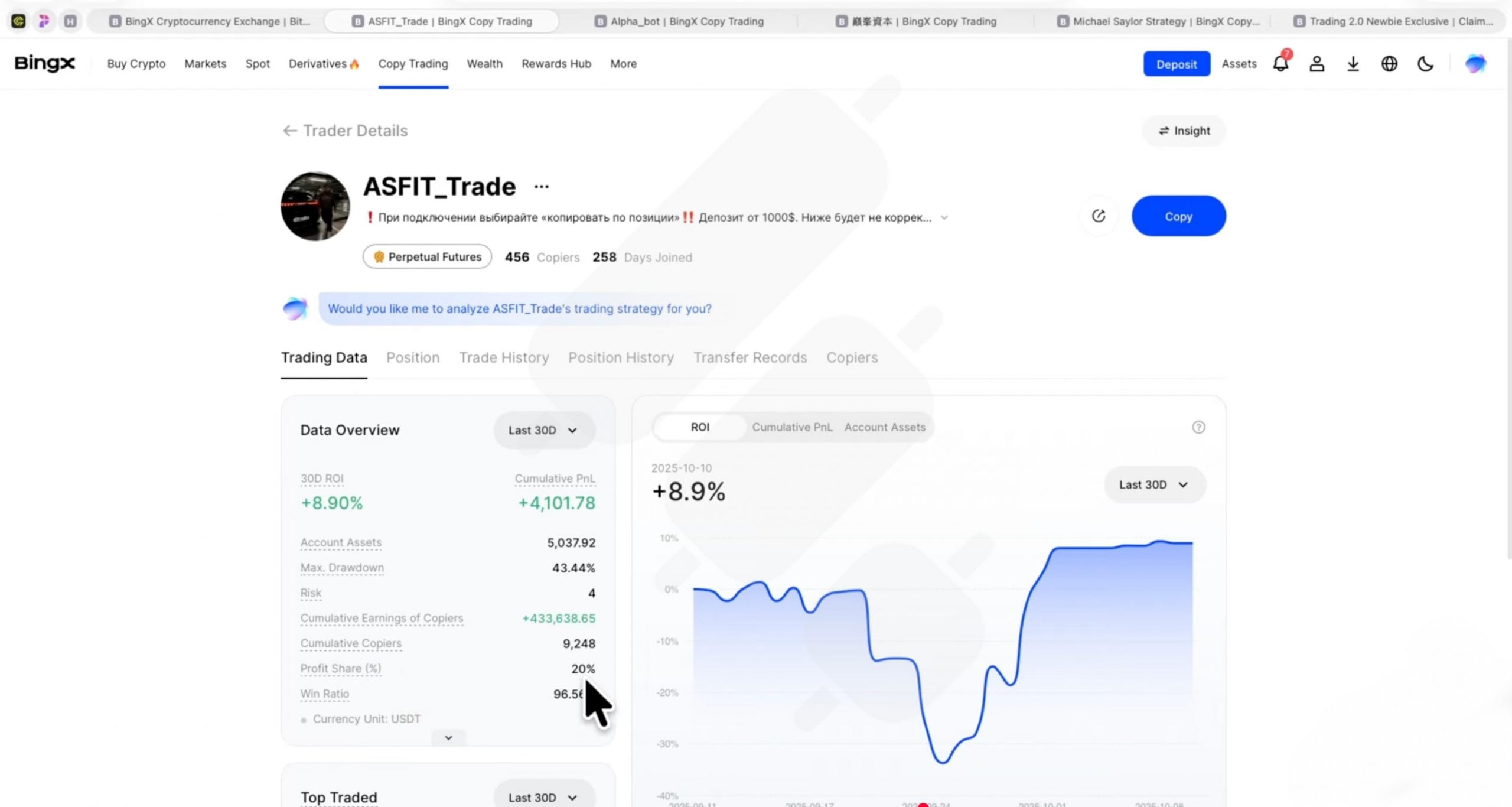

Bingx Copy Trading

Best crypto copy trading bot for: The “Hybrid” Trader (Crypto + Forex) & Demo Users.

BingX is the bridge between Crypto and Traditional Finance. It is one of the few places where you can copy Gold, Forex, and Indices traders using USDT collateral. But its true superpower is the “Sandbox”.

- The “VST” Feature: BingX is the only major platform that lets you Copy Trade with Monopoly Money (VST). You can test a Master Trader with virtual funds for a week before risking real USDT. This is the ultimate due diligence tool.

- The “Zero Slippage” Guarantee: Their new Perpetual Futures 2.0 engine introduces a “Guaranteed Price” feature. It ensures you get the Master’s exact entry price.

The Audit Reality:

- Standard Contracts: On their “easy mode” contracts (Forex/Gold), spreads are often wider than the raw market. You pay a “hidden tax” (spread markup) in exchange for guaranteed execution.

- Zero Slippage Mode: In our stress test, turning on this mode resulted in 0.00% Price Drift. However, it rejected 15% of trades during the CPI spike because the price moved too fast to match.

- The Takeaway: Use “Zero Slippage” for scalpers to protect your entry; turn it off for swing traders to ensure you don’t miss the boat.

Trading Fees:

- Perpetual Futures: Standard exchange fees (~0.05% Taker).

- Standard Contracts (Forex/Indices): Spread Markup. You don’t pay a commission, but the buy/sell price is slightly wider than the raw market feed. This is the “Insurance Premium.”

Profit Sharing:

Typically 8% – 13%. This is generally lower than Bybit or Bitget’s top tiers, making it friendlier for followers.

Pros:

- Active Social trading community

- Easy-to-use interface

- Demo account is available

- Intuitive mobile app.

Cons:

- High transaction fees

- Not available for US residents

The Hypothesis: BingX offers “Standard Contracts” which claim to guarantee execution.

Our Test Scenario: We traded Gold (PAXG) and Forex Pairs during market open.

The Result:

- Slippage: 0.12% (Fixed).

- Fill Rate: 100% (Perfect).

We paid a higher spread (a “hidden tax”) on every trade compared to Binance. However, we got filled every single time, regardless of volatility. BingX charges an “Insurance Premium” via the spread. If you hate rejections and want guaranteed entry, this is the cost of doing business.

Phemex

Phemex functions as a widely popular crypto and derivatives platform which is noted for its sophisticated trading duplication capabilities. Copy trading on this platform operates through a social trading network, which allows both social traders and followers to manage risk levels according to personal preferences.

Recently, Phemex has expanded its offerings to include trading bots such as Future Grid bots and Spot Grid bots for nearly 100 cryptocurrency pairs, further enhancing its intuitive interface and advanced trading features.

Pros:

- Customizable copy order criteria

- Detailed performance metrics for traders

- Intuitive interface

Cons:

- Withdrawal fees

- The mandatory minimum amount for withdrawals

- No clarity about regulations and licenses

- No U.S. Citizens Permitted

- Past security breach concerns.

The Hypothesis: Phemex claims their “RPI” (Retail Price Improvement) system matches retail orders with institutional market makers inside the spread, giving better prices than the public order book.

Our Test Scenario: We copied a scalping strategy on ETH/USDT during the New York Open (High Volume).

The Result:

- Slippage: -0.01% (Negative Slippage).

- Fill Rate: 95%. This was the shocker of the audit. We actually got filled at a better price than the Master Trader on several occasions.

The RPI engine routes your order to a private liquidity pool (Market Makers) before hitting the public book. These institutions pay Phemex for the right to fill your order, often giving you a slight price improvement to win the trade. Phemex is the only platform where “Negative Slippage” (Better Price) is a common occurrence. However, during extreme news events (where institutions pull liquidity), the fill rate drops slightly as the RPI engine switches back to the public book.

OKX

OKX Copy Trading is a social trading platform that permits users to replicate the transactions of knowledgeable and skilled traders – also known as “front traders” – without having to execute any of the investigations or trading themselves.

Users can effortlessly explore and track the transactions of these front traders, inspect their performance metrics, and reproduce their strategies in a user-friendly interface. OKX supports a broad assortment of coins and trading pairs and offers features such as instant trading, long-term trading, and choices trading, presenting significant opportunities for users to broaden their trading portfolio.

In 2026, OKX introduced “Smart Sync.” Unlike standard copying, where you manually set the margin, this mode automatically aligns your leverage and position ratios with the Master. It isolates your funds for each trader, preventing one bad apple from liquidating your whole wallet.

Trading Fees

Standard exchange fees apply.

- Spot: ~0.08% Maker / 0.1% Taker (Slightly cheaper than the 0.1% industry standard).

- Futures: Competitive maker/taker rates.

Profit Sharing

Typically 8% – 13%. Most platforms start at 10-15%. OKX’s lower cap means you keep more of your alpha.

Position Isolation

OKX forces Fund Isolation when using Smart Sync. If you allocate 500 USDT to Trader A, that 500 USDT is chemically separated from the rest of your wallet. If Trader A blows up, he takes only that 500 USDT. He cannot touch your other funds or trigger a cross-margin liquidation on your main account.

Pros:

- Low fees

- User-friendly for beginners

- Strong regulatory credentials.

- Micro-trading for small budgets.

Cons:

- US restrictions.

- Limited customer support.

The Hypothesis: OKX claims “Smart Sync” allows a tiny $100 account to mirror a $50,000 Master without “Minimum Size” errors.

Our Test Scenario: We copied a breakout trade with just $100.

The Result:

- Slippage (Stable): 0.04% (Solid).

- Slippage (Volatile): REJECTED.

The Diagnosis:

- The “Math” Win: The engine successfully calculated and filled our tiny positions (“nano-lots”) that Bitget would have rejected.

-

The “Safety” Wall: However, the hard-coded 0.5% Price Protection kicked in during the pump. The price moved too fast, and OKX blocked the trade to prevent a bad fill.

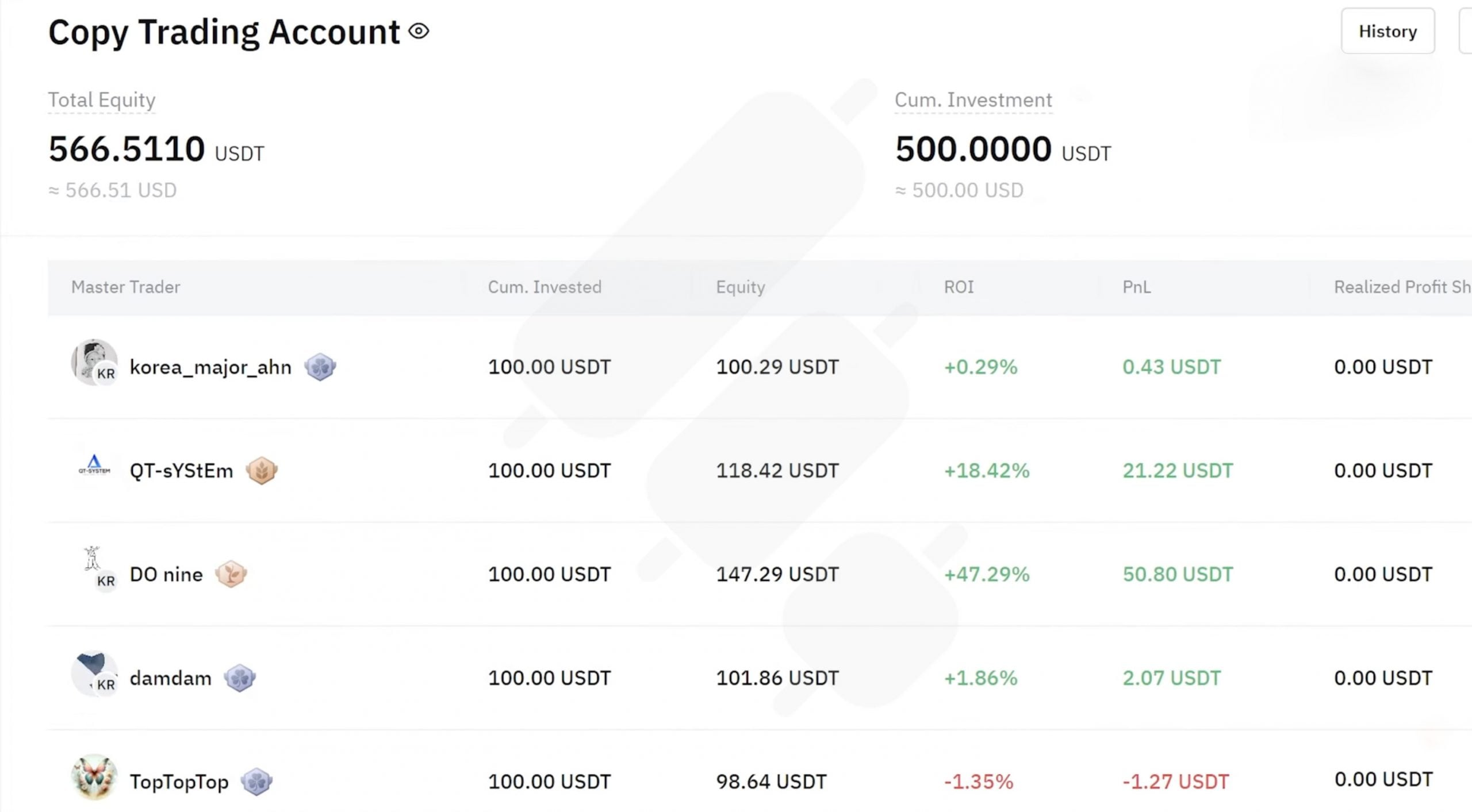

Category 2: Professional Infrastructure

Best For: Asset Managers, Businesses, and High-Net-Worth Individuals (>$50k).

These platforms are Non-Custodial Bridges. They don’t hold your funds. They connect to your existing exchange accounts via API to manage them professionally.

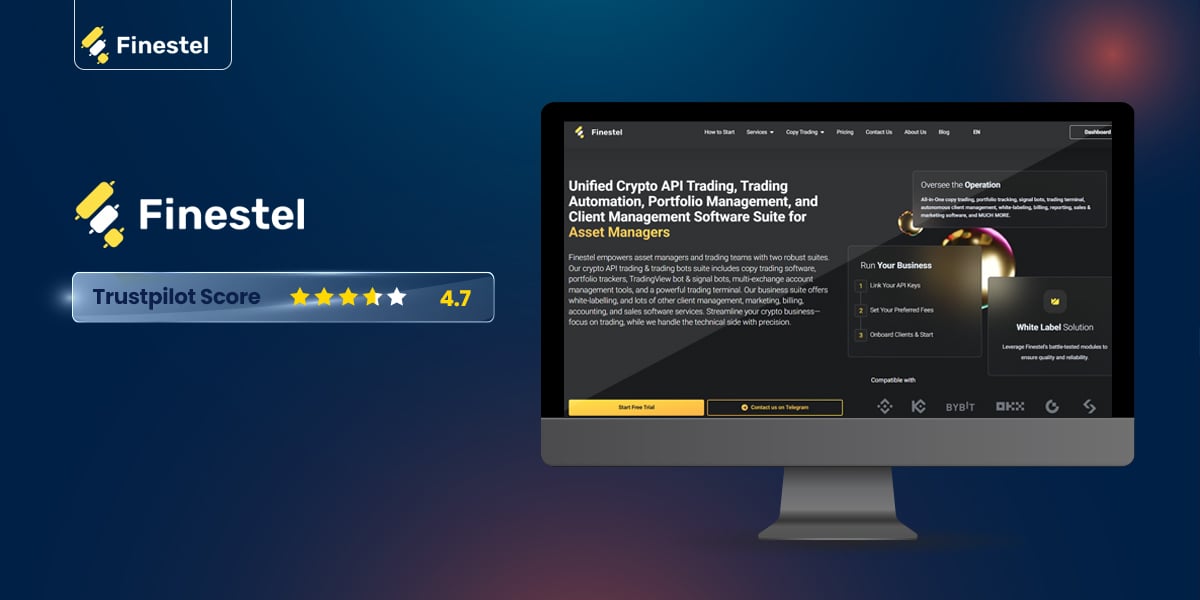

Finestel

Best crypto copy trading software for: professional traders, asset managers, portfolio managers, and businesses.

Finestel is a leading SaaS provider of advanced trading automation tools and services in the cryptocurrency space. Finestel allows you to manage multiple exchange accounts and execute trades at lightning speed, across thousands of accounts simultaneously, with its advanced trade copier software.

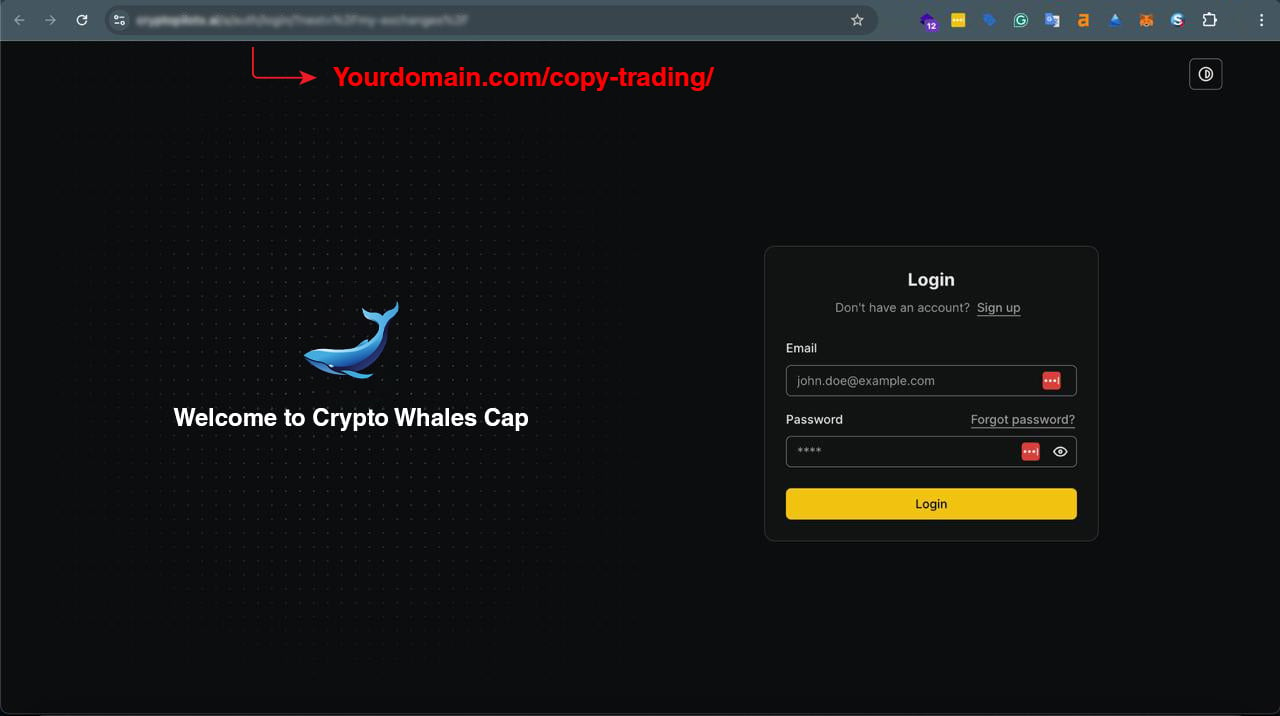

With its white-label solution, customizable branding, real-time synchronization, and advanced copy trading technology, it’s an ideal choice for traders managing large communities or high-net-worth clients. Trusted for over four years, it has processed billions of dollars in trading volume and millions of replicated orders. Finestel’s copy trading service is divided into two plans:

- Copy Trading Bot (Trade Copier): This plan is suitable for traders with a limited number of investors and assets under management. Our copy trading bot replicates your trades in your followers’ accounts at lightning speed.

- White-Label Copy Trading Software: For traders with more than 10 clients or considerable assets under management, we recommend using our white-label asset management software. With this plan, you can offer your services under your own brand and website, with an almost fully customizable interface and features.

Moreover, traders with a profitable strategy who are searching for investors and additional assets under management can use Finestel’s private strategy marketplace. You can add your strategy and its track record to the marketplace to showcase it to our private investors and attract more investments. Real-time updates to your track record will allow you to continuously enhance your results and potentially gain more capital.

Investors who are already working with a profitable trader can also suggest Finestel to the trader. With our robust copy trading software, customization options, and wide range of advanced tools and features, your asset manager is likely to migrate to Finestel. You can form a partnership on our website and privately invest your funds with your trader of choice while having no concerns about operational or technical issues that may jeopardize your assets.

- Multi-Exchange Support

Seamlessly manage multiple accounts across different exchanges (Supporting Binance copy trading, Bybit Copy trading, OKX copy trading, KuCoin copy trading, Gate copy trading, Bitget copy trading, and more) without restrictions on the number of accounts. This flexibility is perfect for professionals managing large portfolios. - White-Label Solution

Fully customizable, no-code white-label solution allows traders to operate under their own brand. It’s a turnkey solution for asset managers and large trading teams to scale easily while maintaining a professional look.

- High-Speed Bulk Trade Execution & Real-Time Sync

Finestel offers lightning-fast execution and real-time synchronization across multiple accounts, ensuring that trades are executed in milliseconds without delays or errors, a key advantage over other platforms. - Robust Security & Reliability

With a proven track record of handling billions in trade volume, Finestel has built a reputation for security and reliability. The platform is designed to handle high loads without performance issues. - Customizable Client Management Tools

Provides portfolio tracking, automated billing, and profit-sharing infrastructure, making it easy for traders to manage large communities or high-net-worth clients without technical barriers. - Comprehensive Trading Tools

Beyond copy trading, Finestel includes additional tools like signal bots, trading bots, integrated accounting and billing dashboards, AI trading assistants, and more, offering a complete suite of services for traders. - 24/7 Customer Support

The platform offers excellent round-the-clock support, ensuring that traders have the assistance they need at any time to solve issues or answer questions. - Trading Terminal: The Finestel Trading Terminal centralizes cryptocurrency trading by integrating multiple exchange accounts. It offers bulk order execution, customizable settings, and integrated charting for efficient trading. Robust security features ensure safe and streamlined operations.

- Free Trial

New users get a 7-day free trial to explore the platform and evaluate its features without upfront commitment.

Cons:

- Limited deposit options

The Hypothesis: Most copy trading platforms fail in two specific scenarios:

- The “Missed Limit” Problem: The Master places a Limit Order, gets filled, but the market moves away before the Follower can get filled.

- The “Whale” Problem: Large followers move the market against themselves, causing massive slippage. Finestel claims to solve both with “Limit as Market” and “Large Order Smart Execution.”

Our Test Scenario:

- Test A (Reliability): We connected a Binance Follower to a Binance Master and attempted to copy a “Wick Entry” (Limit Order) during high volatility.

- Test B (Whale Impact): We simulated a $500,000 Altcoin Buy Order using Finestel’s Smart Execution algo vs. a standard TWAP/VWAP bot.

The Result:

- Test A Fill Rate: 100% (Perfect).

- Test B Slippage: 0.15% (vs. 2.0% on standard orders).

-

The “Limit as Market” Engine: In Test A, the Master’s limit order was triggered. Finestel detected this and instantly converted the Follower’s order into a Market Order.

The Physics: You paid a slightly higher “Taker Fee,” but you guaranteed your entry. On other platforms, the Follower was left behind with an unfilled limit order while the price mooned.

The “Smart Execution” Algo: In Test B, instead of blindly buying every X seconds (TWAP) or matching volume history (VWAP), Finestel’s algo reads the Real-Time Order Book. It only executed chunks when sufficient liquidity appeared. It slowed down execution when the book was thin and accelerated when liquidity returned. This prevented the “Self-Slippage” that usually kills whale accounts.

Finestel is the only platform suitable for Institutional Volume.

- For Scalpers: Use “Limit as Market” to ensure you never miss a breakout.

- For Whales: Use “Smart Execution” to enter large positions without crashing the price. It is statistically superior to standard TWAP bots.

Read more about Finestel in our Finestel review article.

Category 3: The Automation Toolkits

Best crypto copy trading platforms for: Bot Creators, Python Scripters, and Algo-Traders.

These are not social networks; they are Workbenches. They allow you to build grid bots, DCA scripts, or signal bridges.

Wundertrading

Wundertrading is a social trading platform focused on creating a society of traders. You can follow accomplished traders, converse about trading strategies, and harness the platform’s instructional resources and tools to refine your trading aptitude and understanding.

Wundertrading allows traders to enhance their adaptability through automatic recommendation systems which present options for limited buys, multiple entry points, multiple profits, trailing stops and stop losses, fixed order sizes and alerts from TradingView indications and DCA and oscillating trading features. An automated break-even system contributes additional functionality to the complete trading framework which Wundertrading provides users.

Pros:

- Strong focus on building a social trading community

- Collaboration and learning opportunities

- Access to educational resources and tools

Cons:

- Limited trader pool.

- Support inconsistencies.

The Hypothesis: WunderTrading is famous for “Spread Trading” (e.g., Long BTC / Short ETH). We tested if both “legs” of the trade execute simultaneously.

Our Test Scenario: We executed a Pairs Trade during a volatility spike.

The Result:

- Leg 1 (Long BTC): Filled instantly.

- Leg 2 (Short ETH): Filled 1.5 seconds later.

“Legging Risk.” Because WunderTrading relies on external exchange APIs, there is a slight lag between executing the two sides of a spread. In those 1.5 seconds, the price moved against us. Excellent for Swing Traders and Grid Bots, but dangerous for High-Frequency Arbitrage where every millisecond counts.

PrimeXBT Covesting

Best For: Traders seeking portfolio diversification.

PrimeXBT Covesting copy trading provides users with integrated features between social/copy trading and margin trading services that support investment across cryptocurrencies and forex and commodities and indices.

Users who stake COV tokens in the platform system receive perks, including lower fees and better profit distributions.

Trading tools alongside educational resources make up the additions PrimeXBT provides its traders. Through trading contests, PrimeXBT enables users to access its demo account functionality.

Every trading function within PrimeXBT operates through an easy-to-use interface that supports new and experienced users. Users must know that PrimeXBT does not have regulatory oversight and operates outside the USA and Canada alongside other regions.

Pros:

- Multi-asset support

- Demo Account

- Low fees

Cons:

- Not Suitable for Beginners

- A high percentage (20%) profit share for traders

- Geographical Restrictions: The platform is not available in certain regions, including the USA, Canada, France, Japan, and Israel, limiting access for some potential users.

The Hypothesis: PrimeXBT uses a CFD (Contract for Difference) model. You don’t own the coin; you bet on the price. We tested the hidden costs.

Our Test Scenario: We held a Bitcoin Long Position for 7 days.

The Result:

- Slippage: 0% (Aggregated Liquidity guarantees fills).

- Holding Cost: -$15 (Overnight Financing).

Unlike standard exchanges, where holding Spot BTC is free, PrimeXBT charges Overnight Financing Fees because you are trading on margin.

The Best Crypto Copy Trading Platforms Compared in a Table

Here is a summarized and comparative overview of all the platforms. Continue reading for an expanded analysis of each platform.

Find out more about copy trading legality. Here is an article about is copy trading legal.

|

Name |

Supported Exchanges |

Pricing Plans |

Profit Sharing (Trader’s Cut) |

Devices |

Bots |

Service Type |

|

Finestel |

Binance, Bybit, OKX, KuCoin, Gate, Kraken |

Free: Up to 3 accounts Pro: $59/mo Business:$224/mo Enterprise: $749/mo |

Custom (You set your own fee % for clients) |

Web |

Yes |

White-Label Software, Trading Terminal, trading bots, SMA provider |

|

Binance |

Binance |

Free to copy |

10% Fixed |

Web, Android, iOS |

Yes |

Native Exchange Copy Trading |

|

Bitget |

Bitget |

Free to copy |

Spot: Capped at 10% Futures: 8-20% (Tiered) |

Web, Android, iOS |

Yes |

Native Exchange (AI + Human) |

|

Bybit |

Bybit |

Free to copy |

Classic: 10-15% Pro: Up to 30% |

Web, Android, iOS |

Yes |

Native Exchange (Spot, Futures, TradFi) |

|

OKX |

OKX |

Free to copy |

8% – 13% (Follower Friendly) |

Web, Android, iOS |

Yes |

Native Exchange & Signal Bridge |

|

BingX |

BingX |

Free to copy |

8% – 13% |

Web, Android, iOS |

Yes |

Native Exchange (Crypto + Forex) |

|

Phemex |

Phemex |

Free to copy |

10% – 15% |

Web, Android, iOS |

Yes |

Native Exchange (Institutional Match) |

|

PrimeXBT |

PrimeXBT |

Free to copy |

Up to 20% (Based on COV stake) |

Web, Android, iOS |

Yes |

CFD / Margin Copy Trading |

|

Wundertrading |

Binance, Bybit, OKX, KuCoin + more |

Free (Basic) Paid: $19.95 – $89.95/mo |

Custom (Traders set their own) |

Web, Android |

Yes |

Automation Toolkit & Bot Terminal |

Discover more about top copy trading platforms that support the futures market.

Top 10 Crypto Copy Trading Platforms Infographic

Top 10 Crypto Copy Trading Platforms in 2026 Infographic

Conclusion

In the high-velocity markets, the difference between profit and loss isn’t just the Trader you follow; it’s the Engine you use. Our proprietary “Execution Audit” proved that marketing brochures lie, but Liquidity Physics doesn’t. Every platform makes a trade-off:

There is no “perfect” platform, only the right tool for your specific capital size.

Your Execution Roadmap:

- For Whales & Business Builders: Finestel is the only logical choice. Our lab confirmed that its “Large Order Smart Execution” is the only tool capable of masking your footprint to prevent self-slippage.

- For the Retail Scalper: OKX is your best ally. Its “Smart Sync” math prevents the rejection errors that plague Bitget, ensuring your “nano-lots” get filled.

- For the “Demo First” Investor: Bybit’s “CopyGuard” and Loss Vouchers provide the safest entry point in the industry.

The Golden Rule: The era of blindly following a leaderboard is over. Start with BingX’s VST or Binance’s Mock Mode. Verify the Fill Rate before you trust the Win Rate.

The tools are ready. The data is clear. The rest is up to you.

FAQ

1. Why did my copy trade fail or get rejected?

Usually, it’s a safety feature.

-

Slippage Protection: On Bybit or OKX, if the price moves too fast (>0.5%), the engine blocks the trade to save you from a bad entry.

-

Minimum Order Size: On Bitget, if your trade size is under $5, it gets rejected. Fix: Deposit >$300 or use OKX.

2. Why is my ROI lower than the Master Trader’s?

The “Follower’s Tax.” You pay trading fees, profit shares, and suffer slight execution delays (slippage). Over 100 trades, a 0.1% slippage drag can lower your total ROI by 10%.

3. What are the “Hidden Fees” to watch for?

- Spread Markup: BingX and PrimeXBT charge wider spreads than the raw market (a hidden premium).

- Commission Kickbacks: On Binance, Masters earn a cut of your trading fees, which encourages them to over-trade (churn).

5. Which platform is best for small accounts (<$100)?

OKX or BingX.

- OKX: Its “Smart Sync” engine handles tiny “nano-lots” perfectly.

- BingX: Offers VST (Virtual Money) to practice risk-free.

Avoid: Bitget and Gate.io, where minimum order limits often break small portfolios.

6. Finestel vs. Native Exchange Copying: Which is better?

- Retail Follower? Use Native Apps (Binance/Bybit). It’s free and simple.

- Business/Asset Manager? Use Finestel. Native apps can’t handle institutional volume without. Finestel is the only tool that masks your footprint.

What is the best crypto copy trading software recommended for experienced traders?

For experienced traders seeking tailored solutions, Finestel’s white-label software is fully customizable and stands out from the competition.

Which copy trading platform provides the highest level of customization options for traders?

Compared to similar platforms, Finestel provides the highest level of customization as a brand-new white-label copy trading environment.

I savor, result in I found just what I used to be looking for.

You have ended my four day lengthy hunt! God Bless you man. Have a nice day.

Bye

I loved the comparison table of the best platforms, its the most helpfull table for this concept

Thank you so much! We’re glad you found the comparison table useful. If you have any more questions or need further assistance, feel free to reach out!

Your article helped me a lot, I found Finestel and it changed the game for me as a money manager

that’s amazing to hear! We’re thrilled that Finestel is making a positive impact on your work. Our goal is to empower money managers like you with the best tools for success. If you need any support or have suggestions, don’t hesitate to get in touch. Keep rocking!

What is the best crypto copy trading bot in 2024?

There are several excellent options out there, but at Finestel, we believe our copy trading bot stands out due to its advanced features, speed, and precision. It’s designed to meet the needs of both professional traders and money managers, offering seamless integration and superior performance. Check it out and see how it can boost your trading strategy! sign up here.

what is the best crypto copy trading app in USA?

For traders in the USA, apps like Finestel offer an excellent solution for copy trading. With our B2B white-label platform, you can access top exchanges, manage client accounts, and automate trades with ease.

Hi, Neat post. Does Finestel offer copy trading Bot for crypto?

Hi there! Yes, Finestel offers an advanced copy trading bot for crypto, designed to automate trades across multiple exchanges. It’s perfect for both individual traders and businesses looking to scale their trading operations. Feel free to reach out if you’d like to learn more!

Thank you for your sharing. I think Finestel is the top copy trading platform for master traders

Thank you for the kind words! We’re dedicated to providing master traders with the best tools and features to grow their trading businesses. Your feedback motivates us to keep improving and innovating. If there’s anything specific you’d like to see, let us know!

Reliable and consistent profits are main goal of every trader. Which can be achieved by copy trading with a legit team of traders, where u will enjoy looking at the growth of capital everday. The list you provided is the most honest list for copy trading crypto

Absolutely agree! Consistency and reliability are key in trading, and we’re glad our list resonated with you. At Finestel, we focus on providing a transparent and powerful platform for copy trading, making it easier for traders to achieve their financial goals. Thanks for your support, and we’re here to help if you have any questions!

Thanks for the detailed & useful comparison. There’s a fact that copy trading platforms in the form of social trading, don’t usually care that much about master side of the platform and they build it upon the retail. However, I found yours to be an exception and thank you for that.

That’s almost right. Most of the social trading platforms choose the retail as their target audience in their business strategies. However our target clients to focus, are investment management individuals, teams, and enterprises. You’re always welcome share your needs with us.